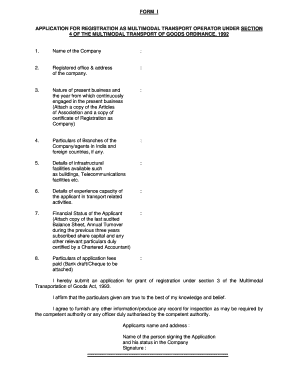

Mto Registration Online Form

What is the MTO Registration Online

The MTO full form refers to the Motor Transport Operator registration, which is essential for businesses operating commercial vehicles in the United States. This registration ensures compliance with federal and state regulations governing transportation services. The MTO registration online provides an efficient way for operators to submit their applications, making the process more accessible and streamlined.

Steps to Complete the MTO Registration Online

Completing the MTO registration online involves several key steps:

- Gather required documents, such as proof of identity, business registration details, and vehicle information.

- Visit the official MTO registration portal to access the online application form.

- Fill out the MTO application form with accurate information, ensuring all fields are completed.

- Review the application for any errors or omissions before submission.

- Submit the application and pay any associated fees through the secure online payment system.

- Receive confirmation of your application submission and await further instructions or approval.

Legal Use of the MTO Registration Online

The MTO registration online is legally binding when completed in accordance with the relevant regulations. To ensure its validity, the application must be filled out accurately and submitted through authorized channels. Compliance with state and federal laws is crucial, as improper registration can lead to penalties or legal issues. Utilizing a trusted platform like airSlate SignNow can enhance the legal standing of your MTO registration by providing secure electronic signatures and maintaining compliance with eSignature laws.

Eligibility Criteria for MTO Registration

To qualify for MTO registration, applicants must meet specific eligibility criteria, which typically include:

- Valid business license or registration.

- Proof of insurance coverage for commercial vehicles.

- Compliance with safety regulations and standards.

- Submission of all required documentation during the application process.

Meeting these criteria is essential for a successful application and to avoid delays in the registration process.

Required Documents for MTO Registration

When applying for MTO registration online, several documents are required to ensure a complete and accurate application. These may include:

- Business identification documents, such as a tax ID or employer identification number (EIN).

- Proof of vehicle ownership, such as titles or registration certificates.

- Insurance documentation that meets state requirements.

- Any additional forms or certifications specific to the state of registration.

Having these documents ready can help expedite the application process.

Who Issues the MTO Registration

The MTO registration is typically issued by the state’s Department of Motor Vehicles (DMV) or a similar regulatory body responsible for transportation in the state. Each state may have its own specific procedures and requirements for issuing the MTO registration, so it is important to consult the relevant state agency for accurate information.

Quick guide on how to complete mto registration online

Effortlessly complete Mto Registration Online on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the needed form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without delays. Handle Mto Registration Online on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign Mto Registration Online easily

- Obtain Mto Registration Online and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, and errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Mto Registration Online and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mto registration online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MTO full form in the context of document signing?

The MTO full form stands for 'Mobile Transportation Office,' which relates to digital documents and signatures that can streamline transportation-related processes. With airSlate SignNow, you can easily manage and sign documents on-the-go, ensuring quick approvals without the hassle of paper.

-

How does airSlate SignNow support MTO full form documentation?

airSlate SignNow provides tools to create, send, and eSign documents efficiently, including those relevant to the MTO full form. This enables businesses to enhance their operational workflows and manage transportation documents seamlessly, reducing time and effort.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers several pricing tiers to accommodate businesses of all sizes. Each plan provides access to features that support the MTO full form and other document needs, making it a cost-effective choice for efficient document management.

-

What features does airSlate SignNow offer that relate to the MTO full form?

Key features of airSlate SignNow include customizable templates, automated workflows, and mobile accessibility, all of which enhance functionalities related to the MTO full form. Businesses can utilize these features to ensure faster document processing and security.

-

How can businesses benefit from using airSlate SignNow for MTO full form documents?

Using airSlate SignNow for MTO full form documents helps businesses save time and reduce costs associated with traditional paperwork. With electronic signatures and streamlined workflows, companies can maintain compliance and improve overall turnaround times.

-

Can airSlate SignNow integrate with other platforms for MTO full form processes?

Yes, airSlate SignNow integrates with various platforms and applications, enhancing workflows related to the MTO full form. This integration enables users to connect their document signing processes with existing tools, promoting higher efficiency and collaboration.

-

Is airSlate SignNow user-friendly for those unfamiliar with the MTO full form?

Absolutely, airSlate SignNow is designed with user-friendliness in mind, making it accessible even for users unfamiliar with the MTO full form. The intuitive interface guides users through the signing process, ensuring a smooth experience for all parties involved.

Get more for Mto Registration Online

Find out other Mto Registration Online

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online

- eSign Utah Rental lease contract Free

- eSign Tennessee Rental lease agreement template Online

- eSign Tennessee Rental lease agreement template Myself