What is Form Rv066 Sd for 2003

What is the South Dakota Tax Form RV066?

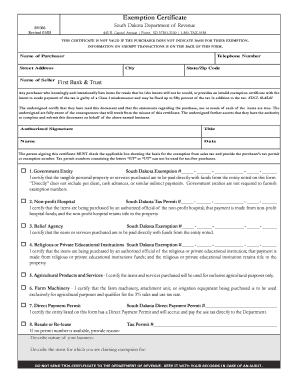

The South Dakota tax form RV066 is a tax exemption certificate used by businesses and individuals to claim exemption from sales tax on certain purchases. This form is particularly relevant for entities that qualify under specific criteria, allowing them to avoid paying sales tax on goods and services that are exempt under state law. Understanding the purpose of this form is crucial for ensuring compliance with South Dakota tax regulations.

How to Use the South Dakota Tax Form RV066

To utilize the RV066 form effectively, individuals or businesses must first determine their eligibility for tax exemption. This involves reviewing the specific categories that qualify for exemption, such as purchases for resale or specific government-related purchases. Once eligibility is established, the form must be filled out accurately, providing all required information, including the purchaser's details and the nature of the exempt purchase.

Steps to Complete the South Dakota Tax Form RV066

Completing the RV066 form involves several key steps:

- Download the form from a reliable source or obtain it from the South Dakota Department of Revenue.

- Fill in the purchaser's name, address, and tax identification number.

- Specify the type of exemption being claimed and provide details about the purchase.

- Sign and date the form to certify the accuracy of the information provided.

Once completed, the form should be presented to the seller at the time of purchase to validate the tax exemption.

Legal Use of the South Dakota Tax Form RV066

The RV066 form holds legal significance as it serves as proof of tax-exempt status for qualifying purchases. It must be used in accordance with South Dakota tax laws to avoid potential penalties for misuse. Proper completion and submission of the form ensure that both the purchaser and seller are compliant with state regulations, safeguarding against legal repercussions.

Required Documents for the South Dakota Tax Form RV066

When filling out the RV066 form, certain documents may be required to substantiate the claim for tax exemption. These may include:

- Proof of eligibility for exemption, such as a tax-exempt certificate or business license.

- Invoices or receipts related to the purchases being claimed for exemption.

- Any additional documentation that supports the nature of the exempt purchase.

Having these documents ready can facilitate a smoother process when presenting the RV066 form to sellers.

Form Submission Methods for the South Dakota Tax Form RV066

The RV066 form can be submitted in various ways, depending on the seller's preference. Common submission methods include:

- Presenting a printed copy of the completed form directly to the seller at the point of sale.

- Providing a digital version of the form via email or electronic means, if accepted by the seller.

It is essential to confirm with the seller regarding their preferred submission method to ensure the exemption is honored.

Quick guide on how to complete what is form rv066 sd for

Effortlessly Prepare What Is Form Rv066 Sd For on Any Device

Managing documents online has become increasingly popular among enterprises and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Handle What Is Form Rv066 Sd For on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

The Simplest Way to Edit and eSign What Is Form Rv066 Sd For with Ease

- Obtain What Is Form Rv066 Sd For and click on Get Form to initiate the process.

- Utilize the tools provided to fill out your document.

- Emphasize essential parts of your documents or redact sensitive information using the specialized tools airSlate SignNow offers for that purpose.

- Create your signature with the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to share your form, be it via email, SMS, or invite link, or download it to your computer.

Eliminate the issues of lost or misplaced documents, the hassle of searching for forms, or the errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign What Is Form Rv066 Sd For and ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct what is form rv066 sd for

Create this form in 5 minutes!

How to create an eSignature for the what is form rv066 sd for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the South Dakota tax form RV066?

The South Dakota tax form RV066 is a specific tax return form used for reporting vehicle-related taxes in the state. It ensures that vehicle owners comply with state tax regulations and enables them to report any applicable fees. This form is essential for accurate tax filing.

-

Where can I download the South Dakota tax form RV066?

You can easily download the South Dakota tax form RV066 directly from the official South Dakota Department of Revenue website. The form is available in PDF format for your convenience. Make sure to have the latest version to ensure compliance with current tax regulations.

-

How can airSlate SignNow help me with the South Dakota tax form RV066?

airSlate SignNow enables you to electronically sign and send the South Dakota tax form RV066 with ease. Its user-friendly interface allows for quick document upload and secure signing, streamlining your tax filing process. This saves time and enhances compliance.

-

What are the pricing options for airSlate SignNow services?

airSlate SignNow offers various pricing tiers to accommodate different business needs, ranging from basic to advanced features. Each plan provides tools necessary for handling documents like the South Dakota tax form RV066 electronically. You can choose the plan that fits your budget while ensuring efficiency.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow seamlessly integrates with various applications and platforms, which can be beneficial when handling the South Dakota tax form RV066. Popular integrations include Google Drive, Dropbox, and CRM solutions. This allows for enhanced document management and workflow efficiency.

-

What benefits will I gain from using airSlate SignNow for the South Dakota tax form RV066?

Using airSlate SignNow for the South Dakota tax form RV066 provides several benefits, including a simplified signing process, greater document security, and improved compliance. You'll also reduce turnaround time for signing and improve overall efficiency in filing.

-

Can I track the signing process of the South Dakota tax form RV066?

Absolutely! With airSlate SignNow, you can easily track the signing process of the South Dakota tax form RV066 in real-time. This gives you peace of mind, knowing exactly where the document is and which parties still need to sign.

Get more for What Is Form Rv066 Sd For

Find out other What Is Form Rv066 Sd For

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document