Nevada Modified Business Tax Return Form

What is the Nevada Modified Business Tax Return Form

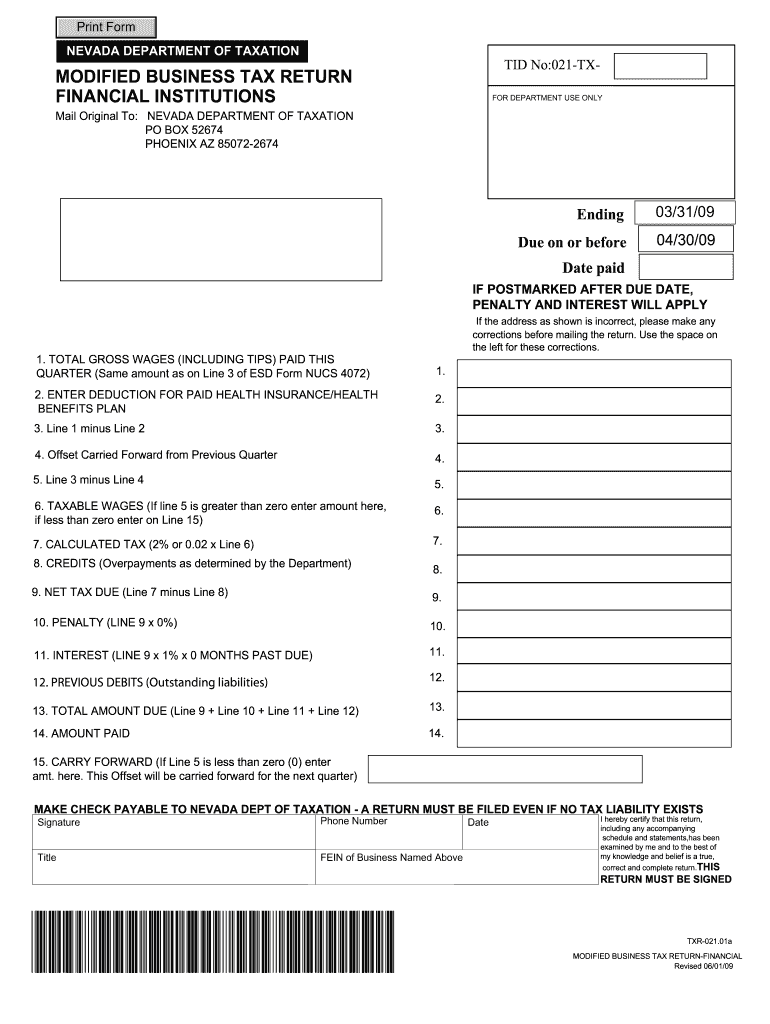

The Nevada Modified Business Tax Return Form is a tax document used by businesses operating in Nevada to report their modified business tax liability. This form is essential for employers who pay wages to employees and is designed to calculate the amount of tax owed based on gross wages. It is crucial for compliance with state tax regulations and helps ensure that businesses contribute appropriately to state revenue.

How to use the Nevada Modified Business Tax Return Form

Using the Nevada Modified Business Tax Return Form involves several steps. First, businesses must gather all necessary financial information, including total gross wages paid during the reporting period. Next, the form must be filled out accurately, detailing the total wages, any applicable deductions, and the resulting tax liability. Once completed, the form can be submitted to the Nevada Department of Taxation, either online or through traditional mail. It is important to ensure that all information is correct to avoid penalties.

Steps to complete the Nevada Modified Business Tax Return Form

Completing the Nevada Modified Business Tax Return Form requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including payroll records.

- Calculate the total gross wages paid to employees during the reporting period.

- Fill out the form, entering the total gross wages and any applicable deductions.

- Calculate the modified business tax based on the provided instructions.

- Review the completed form for accuracy.

- Submit the form electronically or by mail to the appropriate tax authority.

Legal use of the Nevada Modified Business Tax Return Form

The Nevada Modified Business Tax Return Form is legally binding when completed and submitted according to state regulations. It is essential to ensure that all information provided is accurate and truthful, as submitting false information can lead to legal penalties. The form must be signed by an authorized representative of the business, affirming that the information is correct and complete. Compliance with the state's tax laws is critical for maintaining good standing as a business entity.

Filing Deadlines / Important Dates

Filing deadlines for the Nevada Modified Business Tax Return Form are crucial for businesses to avoid penalties. Typically, the form is due on the last day of the month following the end of each quarter. For example, the deadline for the first quarter ending March 31 is April 30. It is important for businesses to track these dates and ensure timely submission to avoid late fees or interest charges.

Form Submission Methods (Online / Mail / In-Person)

The Nevada Modified Business Tax Return Form can be submitted through various methods to accommodate different business needs. Businesses have the option to file online via the Nevada Department of Taxation's website, which is often the quickest and most efficient method. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has specific instructions, so it is important to follow the guidelines provided by the state.

Quick guide on how to complete nevada modified business tax return form 100092536

Complete Nevada Modified Business Tax Return Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-conscious substitute for traditional printed and signed paperwork, as you can easily locate the necessary form and securely keep it online. airSlate SignNow equips you with all the features required to create, modify, and electronically sign your documents quickly and without interruptions. Manage Nevada Modified Business Tax Return Form on any platform using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to modify and electronically sign Nevada Modified Business Tax Return Form with ease

- Find Nevada Modified Business Tax Return Form and click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or conceal sensitive details with tools offered specifically for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Nevada Modified Business Tax Return Form and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nevada modified business tax return form 100092536

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a modified business tax form in Nevada?

A modified business tax form in Nevada is a tax form used by businesses to report their taxable payroll and calculate the amount owed. This form helps businesses comply with state taxes while ensuring accurate reporting. It's essential for smooth operation and adherence to Nevada's tax regulations.

-

How does airSlate SignNow simplify the process of submitting the modified business tax form in Nevada?

airSlate SignNow streamlines the process of submitting the modified business tax form in Nevada by allowing businesses to create, eSign, and send documents electronically. This eliminates paperwork, reduces errors, and accelerates submission times. The platform's user-friendly interface ensures that all users can complete the forms with ease.

-

What are the costs associated with using airSlate SignNow for the modified business tax form in Nevada?

airSlate SignNow offers competitive pricing plans that cater to various business sizes and needs. These plans include features designed for efficient handling of the modified business tax form in Nevada without breaking the bank. You can choose from monthly or annual subscriptions that come with various functionalities.

-

Are there any integration options available for the modified business tax form in Nevada with airSlate SignNow?

Yes, airSlate SignNow provides integration options with various accounting software and business applications that facilitate the processing of the modified business tax form in Nevada. These integrations help streamline your workflow and ensure that all data is synced seamlessly. This makes it easier to manage your tax reports along with other business documents.

-

What are the benefits of using airSlate SignNow for the modified business tax form in Nevada?

Using airSlate SignNow for the modified business tax form in Nevada offers benefits such as enhanced security, faster processing times, and reduced operational costs. The platform allows for electronic signatures, ensuring that documents are legally binding and compliant with state regulations. Additionally, it saves time by simplifying the entire submission process.

-

Is airSlate SignNow compliant with Nevada's tax regulations for modified business tax forms?

Absolutely, airSlate SignNow is designed to comply with Nevada's tax regulations, including those pertaining to the modified business tax form. The platform ensures that all documents are prepared in accordance with current state laws, helping businesses avoid compliance issues. This reliability gives users peace of mind during tax season.

-

Can I track the status of my modified business tax form submission using airSlate SignNow?

Yes, airSlate SignNow includes tracking capabilities that allow you to monitor the status of your modified business tax form submission. This feature ensures you are updated on your document's progress and can address any issues that may arise. It provides transparency and confidence throughout the submission process.

Get more for Nevada Modified Business Tax Return Form

Find out other Nevada Modified Business Tax Return Form

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online