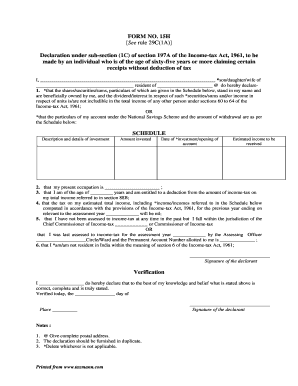

Form Non15g

What is the Form Non15g

The Form Non15g is a tax document used by individuals to declare that their income is below the taxable limit, thereby exempting them from tax deductions on certain payments. This form is particularly relevant for those who may receive interest income or dividends but do not meet the income threshold that necessitates tax withholding. By submitting this form, taxpayers can ensure that they receive their full payment without unnecessary deductions.

Steps to complete the Form Non15g

Completing the Form Non15g involves several key steps:

- Gather necessary information: Collect your personal details, including your name, address, and Social Security number.

- Provide income details: Indicate the types of income you receive that qualify for exemption.

- Sign and date the form: Ensure that you sign the form to validate your declaration.

- Submit the form: Send the completed form to the relevant financial institution or entity that requires it.

Legal use of the Form Non15g

The legal use of the Form Non15g is governed by IRS regulations, which stipulate that taxpayers must accurately report their income status. Misuse of this form can lead to penalties, including fines or back taxes owed. It is essential for individuals to understand their eligibility and ensure that their income genuinely falls below the taxable threshold to avoid legal repercussions.

Required Documents

When filling out the Form Non15g, certain documents may be required to support your claims:

- Proof of income: Documentation showing your income levels, such as pay stubs or bank statements.

- Identification: A government-issued ID, such as a driver's license or passport, may be necessary to verify your identity.

- Previous tax returns: Copies of your prior year’s tax returns can provide context for your current income status.

Filing Deadlines / Important Dates

It is important to be aware of the deadlines associated with the Form Non15g. Typically, this form should be submitted before the end of the tax year to ensure that the financial institution processes it in time for the tax reporting. Missing the deadline may result in tax withholding that could have been avoided.

Examples of using the Form Non15g

Individuals may use the Form Non15g in various scenarios, such as:

- Students who earn minimal income from part-time jobs and wish to avoid tax deductions on interest earned from savings accounts.

- Retirees receiving pension payments that do not exceed the taxable limit, allowing them to retain their full pension amount.

- Freelancers with sporadic income who may not reach the threshold for tax liability.

Quick guide on how to complete form non15g

Complete Form Non15g easily on any device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to create, edit, and electronically sign your documents quickly and without hassle. Handle Form Non15g on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and electronically sign Form Non15g effortlessly

- Obtain Form Non15g and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with specialized tools that airSlate SignNow offers for that purpose.

- Craft your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all details and click the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invite link, or download it to your computer.

Shed the worry of lost or misfiled documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form Non15g and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form non15g

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 15h form fill up sample?

A 15h form fill up sample is a template designed to streamline the completion and submission of certain documents. With airSlate SignNow, users can easily input required data in a guided format, making it efficient to complete these forms. Our platform ensures that even complex forms are user-friendly and accessible.

-

How can I create a 15h form fill up sample using airSlate SignNow?

To create a 15h form fill up sample in airSlate SignNow, simply access our template library and select the 15h form option. You can customize the fields according to your needs, allowing for a tailored solution for your business documents. The intuitive interface makes this process quick and straightforward.

-

What are the pricing options for using airSlate SignNow for 15h form fill up samples?

airSlate SignNow offers various pricing plans to accommodate different business needs and budgets. Whether you're a small business or a large enterprise, you can find a plan that includes features for creating and managing 15h form fill up samples. Check our website for the latest pricing and features comparison.

-

What features does airSlate SignNow provide for 15h form fill up samples?

Our platform provides robust features for managing 15h form fill up samples, including customizable templates, electronic signatures, and real-time tracking. Users benefit from cloud storage, integration with other software, and easy sharing options, making the document signing process seamless. These features enhance productivity and reduce turnaround times.

-

Can I integrate airSlate SignNow with other tools for managing 15h form fill up samples?

Yes, airSlate SignNow provides integrations with various popular tools and platforms such as Google Drive, Salesforce, and Microsoft Office. This allows you to streamline your workflow when dealing with 15h form fill up samples and easily manage your documents across different systems. Integration ensures that your process remains cohesive and efficient.

-

What benefits does using airSlate SignNow for 15h form fill up samples offer?

Using airSlate SignNow for 15h form fill up samples provides numerous benefits, such as increased efficiency, reduced paper usage, and improved accuracy in data management. Our platform simplifies document workflows, allowing teams to focus on core tasks instead of paperwork. Ultimately, this leads to faster decision-making and enhanced overall productivity.

-

Is there customer support for questions related to 15h form fill up samples?

Absolutely! airSlate SignNow offers comprehensive customer support to assist users with any inquiries regarding 15h form fill up samples. Our support team is available through various channels, including chat, email, and phone, ensuring you receive timely help to maximize your experience with our platform.

Get more for Form Non15g

- Pcsi employment form

- Gidc online transfer application 390173689 form

- Dana farber medical records form

- Criminal history affidavit form

- Direct dispensing log veterinary form

- Godparent permission form st thomas parish stthomasbillings

- Book club application form wbms cpsk12vaus cps k12 va

- Parental consent form for youth camp 273947102

Find out other Form Non15g

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template