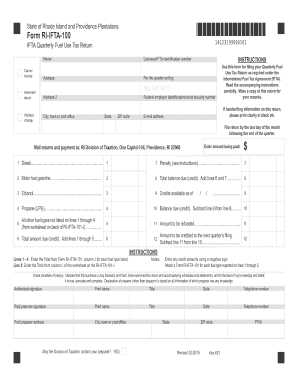

Ifta Ri Form

What is the IFTA RI?

The IFTA RI, or International Fuel Tax Agreement Rhode Island form, is a crucial document for commercial motor carriers operating in multiple jurisdictions. This form facilitates the reporting and payment of fuel taxes to various states and provinces. It streamlines the process for carriers by allowing them to file a single return instead of separate filings for each jurisdiction. The IFTA RI ensures compliance with fuel tax regulations and helps maintain accurate records of fuel consumption across state lines.

Steps to Complete the IFTA RI

Completing the IFTA RI involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary data, including fuel purchase receipts and mileage records for each jurisdiction. Next, calculate the total gallons of fuel purchased and the total miles driven in each state. After compiling this information, fill out the IFTA RI form with the required details, ensuring all calculations are correct. Finally, review the form for completeness and accuracy before submitting it by the designated deadline.

Legal Use of the IFTA RI

The IFTA RI is legally binding and must be filled out accurately to comply with tax regulations. It serves as a record of fuel usage and tax obligations for commercial motor carriers. To ensure the legal validity of the form, it is essential to adhere to the guidelines set forth by the IFTA governing body and the Rhode Island Department of Revenue. Failure to comply with these regulations can result in penalties, including fines and audits.

Filing Deadlines / Important Dates

Filing deadlines for the IFTA RI are typically set on a quarterly basis. Carriers must submit their IFTA returns by the last day of the month following the end of each quarter. For example, the first quarter ends on March 31, and the return is due by April 30. It is important for carriers to keep track of these dates to avoid late fees and maintain compliance with state regulations.

Required Documents

To complete the IFTA RI, several documents are necessary. Carriers should have records of fuel purchases, including invoices and receipts, as well as mileage logs that detail the distance traveled in each jurisdiction. Additionally, any previous IFTA returns may be required for reference. Keeping organized records will facilitate the completion of the form and ensure accurate reporting.

Form Submission Methods

The IFTA RI can be submitted through various methods, including online, by mail, or in person. Many carriers prefer the online submission method for its convenience and efficiency. However, those who choose to submit by mail should ensure that the form is sent well before the deadline to allow for processing time. In-person submissions can be made at designated state offices, providing an opportunity for immediate assistance if needed.

Penalties for Non-Compliance

Non-compliance with IFTA regulations can lead to significant penalties for carriers. These may include fines, interest on unpaid taxes, and potential audits by state authorities. In severe cases, repeated non-compliance can result in the suspension of the carrier's operating authority. It is crucial for carriers to understand their obligations and ensure timely and accurate filing to avoid these consequences.

Quick guide on how to complete ifta ri

Complete Ifta Ri effortlessly on any device

Web-based document management has become popular with businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the needed form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Ifta Ri on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Ifta Ri effortlessly

- Obtain Ifta Ri and then select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Edit and eSign Ifta Ri and ensure exceptional communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ifta ri

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'form ri ifta 100' and why is it important?

'Form RI IFTA 100' is a critical document used for reporting fuel consumption and taxes owed by interstate carriers in Rhode Island. Understanding this form is essential for compliance with state regulations and avoiding penalties, making it a vital tool for businesses in the transportation sector.

-

How can airSlate SignNow help me with the 'form ri ifta 100'?

airSlate SignNow simplifies the process of completing and signing the 'form RI IFTA 100' digitally. With our platform, you can fill out the form, eSign it, and send it securely, saving you time and ensuring compliance with state filing requirements.

-

Is there a cost associated with using airSlate SignNow for the 'form ri ifta 100'?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including options for submitting the 'form RI IFTA 100'. Our plans are competitively priced, ensuring that you get an affordable solution for your document signing and management needs.

-

What features does airSlate SignNow offer for managing the 'form ri ifta 100'?

airSlate SignNow provides robust features for managing the 'form RI IFTA 100', including customizable templates, automated workflows, and secure cloud storage. These features enhance your efficiency and streamline the document management process, making it easier to stay organized.

-

Can I integrate airSlate SignNow with other software for managing the 'form ri ifta 100'?

Absolutely! airSlate SignNow offers seamless integrations with popular software solutions. This allows you to connect your existing tools for improved workflow management while handling the 'form RI IFTA 100' and other documents, enhancing overall productivity.

-

What are the benefits of using airSlate SignNow for the 'form ri ifta 100'?

Using airSlate SignNow for the 'form RI IFTA 100' provides numerous benefits, including faster turnaround times, reduced paperwork, and enhanced compliance tracking. Our platform ensures that your documents are handled quickly and securely, empowering you to focus on your business operations.

-

How secure is airSlate SignNow when handling the 'form ri ifta 100'?

security is a top priority at airSlate SignNow. We implement robust encryption and follow industry-standard protocols to protect your data, ensuring the 'form RI IFTA 100' and other sensitive documents are securely managed throughout the signing process.

Get more for Ifta Ri

Find out other Ifta Ri

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document