Mhil Loan Form

What is the MHIL Loan?

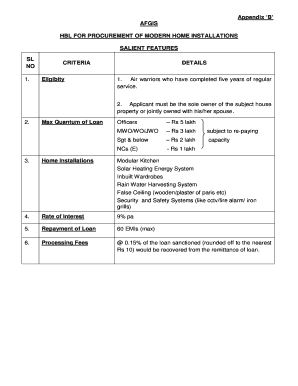

The MHIL loan, or Military Home Improvement Loan, is a financial product designed to assist military personnel and veterans in funding home improvements. This loan can cover a variety of home renovation projects, making it easier for service members to enhance their living conditions. The MHIL loan typically offers competitive interest rates and flexible repayment terms, catering specifically to the needs of military families.

Key Elements of the MHIL Loan

Understanding the key elements of the MHIL loan is essential for potential borrowers. Key features include:

- Loan Amount: The amount available for borrowing can vary based on the lender and the applicant's financial situation.

- Interest Rates: Interest rates for MHIL loans are often lower than conventional loans, making them an attractive option for military personnel.

- Repayment Terms: Borrowers can typically choose from various repayment plans, allowing for greater flexibility.

- Eligibility: Eligibility is generally limited to active-duty service members, veterans, and certain family members.

How to Obtain the MHIL Loan

Obtaining an MHIL loan involves several steps. First, potential borrowers should assess their eligibility based on military service and financial status. Next, they can gather necessary documentation, such as proof of income and military service records. After that, applicants should research lenders that offer MHIL loans and compare their terms. Finally, submitting a loan application will initiate the approval process, which may include a credit check and review of financial documents.

Steps to Complete the MHIL Loan

Completing the MHIL loan process involves a series of organized steps:

- Determine eligibility based on military service and financial criteria.

- Collect required documents, including income verification and military records.

- Research and compare lenders to find the best terms and rates.

- Submit the loan application along with all necessary documentation.

- Await approval and respond to any requests for additional information from the lender.

- Review and sign the loan agreement upon approval.

Legal Use of the MHIL Loan

The legal use of the MHIL loan is primarily for home improvement projects. Borrowers must ensure that the funds are utilized for eligible renovations, which can include repairs, upgrades, and energy-efficient improvements. Misuse of loan funds can lead to penalties or legal repercussions, so it is crucial to adhere to the guidelines set forth by the lender and relevant authorities.

Required Documents

To apply for an MHIL loan, borrowers need to prepare several essential documents. These typically include:

- Proof of military service (e.g., discharge papers or service records).

- Income verification (e.g., pay stubs, tax returns).

- Credit history report.

- Details of the proposed home improvement project.

Form Submission Methods

Submitting the MHIL loan application can be done through various methods. Borrowers may choose to apply online, which often provides a quicker response time. Alternatively, applications can be submitted via mail or in person at the lender's office. Each method has its advantages, so applicants should select the one that best fits their needs and circumstances.

Quick guide on how to complete mhil loan

Effortlessly Prepare Mhil Loan on Any Device

The management of documents online has become increasingly favored by companies and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly and without delays. Handle Mhil Loan on any device using airSlate SignNow's Android or iOS applications and enhance any document-based operation today.

How to Edit and Electronically Sign Mhil Loan with Ease

- Locate Mhil Loan and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for this task.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal significance as a traditional hand-signed signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put an end to the worry of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Modify and electronically sign Mhil Loan and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mhil loan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an AFGIS utilisation certificate?

An AFGIS utilisation certificate is a document that verifies the intended use of certain properties or assets, ensuring that they meet specific guidelines. This certificate is crucial for compliance and often required in various business transactions. Utilizing airSlate SignNow allows you to create and manage these certificates efficiently.

-

How does airSlate SignNow help with obtaining an AFGIS utilisation certificate?

airSlate SignNow streamlines the process of obtaining an AFGIS utilisation certificate by providing a user-friendly platform for document creation and electronic signatures. You can easily customize your documents, send them for eSigning, and manage all your certificates from a single dashboard. This signNowly reduces the time and effort required.

-

What features does airSlate SignNow offer for managing AFGIS utilisation certificates?

airSlate SignNow offers features like customizable templates, cloud storage, and secure electronic signatures, which are essential for managing AFGIS utilisation certificates. Additionally, it includes tracking tools that enable you to monitor the status of your documents in real time. This makes it easier to ensure timely compliance.

-

Can I integrate airSlate SignNow with my existing software for AFGIS utilisation certificates?

Yes, airSlate SignNow provides seamless integrations with various software applications, allowing you to manage AFGIS utilisation certificates efficiently. Whether you use CRM, project management, or document storage solutions, integrating SignNow can enhance your workflow. This ensures that you can use existing tools without disruption.

-

What are the pricing options for airSlate SignNow for managing AFGIS utilisation certificates?

airSlate SignNow offers flexible pricing plans that cater to different business needs, making it cost-effective for managing AFGIS utilisation certificates. You can choose a plan based on features you require, and there are no hidden fees. This allows businesses of all sizes to benefit from the service without overspending.

-

What benefits does airSlate SignNow provide for AFGIS utilisation certificates?

The main benefits of using airSlate SignNow for AFGIS utilisation certificates include increased efficiency, reduced errors, and enhanced security. The platform simplifies the signing process and ensures that documents are stored securely in the cloud. Moreover, it helps in achieving faster turnaround times, thereby enhancing overall productivity.

-

Is airSlate SignNow secure for handling AFGIS utilisation certificates?

Absolutely, airSlate SignNow employs advanced security protocols to ensure that your AFGIS utilisation certificates and other documents are safe. Features like encryption, two-factor authentication, and compliance with industry standards protect your sensitive information. This security assurance makes it a reliable choice for businesses.

Get more for Mhil Loan

Find out other Mhil Loan

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement