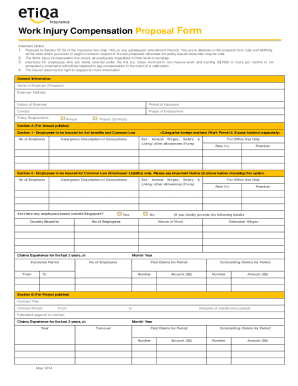

Directorate of Insurance Proposal Form

What is the Directorate of Insurance Proposal Form

The Directorate of Insurance Proposal Form is a crucial document used to initiate the process of obtaining insurance coverage. It serves as a formal request for insurance, detailing the applicant's information and the type of coverage desired. This form is essential for both individuals and businesses seeking to secure insurance policies tailored to their specific needs. By accurately filling out this form, applicants provide insurers with the necessary details to assess risk and determine premium rates.

How to Use the Directorate of Insurance Proposal Form

Using the Directorate of Insurance Proposal Form involves several straightforward steps. First, gather all relevant personal or business information, including identification details, contact information, and specifics about the coverage required. Next, carefully fill out the form, ensuring that all sections are completed accurately. It is important to review the information for any errors before submission, as inaccuracies can lead to delays or complications in the insurance process. Once completed, the form can be submitted electronically or via traditional mail, depending on the insurer's requirements.

Steps to Complete the Directorate of Insurance Proposal Form

Completing the Directorate of Insurance Proposal Form requires attention to detail. Follow these steps for a smooth process:

- Begin by entering your personal or business information, including name, address, and contact details.

- Specify the type of insurance coverage you are seeking, such as health, auto, or property insurance.

- Provide any additional information requested, such as prior insurance history or specific coverage needs.

- Review all entries for accuracy, ensuring that all required fields are filled out.

- Submit the form according to the insurer's guidelines, whether online or by mail.

Key Elements of the Directorate of Insurance Proposal Form

Several key elements must be included in the Directorate of Insurance Proposal Form to ensure its effectiveness. These elements typically consist of:

- Applicant Information: Full name, address, and contact details.

- Type of Insurance: Clear indication of the insurance coverage being requested.

- Coverage Details: Specifics about the desired coverage limits and any additional options.

- Signature: The applicant's signature, confirming the accuracy of the information provided.

Legal Use of the Directorate of Insurance Proposal Form

The Directorate of Insurance Proposal Form holds legal significance as it serves as a binding document between the applicant and the insurance provider. When completed and signed, it demonstrates the applicant's intent to enter into an insurance contract. It is essential that all information provided is truthful and accurate, as any misrepresentation could lead to denial of coverage or cancellation of the policy. Compliance with local and federal regulations is also vital to ensure the form's legal validity.

Form Submission Methods

Submitting the Directorate of Insurance Proposal Form can typically be done through various methods, depending on the insurer's preferences. Common submission options include:

- Online Submission: Many insurers offer a digital platform for submitting the form, allowing for quicker processing.

- Mail: Applicants can print the completed form and send it via postal service to the insurer's designated address.

- In-Person: Some applicants may prefer to deliver the form directly to an insurance office for personal assistance.

Quick guide on how to complete directorate of insurance proposal form

Finish Directorate Of Insurance Proposal Form effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers a perfect eco-friendly substitute for conventional printed and signed documents, as you can access the correct version and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents swiftly without delays. Handle Directorate Of Insurance Proposal Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Directorate Of Insurance Proposal Form with ease

- Obtain Directorate Of Insurance Proposal Form and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to secure your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Directorate Of Insurance Proposal Form to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the directorate of insurance proposal form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an insurance proposal and how does it work with airSlate SignNow?

An insurance proposal is a crucial document that outlines the terms and conditions of an insurance policy. With airSlate SignNow, sending and eSigning your insurance proposals becomes seamless and efficient, allowing you to manage proposals digitally. Our platform ensures that all parties can sign from anywhere, making it faster and easier to finalize your insurance deals.

-

What features does airSlate SignNow offer for managing insurance proposals?

airSlate SignNow provides a range of features designed specifically for managing insurance proposals, including customizable templates, automated workflows, and real-time tracking. These features simplify the process of creating and processing proposals, ensuring that you can focus on closing deals rather than handling paperwork. Furthermore, additional tools such as reminders and notifications keep all parties engaged throughout the signing process.

-

How much does it cost to use airSlate SignNow for insurance proposals?

The pricing for using airSlate SignNow varies based on the plan you choose, but it is designed to be cost-effective for businesses of all sizes. You can select from different subscription levels that cater to varying document needs, including those specific to insurance proposals. We encourage potential users to explore our pricing page for detailed information and find a plan that best meets their requirements.

-

Can I integrate airSlate SignNow with other tools for my insurance proposals?

Yes, airSlate SignNow offers robust integrations with various business applications, including CRM systems and document management tools. This integration capability is particularly beneficial for managing insurance proposals as it streamlines your workflow and enhances productivity. By connecting your existing software with airSlate SignNow, you can ensure that all your proposal processes are unified and efficient.

-

Is it secure to send insurance proposals through airSlate SignNow?

Absolutely! airSlate SignNow prioritizes the security of your documents, utilizing advanced encryption methods to protect all insurance proposals sent through the platform. We also comply with industry standards and regulations to ensure data confidentiality. You can rest assured that your proposals are safeguarded against unauthorized access.

-

How does airSlate SignNow improve the efficiency of handling insurance proposals?

airSlate SignNow signNowly enhances the efficiency of handling insurance proposals by automating time-consuming tasks like reminders and follow-ups. This allows you to focus on your clients rather than administrative work. The easy-to-use interface helps users quickly send out proposals and receive signatures, shortening the overall turnaround time.

-

Can multiple parties sign an insurance proposal using airSlate SignNow?

Yes, airSlate SignNow allows multiple parties to review and eSign an insurance proposal seamlessly. This capability is perfect for insurance professionals who need approvals from different stakeholders. Users can send the proposal to all required signatories at once, facilitating quicker transactions and collaboration.

Get more for Directorate Of Insurance Proposal Form

Find out other Directorate Of Insurance Proposal Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple