FORM W 8 Irs

What is the FORM W-8 IRS

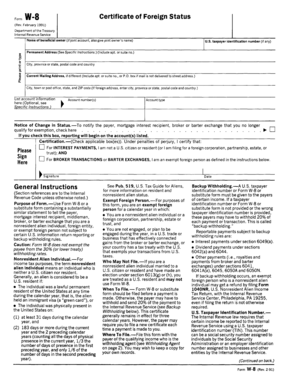

The FORM W-8 IRS is a tax document used by foreign individuals and entities to certify their foreign status for U.S. tax withholding purposes. This form is essential for non-U.S. persons receiving income from U.S. sources, as it helps to establish eligibility for reduced withholding rates or exemptions under U.S. tax law. There are several variants of the W-8 form, including W-8BEN for individuals and W-8BEN-E for entities, each serving specific purposes in compliance with IRS regulations.

How to use the FORM W-8 IRS

To use the FORM W-8 IRS, individuals and businesses must fill out the appropriate version of the form based on their status. The completed form should be submitted to the U.S. withholding agent or financial institution requesting it, rather than the IRS directly. This ensures that the withholding agent can apply the correct tax rates on payments made to the foreign person or entity. It is crucial to keep the form updated and resubmit it every three years or whenever there are changes in circumstances that affect the information provided.

Steps to complete the FORM W-8 IRS

Completing the FORM W-8 IRS involves several straightforward steps:

- Identify the correct version of the form based on your status (individual or entity).

- Provide your name, country of citizenship, and address.

- Include your taxpayer identification number (if applicable) and foreign tax identifying number.

- Certify your foreign status by signing and dating the form.

- Submit the completed form to the withholding agent or financial institution.

Key elements of the FORM W-8 IRS

Key elements of the FORM W-8 IRS include:

- Name and address: Accurate identification of the individual or entity.

- Foreign tax identification number: Required for certain foreign entities.

- U.S. taxpayer identification number: Optional but may be needed for some applicants.

- Certification of foreign status: A declaration that the individual or entity is not a U.S. person.

- Signature and date: Required to validate the form.

Legal use of the FORM W-8 IRS

The legal use of the FORM W-8 IRS is governed by U.S. tax laws, which require foreign persons to provide this form to avoid excessive withholding on U.S. source income. By submitting the form, the foreign individual or entity certifies their non-U.S. status and claims any applicable tax treaty benefits. It is important to ensure that the information provided is accurate and complete to avoid penalties or issues with compliance.

Filing Deadlines / Important Dates

While the FORM W-8 IRS does not have a specific filing deadline, it is important to submit it before receiving any payments from U.S. sources to ensure proper withholding rates are applied. Additionally, the form must be updated every three years or whenever there are changes in the information provided. Keeping track of these timelines helps maintain compliance with IRS regulations and prevents unnecessary withholding tax on payments.

Quick guide on how to complete form w 8 irs

Complete FORM W 8 Irs seamlessly on any device

Digital document management has become increasingly popular with businesses and individuals alike. It presents an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly and efficiently. Manage FORM W 8 Irs on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign FORM W 8 Irs effortlessly

- Obtain FORM W 8 Irs and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information using the tools airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and press the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign FORM W 8 Irs to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 8 irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FORM W 8 Irs used for?

The FORM W 8 Irs is used by non-U.S. persons to signNow their foreign status for tax purposes. It helps determine the appropriate level of withholding tax on income received from U.S. sources. Understanding this form is essential for compliance with U.S. tax regulations.

-

How can airSlate SignNow help me with the FORM W 8 Irs?

airSlate SignNow provides a streamlined platform to send and eSign your FORM W 8 Irs quickly and securely. You can easily integrate this form into your workflow, ensuring that all parties can sign it electronically. Our solution ensures compliance and saves you time.

-

Is there a cost to use airSlate SignNow for sending the FORM W 8 Irs?

airSlate SignNow offers various pricing plans, some of which include a free trial for new users. This allows you to explore our features, such as eSigning the FORM W 8 Irs, without any upfront costs. Review our pricing page for detailed options to find the best fit for your needs.

-

What features does airSlate SignNow offer for handling the FORM W 8 Irs?

airSlate SignNow supports features such as custom templates, real-time tracking, and easy document sharing for the FORM W 8 Irs. Our platform ensures a user-friendly experience, making it simple to manage your documents. You can also automate reminders to ensure timely signing.

-

Can I integrate airSlate SignNow with other applications for FORM W 8 Irs?

Yes, airSlate SignNow offers seamless integrations with various applications, enhancing your workflow for the FORM W 8 Irs. You can connect with popular platforms like Google Drive, Salesforce, and more to streamline your document management process. This connectivity helps you stay organized.

-

What are the benefits of using airSlate SignNow for my FORM W 8 Irs needs?

Using airSlate SignNow for your FORM W 8 Irs filing simplifies the process of obtaining signatures and ensures quicker turnaround times. Our secure platform guarantees that your sensitive information is protected while providing legal compliance with eSignature laws. This efficiency saves time and enhances productivity.

-

Is it easy to manage multiple FORM W 8 Irs documents with airSlate SignNow?

Absolutely! airSlate SignNow is designed for efficiency, allowing you to manage multiple FORM W 8 Irs documents effortlessly. Use our dashboard to track the status of each document and send reminders to signers as needed, ensuring all your paperwork is completed on time.

Get more for FORM W 8 Irs

Find out other FORM W 8 Irs

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors