Form 4013

What is the Form 4013

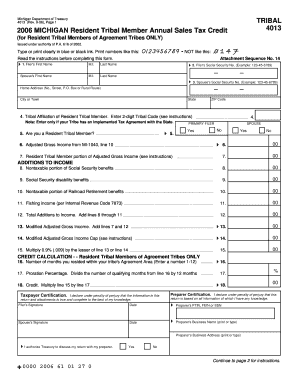

The Form 4013, also known as the Michigan tax form 4013, is a document used by residents of Michigan for specific tax-related purposes. This form is essential for individuals and businesses to report income, deductions, and credits accurately. It is part of the state's tax compliance framework, ensuring that taxpayers fulfill their obligations while benefiting from available credits and deductions.

How to use the Form 4013

Using the Form 4013 involves several steps to ensure accurate completion. Taxpayers should first gather all necessary financial documents, including income statements and receipts for deductions. Next, they should carefully fill out the form, providing accurate information in each section. After completing the form, it is crucial to review it for errors before submission. This ensures compliance with state tax laws and helps avoid potential penalties.

Steps to complete the Form 4013

Completing the Form 4013 requires attention to detail. Here are the steps to follow:

- Gather necessary documents, such as W-2s, 1099s, and other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income accurately.

- Detail deductions and credits applicable to your situation.

- Review the completed form for accuracy.

- Sign and date the form before submission.

Legal use of the Form 4013

The legal use of the Form 4013 is governed by state tax regulations. To be considered valid, the form must be completed accurately and submitted by the designated deadlines. Additionally, eSignatures are legally binding under the ESIGN and UETA acts, allowing taxpayers to submit their forms digitally. Ensuring compliance with these regulations is essential for the form to hold legal weight in any tax-related matters.

Filing Deadlines / Important Dates

Filing deadlines for the Form 4013 are crucial for taxpayers to observe. Typically, the form must be submitted by April 15 for the previous tax year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should stay informed about any changes to filing dates, as timely submission is necessary to avoid penalties and interest on unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

The Form 4013 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online: Many taxpayers prefer to submit their forms electronically through secure platforms, ensuring faster processing.

- Mail: Completed forms can be mailed to the appropriate state tax office, but this method may take longer for processing.

- In-Person: Taxpayers may also choose to submit their forms in person at designated state tax offices for immediate confirmation of receipt.

Quick guide on how to complete form 4013

Complete Form 4013 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily access the necessary form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents quickly and without delays. Manage Form 4013 on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Form 4013 without stress

- Obtain Form 4013 and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, the hassle of searching for forms, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your preference. Modify and eSign Form 4013 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4013

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 4013 and how can it be used?

The form 4013 is a critical document that facilitates specific business processes. With airSlate SignNow, you can easily create, sign, and manage this form, streamlining your workflow and ensuring compliance with your business needs.

-

Are there any costs associated with using the form 4013 through airSlate SignNow?

Using the form 4013 with airSlate SignNow is part of our subscription plans. We offer competitive pricing that is designed to be cost-effective, ensuring that businesses of all sizes can utilize this essential document without breaking the bank.

-

What features does airSlate SignNow offer for managing the form 4013?

airSlate SignNow provides a range of features for the form 4013, including customizable templates, eSignature capabilities, and document tracking. These features guarantee that you can manage the form efficiently and securely, enhancing your overall productivity.

-

Can the form 4013 be integrated with other software?

Yes, the form 4013 can be seamlessly integrated with various third-party applications using airSlate SignNow. Our platform supports multiple integrations, allowing you to connect with tools you already use for a more cohesive workflow.

-

What are the benefits of using airSlate SignNow for the form 4013?

Employing airSlate SignNow for the form 4013 delivers numerous benefits, including increased efficiency, reduced turnaround times, and enhanced security. Our platform ensures that your documents are managed professionally while providing a user-friendly experience.

-

How does eSigning the form 4013 work with airSlate SignNow?

eSigning the form 4013 with airSlate SignNow is straightforward and secure. Users can sign documents electronically in just a few clicks, helping to speed up the signing process and eliminate the need for physical paperwork.

-

Is the form 4013 customizable within airSlate SignNow?

Absolutely, the form 4013 can be fully customized within airSlate SignNow. You can modify the template to fit your specific business needs, ensuring that the document meets all necessary requirements and reflects your brand accurately.

Get more for Form 4013

Find out other Form 4013

- How Do I Sign Idaho Disclosure Notice

- Sign Illinois Drug Testing Consent Agreement Online

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online