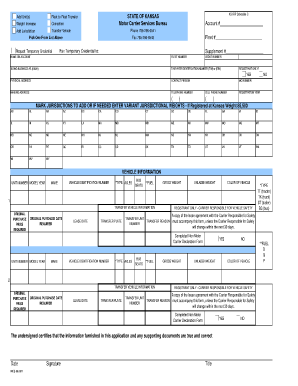

Schedule C Kdor Form

What is the Kansas Schedule C Form?

The Kansas Schedule C form is a tax document used by self-employed individuals and sole proprietors to report income and expenses related to their business activities. This form is crucial for calculating the net profit or loss from a business, which is then reported on the individual’s personal income tax return. The Kansas Schedule C is specifically designed to align with state tax regulations, ensuring compliance with local laws while providing a clear overview of business finances.

Steps to Complete the Kansas Schedule C Form

Completing the Kansas Schedule C form involves several key steps:

- Gather Financial Records: Collect all relevant financial documents, including income statements, expense receipts, and any other records that reflect your business activities.

- Fill Out Income Section: Report all income earned from your business activities. This includes sales, services, and any other revenue streams.

- Document Expenses: List all allowable business expenses, such as operating costs, supplies, and other necessary expenditures that contribute to your business operations.

- Calculate Net Profit or Loss: Subtract total expenses from total income to determine your net profit or loss for the year.

- Review and Sign: Carefully review the completed form for accuracy, then sign and date it before submission.

Legal Use of the Kansas Schedule C Form

The Kansas Schedule C form serves as a legally binding document when properly completed and submitted. It is essential for individuals to ensure that all information provided is accurate and truthful, as discrepancies can lead to penalties or legal issues. The form's legal standing is reinforced by compliance with state tax laws, making it a critical component of the tax filing process for self-employed individuals.

Filing Deadlines / Important Dates

Filing deadlines for the Kansas Schedule C form typically align with the federal tax filing deadlines. Generally, self-employed individuals must file their tax returns by April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to stay informed about any changes to filing dates and ensure timely submission to avoid penalties.

Who Issues the Kansas Schedule C Form?

The Kansas Schedule C form is issued by the Kansas Department of Revenue. This state agency is responsible for collecting taxes and ensuring compliance with tax laws. Individuals can obtain the form directly from the Department of Revenue’s website or through authorized tax preparation services that facilitate the filing process.

Examples of Using the Kansas Schedule C Form

Self-employed individuals in various fields utilize the Kansas Schedule C form to report their business income and expenses. Examples include:

- A freelance graphic designer reporting income from client projects and deducting expenses for software and equipment.

- A small business owner detailing revenue from product sales and expenses related to inventory and marketing.

- A consultant documenting fees earned and costs incurred while providing professional services.

Quick guide on how to complete schedule c kdor form

Effortlessly Prepare Schedule C Kdor Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle Schedule C Kdor Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and Electronically Sign Schedule C Kdor Form with Ease

- Obtain Schedule C Kdor Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious searches for forms, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and electronically sign Schedule C Kdor Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule c kdor form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Kansas Schedule C and why is it important?

A Kansas Schedule C is used by sole proprietors to report income or loss from their business activities. It plays a vital role in calculating your taxable income, making it essential for accurate financial reporting. Understanding how to fill out the Kansas Schedule C correctly can minimize errors and ensure compliance with state tax regulations.

-

How can airSlate SignNow help with Kansas Schedule C documentation?

airSlate SignNow simplifies the process of managing Kansas Schedule C documentation by allowing users to easily send and eSign necessary forms. This digital solution helps maintain organization and ensures that documents are securely stored. With airSlate SignNow, you can streamline your paperwork, making it easy to meet deadlines.

-

What features does airSlate SignNow offer for Kansas Schedule C management?

airSlate SignNow offers features such as customizable templates, eSignature functionality, and document tracking that specifically assist with Kansas Schedule C management. These tools provide a user-friendly experience, allowing business owners to focus on their core activities rather than paperwork. Additionally, the platform is secure and compliant with various regulations.

-

Is airSlate SignNow cost-effective for small businesses filing Kansas Schedule C?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses handling Kansas Schedule C filings. With competitive pricing plans, businesses can access robust document management features without breaking the bank. The savings on paper and mailing costs further enhance its affordability for entrepreneurs.

-

Can airSlate SignNow integrate with accounting software for Kansas Schedule C?

Absolutely, airSlate SignNow can seamlessly integrate with popular accounting software, making it easier to manage your Kansas Schedule C. This integration allows for automatic syncing of financial data, ensuring accuracy in your tax reports. By reducing manual entry, you can save time and minimize the risk of errors in your filings.

-

What are the benefits of using airSlate SignNow for submitting Kansas Schedule C?

Using airSlate SignNow for submitting your Kansas Schedule C comes with several benefits, including increased efficiency and enhanced security. The eSignature feature ensures that your documents are signed promptly, expediting the filing process. Additionally, the platform provides compliance tracking, which is crucial for maintaining up-to-date records.

-

How does airSlate SignNow ensure security when handling Kansas Schedule C data?

airSlate SignNow employs advanced security measures to protect your Kansas Schedule C data, including encryption and secure access controls. With these protections, your sensitive financial information remains confidential and safe. Users can trust that their documents are managed in compliance with industry standards and regulations.

Get more for Schedule C Kdor Form

Find out other Schedule C Kdor Form

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later