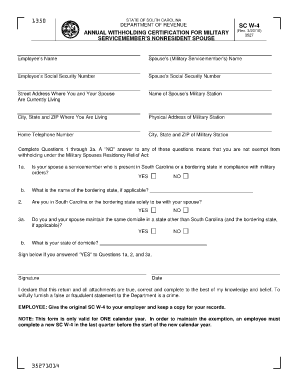

Sc W4 Form

What is the SC W-4?

The SC W-4, also known as the South Carolina Employee Withholding Form, is a critical document used by employees to determine the amount of state income tax that should be withheld from their paychecks. This form is essential for ensuring that the correct amount of taxes is deducted, helping to avoid underpayment or overpayment throughout the tax year. It is specifically designed for residents of South Carolina and aligns with state tax regulations.

How to Use the SC W-4

To use the SC W-4 effectively, employees must complete the form accurately and submit it to their employer. The form requires personal information, including the employee's name, address, and Social Security number. Additionally, employees must indicate their filing status and any allowances they wish to claim. These allowances can reduce the amount of state tax withheld, which can be beneficial for employees who expect to owe less tax at the end of the year.

Steps to Complete the SC W-4

Completing the SC W-4 involves several straightforward steps:

- Obtain the SC W-4 form from your employer or download it from the South Carolina Department of Revenue website.

- Fill in your personal information, including your name, address, and Social Security number.

- Select your filing status (single, married, etc.) and calculate the number of allowances you are eligible to claim.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to your employer for processing.

Legal Use of the SC W-4

The SC W-4 is legally recognized as a valid form for determining state tax withholding. It must be filled out truthfully and accurately to comply with South Carolina tax laws. Employers are required to keep this form on file and use it to calculate the appropriate amount of state income tax to withhold from employee wages. Failure to submit a completed SC W-4 may result in the employer withholding taxes at the highest rate, which can lead to unnecessary tax burdens for employees.

Key Elements of the SC W-4

Key elements of the SC W-4 include:

- Personal Information: Employee's name, address, and Social Security number.

- Filing Status: Options include single, married, or head of household.

- Allowances: The number of allowances claimed affects the withholding amount.

- Signature: The employee must sign and date the form, affirming its accuracy.

Who Issues the SC W-4?

The SC W-4 is issued by the South Carolina Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among employers and employees. The form is updated periodically to reflect changes in tax regulations, so it is important for employees to use the most current version when submitting their information.

Quick guide on how to complete sc w4

Complete Sc W4 effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documentation, allowing you to easily obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without any delays. Manage Sc W4 on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to modify and electronically sign Sc W4 effortlessly

- Obtain Sc W4 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or mask sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Adjust and electronically sign Sc W4 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sc w4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SC W4 form and how can airSlate SignNow help?

The SC W4 form is used by employees in South Carolina to determine the amount of state income tax withholding. With airSlate SignNow, you can easily complete and eSign the SC W4 form online, ensuring that your filing is both accurate and efficient. Our platform streamlines this process, making it secure and accessible.

-

Is there a cost associated with using airSlate SignNow for the SC W4?

airSlate SignNow offers a variety of pricing plans to accommodate businesses of all sizes. You can get started with a free trial to explore features related to the SC W4 form without any obligations. After the trial, you can choose a plan that fits your needs and budget.

-

What features does airSlate SignNow offer for managing SC W4 documents?

airSlate SignNow provides a range of features for managing SC W4 documents, including customizable templates, secure eSignature capabilities, and document tracking. These features help you streamline your onboarding processes and ensure compliance with state regulations. You can securely store and manage your SC W4 documentation all in one place.

-

How does airSlate SignNow ensure the security of SC W4 forms?

The security of your SC W4 forms is a top priority at airSlate SignNow. We utilize encryption, secure data storage, and stringent authentication protocols to safeguard your sensitive information. This ensures that your documents remain confidential and protected from unauthorized access.

-

Can I integrate airSlate SignNow with other software for SC W4 processing?

Yes, airSlate SignNow offers seamless integrations with various software tools to simplify SC W4 processing. You can connect with popular HR and payroll systems, enabling automatic data transfer and reducing manual entry errors. This integration enhances efficiency and accuracy in handling your SC W4 forms.

-

What are the benefits of using airSlate SignNow for SC W4 eSigning?

Using airSlate SignNow for SC W4 eSigning provides numerous benefits, including reduced turnaround time, improved accuracy, and enhanced convenience. With our user-friendly interface, employees can complete their SC W4 forms from anywhere, on any device, making the process faster and more efficient. This ultimately leads to better compliance and a smoother payroll experience.

-

Is support available if I have questions about the SC W4 process with airSlate SignNow?

Absolutely! airSlate SignNow provides robust customer support to assist you with any questions regarding the SC W4 process. Whether you need help navigating the platform or specific guidance on completing your SC W4, our team is available through various channels to ensure you have the assistance you need.

Get more for Sc W4

- Salitang magkasingkahulugan form

- Informational graphic organizer

- Footwear declaration form

- B category past papers part 1 form

- Diving dd chart form

- Safeguarding incident report form word version 115kb safeguarding report form

- Child protectioninformation and record keeping

- Hospice intake form 401827885

Find out other Sc W4

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy