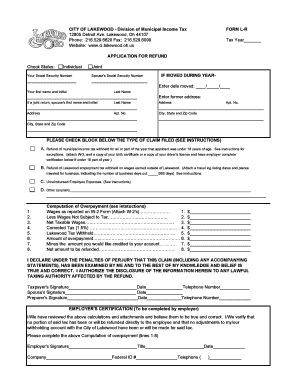

City of Lakewood Income Tax Form

What is the City of Lakewood Income Tax

The City of Lakewood imposes an income tax on residents and businesses operating within its jurisdiction. This tax is designed to fund local services and infrastructure. The Lakewood income tax applies to all earned income, including wages, salaries, and business profits. Understanding this tax is essential for residents and business owners to ensure compliance and proper financial planning.

Steps to Complete the City of Lakewood Income Tax

Completing the Lakewood income tax form involves several key steps:

- Gather necessary documents, including W-2s and 1099s.

- Determine your total income for the tax year.

- Calculate any deductions or credits that may apply.

- Fill out the Lakewood income tax form accurately, ensuring all information is complete.

- Review your completed form for any errors.

- Submit the form by the designated deadline.

How to Obtain the City of Lakewood Income Tax Form

The Lakewood income tax form can be obtained through the city’s official website or the Lakewood tax office. Residents can also request a physical copy by contacting the tax department directly. It is important to ensure that you are using the most current version of the form to avoid any compliance issues.

Form Submission Methods

Residents have several options for submitting their Lakewood income tax forms:

- Online: Submit your completed form through the city’s online portal for a quick and efficient process.

- Mail: Send your form via postal service to the designated tax office address.

- In-Person: Visit the Lakewood tax office to submit your form directly, allowing for any immediate questions or clarifications.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Lakewood income tax. Typically, the deadline aligns with the federal tax deadline, which is April 15. However, any changes or extensions will be communicated by the city’s tax department, so staying informed is essential.

Penalties for Non-Compliance

Failure to comply with the Lakewood income tax regulations can result in penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is important for residents and businesses to file their taxes accurately and on time to avoid these consequences.

Quick guide on how to complete city of lakewood income tax

Prepare City Of Lakewood Income Tax with ease on any device

Online document management has become increasingly prevalent among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage City Of Lakewood Income Tax on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The simplest way to alter and eSign City Of Lakewood Income Tax effortlessly

- Find City Of Lakewood Income Tax and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign City Of Lakewood Income Tax and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of lakewood income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to Lakewood income tax?

airSlate SignNow is a document signing solution that helps businesses streamline their documentation processes. For businesses dealing with Lakewood income tax, SignNow allows for quick, secure, and legally binding eSignatures on essential tax documents, enhancing efficiency and compliance.

-

How does airSlate SignNow simplify the preparation of Lakewood income tax documents?

With airSlate SignNow, users can easily create, edit, and send Lakewood income tax documents for eSignature. This simplifies the preparation process by allowing users to automate reminders and track document status, ensuring that all tax documents are signed on time.

-

What features of airSlate SignNow are beneficial for managing Lakewood income tax forms?

Key features of airSlate SignNow include customizable templates and advanced security measures. These features are particularly beneficial when managing Lakewood income tax forms, as they ensure that documents are both personalized and secure, meeting all necessary compliance standards.

-

Is airSlate SignNow cost-effective for handling Lakewood income tax submissions?

Absolutely! airSlate SignNow offers competitive pricing plans that cater to various business sizes. Using SignNow for Lakewood income tax submissions can save you time and money by reducing the need for physical printing and mailing, making it a cost-effective solution.

-

Can airSlate SignNow integrate with other accounting software for Lakewood income tax?

Yes, airSlate SignNow integrates seamlessly with many popular accounting software platforms. This integration is particularly useful for handling Lakewood income tax, as it allows for easy transfer of information and smooth workflows between your accounting tools and eSignature processes.

-

What kind of support does airSlate SignNow provide for Lakewood income tax users?

airSlate SignNow offers excellent customer support through various channels, including live chat, email, and a detailed knowledge base. Whether you have questions about Lakewood income tax processes or the platform itself, their support team is ready to assist.

-

Are electronic signatures from airSlate SignNow legally accepted for Lakewood income tax?

Yes, electronic signatures created using airSlate SignNow are legally accepted for Lakewood income tax documents. SignNow complies with national and state laws regarding eSignatures, ensuring that all signed documents hold legal validity.

Get more for City Of Lakewood Income Tax

Find out other City Of Lakewood Income Tax

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form