Ctr Form PDF

What is the CTR Form PDF

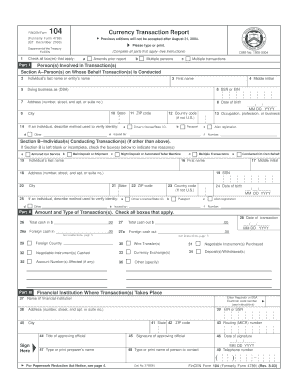

The CTR Form PDF, also known as the Currency Transaction Report, is a crucial document used in the United States to report cash transactions exceeding ten thousand dollars. This form is mandated by the Financial Crimes Enforcement Network (FinCEN) to help prevent money laundering and other financial crimes. The form collects essential information about the transaction, including details about the individual or entity conducting the transaction, the financial institution involved, and the amount of cash exchanged.

How to Obtain the CTR Form PDF

To obtain the CTR Form PDF, individuals and businesses can visit the official FinCEN website or contact their financial institution. Most banks and credit unions provide access to the form directly or can assist customers in completing it. Additionally, the form is available in a downloadable PDF format, allowing users to print and fill it out manually if needed.

Steps to Complete the CTR Form PDF

Completing the CTR Form PDF involves several steps to ensure accuracy and compliance with federal regulations. Here are the key steps:

- Gather necessary information about the transaction, including the amount, date, and parties involved.

- Fill in the details of the individual or entity conducting the transaction, including name, address, and Social Security number or Tax Identification Number.

- Provide information about the financial institution processing the transaction.

- Review the completed form for accuracy before submission.

- Submit the form electronically or via mail, depending on the preference of the financial institution.

Legal Use of the CTR Form PDF

The legal use of the CTR Form PDF is essential for compliance with the Bank Secrecy Act (BSA). Financial institutions are required to file this form for cash transactions that exceed ten thousand dollars. Failure to file the form or filing inaccurate information can result in significant penalties for both the institution and the individual involved. It is crucial to ensure that all information is complete and accurate to avoid legal repercussions.

Key Elements of the CTR Form PDF

The CTR Form PDF includes several key elements that must be accurately completed. These elements include:

- Identification of the individual or entity conducting the transaction.

- Details of the cash transaction, including the amount and date.

- Information about the financial institution involved.

- Signature of the individual completing the form, affirming the accuracy of the information provided.

Form Submission Methods

The CTR Form PDF can be submitted through various methods, depending on the requirements of the financial institution. Common submission methods include:

- Electronic submission via the financial institution's online platform.

- Mailing the completed form to the appropriate FinCEN address.

- In-person submission at the financial institution's branch.

Quick guide on how to complete ctr form pdf

Finalize Ctr Form Pdf effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed materials, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, alter, and electronically sign your documents quickly without delays. Manage Ctr Form Pdf on any gadget with airSlate SignNow's Android or iOS applications and streamline any document-centered process today.

The easiest way to modify and electronically sign Ctr Form Pdf without hassle

- Find Ctr Form Pdf and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight essential sections of your documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes moments and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, text (SMS), or invitation link, or download it to your computer.

No more lost or misplaced documents, tedious form searching, or errors that necessitate printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and sign Ctr Form Pdf digitally and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ctr form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the alcpt form 112 used for?

The alcpt form 112 is a critical document used by businesses for standardizing their processes and ensuring compliance with specific regulations. This form helps organizations streamline their workflows, making it essential for effective document management.

-

How does airSlate SignNow support the alcpt form 112?

airSlate SignNow provides a robust platform for electronically signing and sending the alcpt form 112. Our easy-to-use interface allows users to quickly upload the form, obtain signatures, and ensure secure delivery, enhancing workflow efficiency.

-

What are the pricing plans available for using airSlate SignNow with the alcpt form 112?

airSlate SignNow offers flexible pricing plans catering to various business needs when using the alcpt form 112. You can choose from monthly or annual subscriptions, allowing businesses of all sizes to access our eSignature solutions at competitive rates.

-

Can I integrate airSlate SignNow with other applications while using the alcpt form 112?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing the usability of the alcpt form 112. This integration allows you to streamline your workflow further by connecting with your CRM, storage solutions, and other essential tools.

-

What are the key benefits of using airSlate SignNow for the alcpt form 112?

Using airSlate SignNow for the alcpt form 112 provides numerous benefits, including faster turnaround times and enhanced security. Our platform ensures that your documents are easily accessible and securely stored, reducing the risk of errors and improving overall efficiency.

-

Is it possible to customize the alcpt form 112 within airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize the alcpt form 112 to meet your specific requirements. You can easily add branding, adjust fields, and modify content to align with your business's unique needs.

-

How secure is the signing process for the alcpt form 112 with airSlate SignNow?

The signing process for the alcpt form 112 is highly secure with airSlate SignNow. We utilize advanced encryption measures and authentication protocols to ensure that your documents are protected, providing peace of mind throughout the signing process.

Get more for Ctr Form Pdf

Find out other Ctr Form Pdf

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive