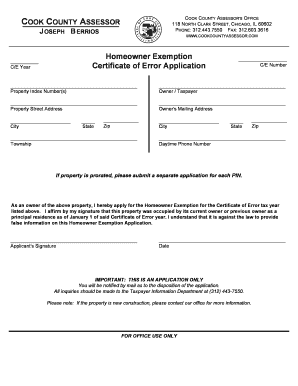

Homeowner Exemption Certificate of Error Application Form

What is the homeowner exemption certificate of error application

The homeowner exemption certificate of error application is a legal document that allows property owners to correct errors related to their property tax exemptions. This application is crucial for homeowners who believe they have been incorrectly assessed or denied an exemption that they are entitled to. The certificate of error serves to formally request a review and adjustment of the property tax records, ensuring that homeowners receive the correct benefits associated with their property ownership. Understanding this application is essential for maintaining fair tax assessments and ensuring compliance with local tax regulations.

Steps to complete the homeowner exemption certificate of error application

Completing the homeowner exemption certificate of error application involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, including your property details and any relevant documentation that supports your claim. Next, fill out the application form carefully, ensuring all sections are completed accurately. After completing the form, review it for any errors or omissions. Once verified, submit the application to the appropriate local tax authority, either online or by mail, depending on your jurisdiction's requirements. Keeping a copy of the submitted application is advisable for your records.

Eligibility criteria for the homeowner exemption certificate of error application

To qualify for the homeowner exemption certificate of error application, certain eligibility criteria must be met. Homeowners must demonstrate that they own and occupy the property as their primary residence. Additionally, the error in question must pertain to the assessment of the property tax exemption, such as incorrect property classification or failure to apply for an exemption within the required timeframe. It is essential to review local regulations, as specific criteria may vary by state or municipality. Meeting these criteria is crucial for a successful application process.

Required documents for the homeowner exemption certificate of error application

When submitting the homeowner exemption certificate of error application, specific documents are typically required to support your claim. These may include proof of ownership, such as a deed or title, and documentation that substantiates the error, like previous tax assessments or notices from the tax authority. Additionally, you may need to provide identification, such as a driver's license or state ID, to verify your identity as the property owner. Ensuring that all necessary documents are included with your application can help expedite the review process.

Legal use of the homeowner exemption certificate of error application

The homeowner exemption certificate of error application is legally binding and must be completed in accordance with state and local laws. This application allows homeowners to formally contest errors in their property tax assessments, ensuring that they are not overpaying taxes due to administrative mistakes. The legal framework surrounding this application is designed to protect homeowners' rights and ensure that tax authorities maintain accurate records. Submitting a properly completed application is essential for it to be considered valid and for the homeowner to receive the appropriate relief.

Form submission methods for the homeowner exemption certificate of error application

Submitting the homeowner exemption certificate of error application can typically be done through various methods, depending on local regulations. Homeowners may have the option to submit their application online via the local tax authority's website, which often provides a streamlined process. Alternatively, applications can be mailed directly to the appropriate office or submitted in person at designated tax offices. It is important to check with your local tax authority for specific submission guidelines and to ensure that you are using the correct method for your jurisdiction.

Quick guide on how to complete homeowner exemption certificate of error application

Effortlessly Prepare Homeowner Exemption Certificate Of Error Application on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can easily locate the appropriate form and securely preserve it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage Homeowner Exemption Certificate Of Error Application across any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Edit and Electronically Sign Homeowner Exemption Certificate Of Error Application with Ease

- Find Homeowner Exemption Certificate Of Error Application and click on Get Form to start.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign tool, which only takes a few seconds and has the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to submit your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Homeowner Exemption Certificate Of Error Application to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the homeowner exemption certificate of error application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a homeowner exemption form?

A homeowner exemption form is a document that allows qualifying property owners to reduce their property tax assessments. By filing this form, homeowners can potentially save signNow amounts on their property taxes, making it an essential request for eligible individuals.

-

How do I complete a homeowner exemption form using airSlate SignNow?

To complete a homeowner exemption form using airSlate SignNow, simply upload the document to our platform. You can fill out the necessary fields, eSign it, and securely send it to the relevant authorities—all within minutes, ensuring a seamless experience.

-

Is there a cost associated with using airSlate SignNow for homeowner exemption forms?

airSlate SignNow offers flexible pricing plans, allowing users to choose the best option for their needs. Whether you’re an individual or a business, our cost-effective solution makes managing homeowner exemption forms affordable without compromising on quality.

-

What are the benefits of using airSlate SignNow for homeowner exemption forms?

Using airSlate SignNow for your homeowner exemption form provides numerous benefits, including ease of use, security, and real-time tracking of document status. This ensures that your requests are processed quickly and efficiently, saving you time and reducing stress.

-

Can I integrate airSlate SignNow with other tools for managing homeowner exemption forms?

Yes, airSlate SignNow offers integrations with various applications, enhancing your workflow for managing homeowner exemption forms. You can connect with tools like CRM systems and cloud storage services, streamlining the document management process.

-

How secure is my data when using airSlate SignNow for homeowner exemption forms?

At airSlate SignNow, we prioritize your data security when processing homeowner exemption forms. Our platform employs advanced encryption technologies and adheres to industry standards, ensuring that your sensitive information remains safe and confidential.

-

Can I track the status of my homeowner exemption form sent through airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your homeowner exemption form in real-time. You’ll receive notifications when the document is viewed and signed, helping you stay informed throughout the process.

Get more for Homeowner Exemption Certificate Of Error Application

- 2nd intimation form punjab bar council

- Jss 0251 standard pdf form

- Kentucky marriage license form pdf

- How to fill up pag ibig specimen signature form

- Quest towing reimbursement form

- Bob net banking form

- Fms 210 form

- Www njcourts govforms10308osctemprestrainosc as original processsubmitted with new complaint

Find out other Homeowner Exemption Certificate Of Error Application

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT