Form Wh 4p Indiana

What is the Form WH-4P Indiana

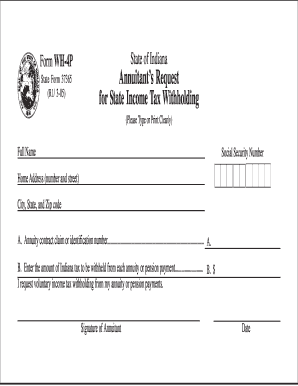

The Form WH-4P Indiana is a state-specific tax form used for withholding tax purposes. It is primarily utilized by individuals who receive pension or annuity payments in Indiana. This form allows recipients to specify their withholding preferences, ensuring that the correct amount of state income tax is deducted from their payments. Understanding the purpose of this form is crucial for managing tax liabilities effectively.

How to Use the Form WH-4P Indiana

To use the Form WH-4P Indiana, individuals must first obtain the form, which can typically be found on the Indiana Department of Revenue's website or through financial institutions that handle pension payments. Once in possession of the form, recipients should carefully fill it out, providing accurate personal information and specifying the desired withholding amount. After completing the form, it should be submitted to the payer of the pension or annuity, ensuring that the correct withholding begins with the next payment cycle.

Steps to Complete the Form WH-4P Indiana

Completing the Form WH-4P Indiana involves several straightforward steps:

- Obtain the form from a reliable source.

- Provide your personal information, including your name, address, and Social Security number.

- Indicate the amount you wish to have withheld from your payments.

- Review the form for accuracy before signing and dating it.

- Submit the completed form to your pension or annuity payer.

Following these steps ensures that your tax withholding preferences are accurately reflected in your payments.

Legal Use of the Form WH-4P Indiana

The legal use of the Form WH-4P Indiana is governed by state tax regulations. It is essential for individuals to understand that submitting this form correctly is necessary for compliance with Indiana tax laws. Failure to submit the form or providing inaccurate information can lead to improper withholding, potentially resulting in tax penalties or underpayment issues. Therefore, it is advisable to keep a copy of the submitted form for personal records.

Key Elements of the Form WH-4P Indiana

Several key elements are crucial when filling out the Form WH-4P Indiana:

- Personal Information: Ensure that your name, address, and Social Security number are accurate.

- Withholding Amount: Clearly indicate the amount you wish to be withheld, which can affect your overall tax liability.

- Signature: The form must be signed and dated to validate your request.

These elements are vital for ensuring that the form is processed correctly and reflects your tax withholding preferences.

Form Submission Methods

The Form WH-4P Indiana can be submitted through various methods, depending on the payer's requirements. Common submission methods include:

- Online: Some pension or annuity payers may allow electronic submission of the form through their websites.

- Mail: The completed form can be mailed directly to the payer's address.

- In-Person: Individuals may also have the option to deliver the form in person, especially if they have questions or require immediate confirmation.

Choosing the appropriate submission method can help ensure timely processing of your withholding preferences.

Quick guide on how to complete form wh 4p indiana

Prepare Form Wh 4p Indiana easily on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without interruptions. Handle Form Wh 4p Indiana on any device using airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to edit and eSign Form Wh 4p Indiana effortlessly

- Find Form Wh 4p Indiana and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you would like to submit your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device you choose. Edit and eSign Form Wh 4p Indiana and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form wh 4p indiana

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form wh 4p?

The form wh 4p is a specific document used for wage withholding in certain payroll contexts. It is vital for employers to understand how to properly fill out and submit the form wh 4p to ensure compliance with tax regulations and employee management.

-

How does airSlate SignNow facilitate the completion of the form wh 4p?

airSlate SignNow allows users to easily upload, edit, and eSign the form wh 4p digitally, streamlining the process. With its user-friendly interface, businesses can quickly fill out required fields, ensuring accuracy and efficiency in document management.

-

What features does airSlate SignNow offer for managing the form wh 4p?

airSlate SignNow provides features such as template creation, bulk send options, and secure eSigning specifically tailored for forms like the form wh 4p. These features enhance the user experience by simplifying workflows and ensuring secure and organized document handling.

-

Is there a cost associated with using airSlate SignNow for the form wh 4p?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans provide users with access to all features required for managing forms, including the form wh 4p, at competitive rates for ease of budget management.

-

Can I integrate airSlate SignNow with other software to manage the form wh 4p?

Absolutely! airSlate SignNow supports integrations with many popular business applications, allowing seamless management of the form wh 4p alongside other business processes. This enhances productivity by ensuring that you can access and manage documents from a single platform.

-

What benefits does airSlate SignNow provide for handling the form wh 4p?

Using airSlate SignNow for the form wh 4p streamlines the process, reduces errors, and saves time. Digital signatures make the form legally binding and compliant, which helps businesses avoid costly penalties associated with improper handling of tax documents.

-

How secure is airSlate SignNow when dealing with the form wh 4p?

airSlate SignNow prioritizes security, employing encryption protocols to protect users' information while handling the form wh 4p. This commitment to data security ensures that sensitive payroll information is always kept confidential and safe from unauthorized access.

Get more for Form Wh 4p Indiana

- Instructions for form dtf 95 business tax account update revised 922

- Form dtf 95 business tax account update revised 922

- Metropolitan commuter transportation mobility tax taxnygov form

- Form it 2104 sny certificate of exemption from withholding

- Form st 809 new york state and local sales and use tax return for part quarterly monthly filers revised 123

- Instructions for form it 201 full year resident income

- 1 add 2a deduct 2b 2c 3a 3c 3d 4 5 6a 6b 6c 7a 7b 3bii form

- Form 17reconciliation of income tax withheld

Find out other Form Wh 4p Indiana

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online