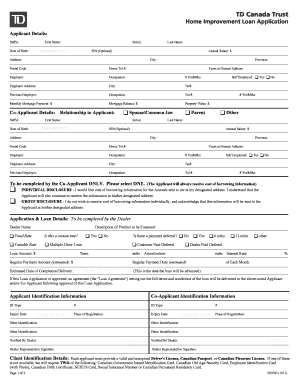

TD Canada Trust Home Improvement Loan Application Patioline Form

Understanding the bank home improvement loan application

The bank home improvement loan application is a crucial document for homeowners seeking financial assistance to enhance their property. This application allows individuals to request funds specifically for renovations, repairs, or upgrades. It typically requires personal information, details about the property, and a description of the intended improvements. Understanding the components of this application is essential for a smooth approval process.

Steps to complete the bank home improvement loan application

Completing the bank home improvement loan application involves several key steps:

- Gather necessary documents: Collect financial statements, proof of income, and details about your property.

- Fill out the application: Provide accurate personal information, loan amount requested, and details about the planned improvements.

- Review the application: Check for any errors or missing information to ensure accuracy.

- Submit the application: Send it to your bank through the preferred submission method, whether online, by mail, or in person.

Eligibility criteria for a bank home improvement loan

To qualify for a bank home improvement loan, applicants typically need to meet specific eligibility criteria, including:

- Being a homeowner with equity in the property.

- Demonstrating a stable income and good credit history.

- Providing a clear plan for the intended home improvements.

Meeting these criteria can enhance the likelihood of loan approval and favorable terms.

Key elements of the bank home improvement loan application

The bank home improvement loan application consists of several key elements that applicants should be aware of:

- Personal information: Name, address, and contact details.

- Financial details: Income, employment history, and existing debts.

- Property information: Address, type of property, and current value.

- Project description: A detailed outline of the improvements planned.

Form submission methods for the bank home improvement loan application

Applicants can submit the bank home improvement loan application through various methods, including:

- Online: Many banks offer digital platforms for easy submission.

- By mail: Print and send the completed application to the bank's address.

- In person: Visit a local branch to submit the application directly.

Application process and approval time

The application process for a bank home improvement loan generally involves the following stages:

- Submission: Once the application is submitted, the bank will review it for completeness.

- Verification: The bank will verify the information provided, including credit checks and income validation.

- Approval: If approved, the bank will outline the loan terms, including interest rates and repayment schedules.

- Funding: After acceptance of the terms, funds will be disbursed for the home improvement project.

The entire process can take anywhere from a few days to several weeks, depending on the bank's policies and the complexity of the application.

Quick guide on how to complete td canada trust home improvement loan application patioline

Complete TD Canada Trust Home Improvement Loan Application Patioline effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage TD Canada Trust Home Improvement Loan Application Patioline on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest way to adjust and electronically sign TD Canada Trust Home Improvement Loan Application Patioline with ease

- Obtain TD Canada Trust Home Improvement Loan Application Patioline and then click Get Form to begin.

- Leverage the tools we provide to complete your form.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the information and then click on the Done button to save your changes.

- Select how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign TD Canada Trust Home Improvement Loan Application Patioline and ensure excellent communication at any step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the td canada trust home improvement loan application patioline

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a bank home improvement loan?

A bank home improvement loan is a financing option offered by banks to help homeowners fund renovation or improvement projects for their homes. These loans can cover a variety of work, such as kitchen remodels and new roofing, ensuring your home remains functional and stylish.

-

How do I qualify for a bank home improvement loan?

Qualification for a bank home improvement loan typically depends on your credit score, income level, and the amount of equity in your home. Banks may require detailed documentation to assess your financial situation, aiming to offer loans to applicants who can reliably repay them.

-

What are the typical interest rates for a bank home improvement loan?

Interest rates for a bank home improvement loan can vary based on several factors, including your creditworthiness and the loan's term length. Generally, rates tend to be lower than credit cards, providing a cost-effective financing solution for home improvements.

-

What are the benefits of choosing a bank home improvement loan?

Choosing a bank home improvement loan provides several benefits, including competitive interest rates and flexible repayment options. Additionally, this financing can help enhance your property value while allowing you to undertake necessary renovations without depleting your savings.

-

Can I use a bank home improvement loan for any type of renovation?

Yes, you can use a bank home improvement loan for various types of renovations, including structural repairs, aesthetic upgrades, and efficiency improvements. However, some lenders may have restrictions on the types of projects that qualify for financing.

-

How does the application process for a bank home improvement loan work?

The application process for a bank home improvement loan typically involves submitting an application form along with required documentation, such as proof of income and information about your property. Once submitted, the bank will evaluate your application and creditworthiness before making a lending decision.

-

Are there any fees associated with a bank home improvement loan?

Yes, there may be various fees associated with a bank home improvement loan, including origination fees, appraisal fees, and closing costs. It's essential to review the loan agreement carefully and ask your lender about any potential fees to ensure you understand the total cost.

Get more for TD Canada Trust Home Improvement Loan Application Patioline

- Cp16 bindt 2012 form

- Ej 160 claim of exemption on line fillable form

- San bernardino superior court pdf fillable form

- Montana historic property record for the montana form

- Taylor herr house designation report louisvilleky form

- Tenant acknowledgement form logans reserve

- Rule 17 100form 126 notice of intent to file written application

- Rule 17 100form 127 request for relief in a dissolution of

Find out other TD Canada Trust Home Improvement Loan Application Patioline

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe