540 Form

What is the 540 Form

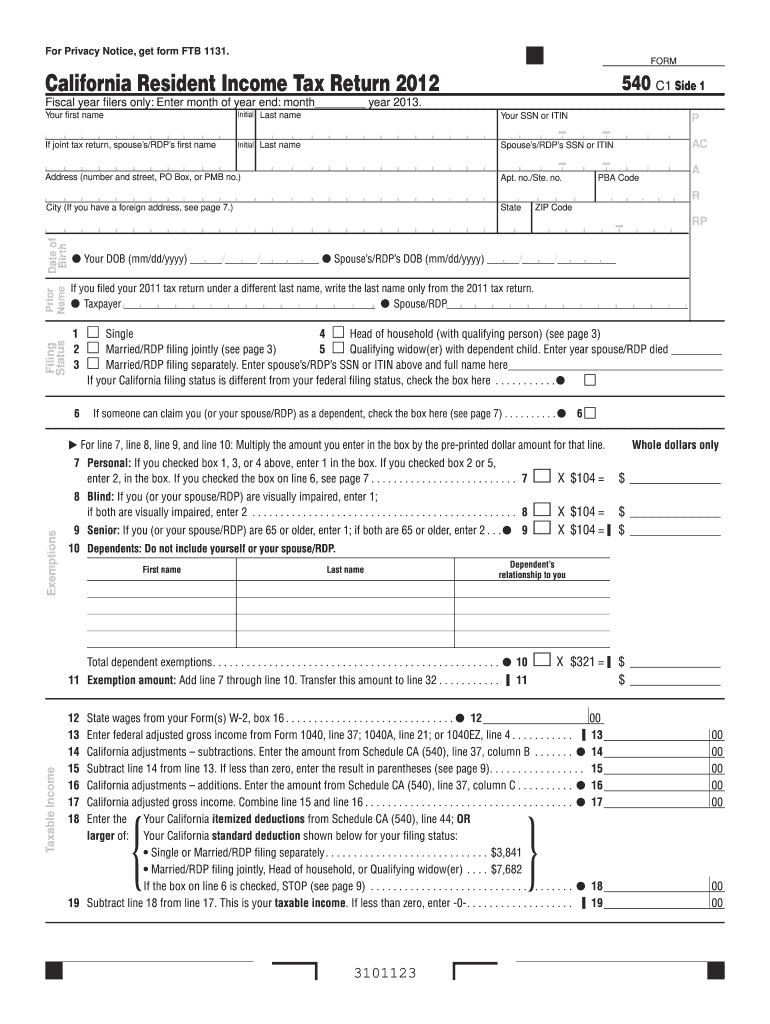

The 540 form, specifically the 540 tax form for the year 2014, is a state income tax return used by residents of California to report their income and calculate their tax liability. This form is essential for individuals who need to file their state taxes and may also be required to complete additional schedules depending on their financial situation. The 540 form allows taxpayers to claim various deductions and credits available under California tax law, helping to reduce their overall tax burden.

Steps to complete the 540 Form

Completing the 540 form involves several key steps to ensure accuracy and compliance with California tax regulations. Here is a simplified process:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, such as your name, address, and Social Security number.

- Report your total income, including wages, interest, and dividends.

- Claim deductions and credits applicable to your situation, such as the standard deduction or itemized deductions.

- Calculate your total tax owed or refund due.

- Review the form for accuracy before submission.

How to obtain the 540 Form

The 540 form can be obtained through several methods. Taxpayers can download a fillable version directly from the California Franchise Tax Board (FTB) website. Additionally, physical copies of the form may be available at local libraries, post offices, or FTB offices. For those who prefer digital solutions, using e-signature platforms can facilitate the completion and submission process.

Legal use of the 540 Form

The 540 form is legally binding when completed and submitted in accordance with California state tax laws. To ensure its validity, taxpayers must adhere to the regulations set forth by the California Franchise Tax Board. This includes providing accurate information, signing the form, and submitting it by the designated deadline. Using a reliable e-signature service can enhance the legal standing of the form by ensuring compliance with electronic signature laws.

Form Submission Methods

Taxpayers have multiple options for submitting the 540 form. The form can be filed online through the California Franchise Tax Board’s e-file system, which is often the quickest method. Alternatively, individuals can mail their completed forms to the appropriate FTB address. In-person submissions may also be possible at designated FTB offices, providing another avenue for those who prefer face-to-face assistance.

Filing Deadlines / Important Dates

For the 2014 tax year, the deadline to file the 540 form was typically April 15 of the following year. However, extensions may be available for taxpayers who need additional time. It is crucial to stay informed about any changes to deadlines, as late submissions can result in penalties and interest on unpaid taxes. Keeping track of these important dates helps ensure compliance and avoids unnecessary complications.

Quick guide on how to complete 540 form

Prepare 540 Form effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, edit, and eSign your documents swiftly without any delays. Handle 540 Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign 540 Form with ease

- Obtain 540 Form and click on Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Mark relevant sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a standard wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form-filling, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Modify and eSign 540 Form to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 540 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 540 form 2014, and why is it important?

The 540 form 2014 is a tax form used by California residents to file their income taxes. Understanding the 540 form 2014 is essential for ensuring compliance with state tax laws and maximizing potential refunds. Correctly filing this form can also help you avoid penalties and ensure you're taking advantage of available tax credits.

-

How can airSlate SignNow help with the 540 form 2014?

AirSlate SignNow provides a seamless platform to eSign and manage your 540 form 2014. With its easy-to-use interface, you can quickly fill out and send your form for signatures, making the filing process more efficient. This eliminates paperwork and helps maintain an organized record of your submissions.

-

Is there a cost associated with using airSlate SignNow for the 540 form 2014?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business needs when handling documents like the 540 form 2014. Our plans are designed to be cost-effective, allowing you to choose the one that best suits your volume of document transactions. Additionally, you can utilize a trial period to evaluate our features before committing.

-

What features does airSlate SignNow offer for managing the 540 form 2014?

AirSlate SignNow provides several features for managing the 540 form 2014, including document templates, eSignature capabilities, and real-time tracking of signatures. These features streamline the process, reduce errors, and help you keep tabs on your document submissions. The platform also integrates with various cloud storage services for easy access.

-

Are there integrations available for airSlate SignNow when working on the 540 form 2014?

Yes, airSlate SignNow integrates with various applications to enhance your workflow when dealing with the 540 form 2014. These integrations include popular services like Google Drive, Dropbox, and CRM tools, which help centralize document management. This allows for efficient document sharing and better collaboration among team members.

-

Can airSlate SignNow help ensure compliance when using the 540 form 2014?

Absolutely! AirSlate SignNow is designed to help users maintain compliance when filling out and submitting the 540 form 2014. The platform includes features like audit trails and secure storage of documents, which help ensure that your submissions meet regulatory requirements.

-

What benefits does airSlate SignNow provide for businesses filing the 540 form 2014?

Using airSlate SignNow to file the 540 form 2014 offers numerous benefits, including time savings and reduced paperwork. The software's ease of use allows for quick document creation and signature collection, streamlining the filing process. This results in a more productive workflow with fewer hiccups along the way.

Get more for 540 Form

Find out other 540 Form

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement

- eSign Utah Non-Compete Agreement Online

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast

- eSign Michigan LLC Operating Agreement Fast

- eSign North Dakota LLC Operating Agreement Computer

- How To eSignature Louisiana Quitclaim Deed

- eSignature Maine Quitclaim Deed Now

- eSignature Maine Quitclaim Deed Myself

- eSignature Maine Quitclaim Deed Free

- eSignature Maine Quitclaim Deed Easy