New York Au Form 2010-2026

What is the New York Au Form

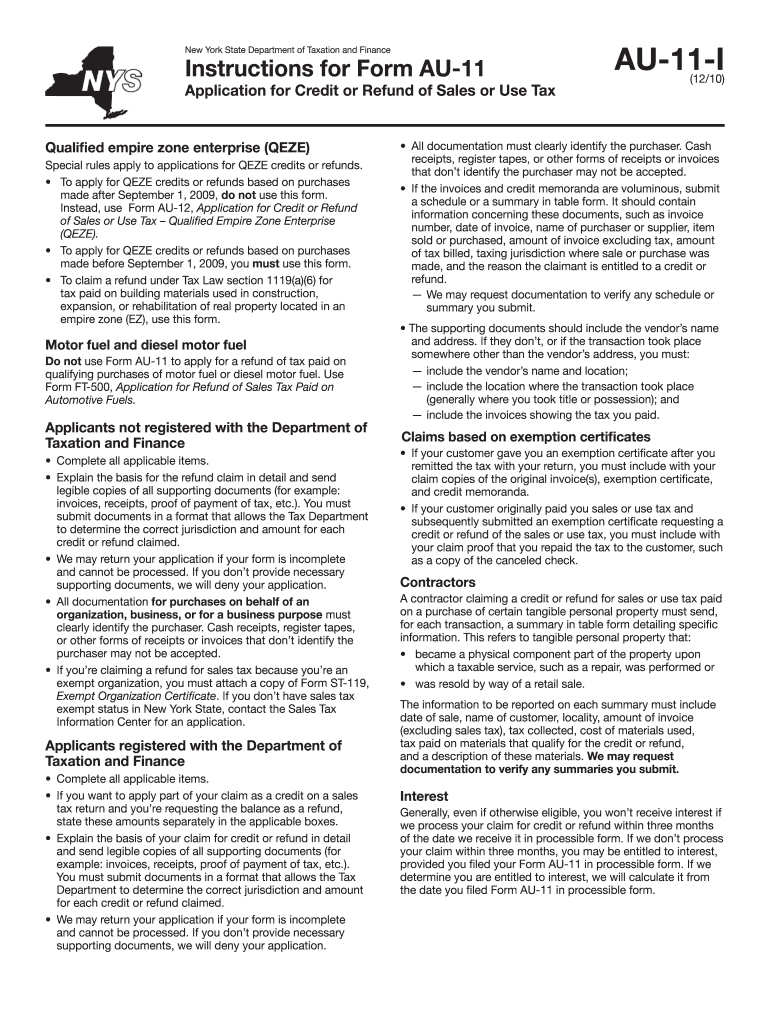

The New York Au Form, also known as the au 11 form, is a document used primarily for tax purposes in the state of New York. This form is specifically designed for taxpayers to report and request a refund of sales tax overpayments. It serves as an essential tool for individuals and businesses to ensure compliance with state tax regulations. Understanding the purpose and function of the au 11 form is vital for accurate tax reporting and maintaining good standing with the New York State Department of Taxation and Finance.

Steps to Complete the New York Au Form

Completing the New York Au Form requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather necessary documents, including previous sales tax returns and any relevant receipts.

- Fill out the form with accurate information, including your name, address, and tax identification number.

- Detail the sales tax overpayments you are claiming, providing clear calculations to support your request.

- Review the completed form for any errors or omissions before signing.

- Submit the form either electronically through the state’s online portal or by mailing it to the appropriate address.

How to Obtain the New York Au Form

The au 11 form can be easily obtained through the New York State Department of Taxation and Finance website. It is available as a fillable PDF, allowing taxpayers to complete the form online before printing. Additionally, physical copies of the form can be requested at local tax offices or downloaded from various tax assistance resources. Ensuring you have the most current version of the form is crucial for compliance.

Legal Use of the New York Au Form

The legal use of the New York Au Form is governed by state tax laws. It is essential for taxpayers to understand that this form must be filled out accurately and submitted within the specified timeframes to avoid penalties. The form is legally binding once signed, and any false information can result in legal repercussions. Therefore, it is advisable to consult with a tax professional if there are uncertainties regarding the form’s completion or submission.

Filing Deadlines / Important Dates

Filing deadlines for the New York Au Form are crucial for taxpayers to meet in order to avoid penalties. Generally, the form should be submitted within three years from the date of the overpayment. Specific deadlines may vary based on individual circumstances, such as the type of tax year being reported. It is important to keep track of these dates to ensure timely filing and to maximize potential refunds.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the New York Au Form. The preferred method is electronic submission through the New York State Department of Taxation and Finance's online portal, which offers a streamlined process. Alternatively, the completed form can be mailed to the designated address provided on the form. In-person submissions are also accepted at local tax offices, allowing for immediate assistance if needed. Choosing the right submission method can enhance the efficiency of the filing process.

Quick guide on how to complete where to file form au 11 i

Your assistance manual on how to prepare your New York Au Form

If you’re wondering how to generate and submit your New York Au Form, here are some brief instructions on how to streamline tax processing.

To get started, you just need to sign up for your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an extremely intuitive and powerful document management solution that enables you to modify, create, and complete your income tax documents with ease. Utilizing its editor, you can alternate between text, checkboxes, and eSignatures and return to edit information as needed. Simplify your tax administration with enhanced PDF editing, eSigning, and straightforward sharing.

Complete the following steps to finalize your New York Au Form in just a few minutes:

- Create your account and begin working on PDFs within minutes.

- Utilize our directory to obtain any IRS tax form; explore various versions and schedules.

- Click Get form to launch your New York Au Form in our editor.

- Populate the necessary fillable fields with your information (text, numbers, check marks).

- Use the Sign Tool to insert your legally-recognized eSignature (if applicable).

- Review your document and amend any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to electronically submit your taxes with airSlate SignNow. Please be aware that paper filing may lead to increased errors and delayed refunds. Naturally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

FAQs

-

How can I create an auto-fill JavaScript file to fill out a Google form which has dynamic IDs that change every session?

Is it possible to assign IDs on the radio buttons as soon as the page loads ?

-

How do I store form values to a JSON file after filling the HTML form and submitting it using Node.js?

//on submit you can do like this

Create this form in 5 minutes!

How to create an eSignature for the where to file form au 11 i

How to generate an electronic signature for the Where To File Form Au 11 I online

How to make an electronic signature for the Where To File Form Au 11 I in Google Chrome

How to create an eSignature for putting it on the Where To File Form Au 11 I in Gmail

How to generate an eSignature for the Where To File Form Au 11 I from your smartphone

How to generate an eSignature for the Where To File Form Au 11 I on iOS

How to generate an electronic signature for the Where To File Form Au 11 I on Android

People also ask

-

What is the au 11 feature in airSlate SignNow?

The au 11 feature in airSlate SignNow refers to our advanced document authentication process. It helps ensure that all electronic signatures are legally binding and secure, providing businesses with peace of mind.

-

How much does airSlate SignNow cost with au 11 functionalities?

The pricing for airSlate SignNow varies based on the plan you choose. Our competitive pricing ensures that you gain access to the critical au 11 features without straining your budget, making it a cost-effective solution.

-

What are the benefits of using the au 11 capabilities in airSlate SignNow?

Using the au 11 capabilities enhances the security of your electronic agreements. This feature ensures that your documents are protected by robust encryption and authentication, making airSlate SignNow a trusted tool for businesses.

-

Is airSlate SignNow with au 11 easy to integrate with existing systems?

Yes, airSlate SignNow integrates seamlessly with various business applications. Whether you use CRM systems or other digital tools, our au 11 feature can be smoothly incorporated, minimizing disruption to your workflow.

-

Can I access the au 11 features on mobile devices?

Absolutely! airSlate SignNow is optimized for mobile use, allowing you to access au 11 features from your smartphone or tablet. This flexibility ensures that you can manage documents and signatures on the go.

-

How do I get started with the au 11 feature in airSlate SignNow?

Getting started with the au 11 feature is easy. Simply sign up for an account on our website, select a plan that includes the au 11 functionalities, and you can begin sending and signing documents securely.

-

What types of documents can I sign using au 11 in airSlate SignNow?

You can sign a wide variety of documents using the au 11 feature in airSlate SignNow, including contracts, agreements, and forms. Our solution caters to businesses of all sizes and industries, ensuring compliance and security.

Get more for New York Au Form

- City of glen eira disabled parking permit renewal form

- Long service leave form

- D1221 form

- Form 106 request to withdraw a lodged document australian asic gov

- Enduring power of guardianship form victoria legal aid

- Easy english consumer consent form 79kb pdf

- Medicare levy exemption certification application and supporting humanservices gov form

- Local government woolongong section 68 form v2 application form

Find out other New York Au Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT