American Fidelity Flex Account Form

What is the American Fidelity Flex Account

The American Fidelity Flex Account is a flexible spending account designed to help employees manage their healthcare and dependent care expenses. This account allows users to set aside pre-tax dollars for eligible expenses, which can lead to significant tax savings. The funds can be used for a variety of qualified expenses, including medical bills, prescription medications, and childcare costs. By utilizing this account, employees can effectively budget for these expenses while minimizing their taxable income.

How to use the American Fidelity Flex Account

Using the American Fidelity Flex Account involves a few straightforward steps. First, employees need to determine their eligible expenses and the amount they wish to contribute to the account. Once the contributions are set, users can access their funds to pay for qualified expenses. This can typically be done through a debit card linked to the account or by submitting reimbursement requests for expenses paid out of pocket. It is essential to keep receipts and documentation for all transactions to ensure compliance with IRS guidelines.

Steps to complete the American Fidelity Flex Account

Completing the American Fidelity Flex Account involves several key steps:

- Determine the eligible expenses that can be covered by the account.

- Select the amount to contribute based on anticipated expenses.

- Complete the enrollment process through your employer or American Fidelity's platform.

- Use the funds for qualified expenses via a debit card or reimbursement submission.

- Maintain accurate records of all transactions and receipts for tax purposes.

Legal use of the American Fidelity Flex Account

The legal use of the American Fidelity Flex Account is governed by IRS regulations regarding flexible spending accounts. To ensure compliance, it is crucial to only use the funds for qualified medical and dependent care expenses. Misuse of the account can lead to penalties, including taxation on the funds used improperly. Employees should familiarize themselves with IRS guidelines to understand what constitutes a qualified expense and maintain proper documentation to support their claims.

Eligibility Criteria

Eligibility for the American Fidelity Flex Account typically depends on employment status and the specific benefits offered by an employer. Generally, employees must be enrolled in a qualified health plan to participate. Some employers may impose additional requirements, such as a minimum number of hours worked or specific job classifications. It is advisable for employees to check with their human resources department to confirm their eligibility and understand any specific criteria that may apply.

Required Documents

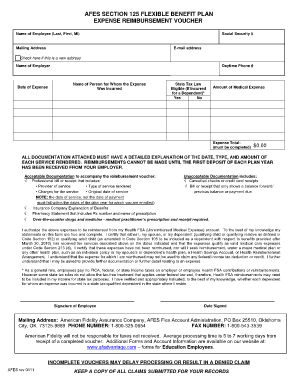

To successfully utilize the American Fidelity Flex Account, certain documents may be required. These typically include:

- Proof of eligible expenses, such as receipts or invoices.

- Enrollment forms to establish the account and set contribution levels.

- Any additional documentation requested by the employer or American Fidelity for reimbursement processing.

Filing Deadlines / Important Dates

Filing deadlines for the American Fidelity Flex Account can vary based on the employer's plan year and specific policies. Generally, employees should be aware of the following important dates:

- The enrollment period, which typically occurs annually.

- The deadline for submitting reimbursement requests, often set at the end of the plan year.

- Any grace periods or carryover options that may apply to unused funds.

Quick guide on how to complete american fidelity flex account

Prepare American Fidelity Flex Account effortlessly on any device

Digital document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct template and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage American Fidelity Flex Account on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign American Fidelity Flex Account easily

- Find American Fidelity Flex Account and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to distribute your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign American Fidelity Flex Account and ensure excellent communication throughout the preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the american fidelity flex account

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an American Fidelity Flex Account?

An American Fidelity Flex Account is a tax-advantaged account that allows users to set aside money for eligible medical, dependent care, or other qualified expenses. By utilizing an American Fidelity Flex Account, individuals can reduce their taxable income while managing their healthcare and related costs more effectively.

-

How does an American Fidelity Flex Account work?

An American Fidelity Flex Account functions by allowing employees to allocate a portion of their pre-tax earnings to cover eligible expenses. These funds can be accessed with a debit card or through reimbursement, making it an efficient way to manage healthcare costs and dependent care without impacting your take-home pay.

-

What are the benefits of using an American Fidelity Flex Account?

The primary benefits of an American Fidelity Flex Account include tax savings, increased budgeting flexibility, and the ability to cover a wider range of health and childcare expenses. This account helps users save money by reducing their taxable income and providing a structured way to manage out-of-pocket costs.

-

Are there fees associated with an American Fidelity Flex Account?

Typically, American Fidelity Flex Accounts do not have stringent account fees, making them a cost-effective choice for managing healthcare and dependent care expenses. However, it’s important to review your specific plan details to understand any potential administrative fees that may apply.

-

Can I integrate my American Fidelity Flex Account with other financial tools?

Yes, many users find that their American Fidelity Flex Account can be integrated with various financial tools for seamless tracking and management. This includes budget apps and payroll systems, allowing you to keep all your financial information in sync and monitor your spending effortlessly.

-

What types of expenses can I cover with an American Fidelity Flex Account?

An American Fidelity Flex Account can be used to cover a wide variety of eligible expenses, including healthcare costs, copays, prescriptions, and dependent care costs. This versatility makes it an excellent tool for managing everyday expenses tax-advantaged.

-

How do I enroll in an American Fidelity Flex Account?

To enroll in an American Fidelity Flex Account, you typically need to go through your employer's benefits enrollment process. Make sure to check with your HR department for specific enrollment periods and documentation required to set up your account.

Get more for American Fidelity Flex Account

- Boc online banking registration form

- Ltfrb online confirmation form

- New patta application form pdf

- United india insurance satisfaction voucher form

- Personal property addendum to real estate contract form

- Same name affidavit format pdf

- Food stamp change of address form

- Ta6 form download 2022 100262180

Find out other American Fidelity Flex Account

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation