Vat515 Form

What is the Vat515 Form

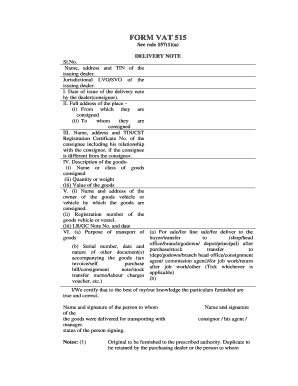

The Vat515 Form is a specific document used in the United States for tax purposes, particularly concerning the reporting of value-added tax (VAT) for businesses. This form is essential for companies that engage in international trade or provide services that may be subject to VAT regulations. Understanding the Vat515 Form is crucial for compliance with federal tax laws and ensuring accurate reporting of taxable transactions.

How to use the Vat515 Form

Using the Vat515 Form involves several steps that ensure accurate completion and submission. Initially, gather all necessary financial documentation related to VAT transactions. This may include invoices, receipts, and records of sales and purchases. Next, fill out the form with precise information, including your business details, VAT registration number, and the amounts subject to VAT. Once completed, review the form for accuracy before submission to the appropriate tax authority.

Steps to complete the Vat515 Form

Completing the Vat515 Form requires careful attention to detail. Follow these steps:

- Gather necessary documents, including financial records and previous VAT filings.

- Enter your business name, address, and VAT registration number in the designated fields.

- Detail the taxable sales and purchases, ensuring all amounts are accurate and correctly categorized.

- Calculate the total VAT due or refundable based on the information provided.

- Review the form for any errors or omissions before finalizing it.

Legal use of the Vat515 Form

The legal use of the Vat515 Form is governed by federal tax laws and regulations. It must be filled out accurately to ensure compliance with the Internal Revenue Service (IRS) guidelines. Failure to use the form correctly can result in penalties or audits. It is essential to maintain records of all submissions and correspondence related to the Vat515 Form to protect your business in case of any disputes or inquiries from tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Vat515 Form can vary based on your business's tax reporting schedule. Generally, the form must be submitted annually or quarterly, depending on your VAT obligations. It is important to stay informed about specific due dates to avoid late penalties. Mark your calendar with these important dates to ensure timely filing and compliance with tax regulations.

Who Issues the Form

The Vat515 Form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and resources to help businesses understand how to properly complete and submit the form. It is advisable to refer to the IRS website or contact them directly for the most current information regarding the Vat515 Form and its requirements.

Quick guide on how to complete vat515 form

Complete Vat515 Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents swiftly without delays. Handle Vat515 Form on any device using airSlate SignNow apps for Android or iOS and enhance any document-based process today.

The easiest way to modify and eSign Vat515 Form effortlessly

- Obtain Vat515 Form and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Vat515 Form while ensuring exceptional communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat515 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Vat515 Form and why is it important?

The Vat515 Form is a critical document used in the VAT registration process. It helps businesses declare their eligible VAT taxable sales and reclaim input VAT, ensuring compliance with tax regulations. Understanding this form is essential for managing your tax responsibilities effectively.

-

How can airSlate SignNow simplify the process of handling the Vat515 Form?

airSlate SignNow streamlines the completion and signing of the Vat515 Form through its intuitive electronic signature platform. By allowing users to fill out, eSign, and send documents securely, it reduces the time and hassle often associated with paperwork. This efficiency can help businesses focus on their core activities without getting bogged down in administrative tasks.

-

What are the pricing options for using airSlate SignNow for the Vat515 Form?

airSlate SignNow offers flexible pricing plans suitable for all business sizes, starting from a basic plan to more advanced options. These plans provide access to features like document templates, team collaboration tools, and integrations that can enhance the filing of the Vat515 Form. Visit our pricing page to choose the plan that best fits your needs.

-

Is airSlate SignNow compliant with regulations for the Vat515 Form?

Yes, airSlate SignNow is designed with compliance in mind. It adheres to e-signature laws and standards, ensuring that your Vat515 Form submissions are legally binding and secure. This compliance helps mitigate any concerns regarding the validity of your electronic documents.

-

Can I integrate airSlate SignNow with other tools for managing the Vat515 Form?

Absolutely! airSlate SignNow offers robust integrations with popular business tools such as CRM and accounting software, which can help streamline your handling of the Vat515 Form. These integrations enhance workflow efficiency, enabling seamless data transfer and reducing the likelihood of errors.

-

What benefits does airSlate SignNow provide for managing the Vat515 Form?

Using airSlate SignNow for the Vat515 Form provides numerous benefits, including quick turnaround times for document signing and enhanced security features. Additionally, its user-friendly interface ensures that team members can easily access and manage the form, promoting collaboration and efficiency in your VAT management process.

-

How does airSlate SignNow enhance the security of the Vat515 Form?

airSlate SignNow employs state-of-the-art encryption and security protocols to protect your Vat515 Form and other sensitive documents. These measures ensure that your data is kept confidential and secure throughout the signing process. Users can also benefit from audit trails that track document activity for added peace of mind.

Get more for Vat515 Form

- Mercer county surrogates court nj form

- Tommy bahama watch repair form

- Vectorconnect form

- Spa sweet new client questionnaire facial docx form

- Lb014 02 form

- Dl 015 12 13 mva maryland gov mva maryland form

- Application for display certificate of competency dsfm 165 rev 01 nh form

- Planning engineering ampamp permitsthe official website forplanning engineering and permits faqthe official planning form

Find out other Vat515 Form

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile