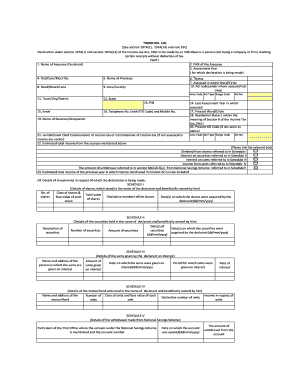

Tmb Form 15h

What is the Form 15G?

The Form 15G is a self-declaration form used in the United States primarily for tax purposes. It allows individuals to ensure that no tax is deducted from their interest income if their total taxable income is below the taxable limit. This form is particularly useful for senior citizens and those with minimal earnings, as it helps in avoiding unnecessary tax deductions on interest earned from savings accounts, fixed deposits, and other financial instruments.

Steps to Complete the Form 15G

Completing the Form 15G involves several straightforward steps:

- Download the Form: Obtain the Form 15G sample PDF download from a reliable source.

- Fill in Personal Details: Enter your name, address, PAN (Permanent Account Number), and other required personal information accurately.

- Declare Income: Provide details of your total income for the financial year, ensuring it is below the taxable limit.

- Sign the Form: After filling in the necessary details, sign the form to validate your declaration.

- Submit the Form: Submit the completed form to your bank or financial institution where you hold your account.

Legal Use of the Form 15G

The Form 15G is legally recognized as a declaration for tax exemption on interest income. When properly filled out and submitted, it provides a legal basis for banks and financial institutions to refrain from deducting tax at source. It is important to ensure that the information provided is accurate and truthful, as any discrepancies can lead to legal repercussions or penalties from tax authorities.

Key Elements of the Form 15G

Several key elements must be included in the Form 15G to ensure its validity:

- Personal Information: Full name, address, and PAN are essential for identification.

- Income Details: A declaration of total income for the financial year is crucial.

- Signature: The form must be signed by the individual submitting it.

- Financial Institution Information: Details about the bank or financial institution where the form is submitted.

Eligibility Criteria for Using Form 15G

To be eligible to use Form 15G, individuals must meet specific criteria:

- Must be a resident of the United States.

- Total taxable income should be below the taxable limit for the financial year.

- Must not be a company or firm, as this form is intended for individual taxpayers.

Form Submission Methods

The completed Form 15G can be submitted through various methods:

- Online Submission: Many banks offer online facilities where you can upload the form directly through their website.

- Mail: You can send the form via postal mail to your bank's designated address.

- In-Person: Visit your bank branch and submit the form directly to a representative.

Quick guide on how to complete tmb form 15h

Effortlessly Prepare Tmb Form 15h on Any Device

Digital document management has become increasingly favored by organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can easily locate the correct form and securely archive it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle Tmb Form 15h on any platform with the airSlate SignNow Android or iOS applications and simplify your document-centric processes today.

The easiest way to modify and electronically sign Tmb Form 15h effortlessly

- Obtain Tmb Form 15h and click on Get Form to initiate the process.

- Utilize the tools available to complete your document.

- Emphasize signNow sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Tmb Form 15h and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tmb form 15h

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form 15G filled sample and why is it important?

A form 15G filled sample is a tax declaration form that individuals use to ensure that TDS (Tax Deducted at Source) is not deducted from their interest income. Providing a completed form 15G sample helps in claiming tax benefits, especially for individuals with earnings below the taxable limit. Understanding and utilizing this form is crucial for effective financial management.

-

How can airSlate SignNow simplify the process of filling out a form 15G?

airSlate SignNow offers an intuitive platform where users can easily fill out and eSign a form 15G filled sample. With its user-friendly interface, you can complete documents efficiently, minimizing errors and saving time. The digital format also ensures that your completed forms are securely stored and easily accessible.

-

Is there a cost associated with using airSlate SignNow for form 15G?

Yes, airSlate SignNow operates on a subscription model, offering various pricing tiers to cater to different business needs. Each plan includes the ability to create and manage documents like a form 15G filled sample. The pricing is cost-effective, providing great value for features like eSigning and cloud storage.

-

Can I customize the form 15G filled sample using airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize the form 15G filled sample by adding fields, text boxes, and dropdowns to fit specific requirements. This flexibility ensures that you can tailor the form to better meet your needs and streamline the completion process.

-

Are there any integrations available for managing form 15G through airSlate SignNow?

Yes, airSlate SignNow seamlessly integrates with various applications that enhance workflow efficiency. By connecting to tools like Google Drive, Dropbox, and CRM platforms, you can easily access and manage your form 15G filled sample alongside your other important documents. These integrations further simplify the process of document management.

-

What are the benefits of using airSlate SignNow for tax-related forms like form 15G?

Using airSlate SignNow for tax-related forms like a form 15G filled sample provides several benefits, including electronic signatures, secure storage, and real-time tracking. This not only speeds up the submission process but also ensures compliance and accuracy. Additionally, the document history feature allows you to refer back to previous submissions, enhancing your record-keeping.

-

Is it safe to use airSlate SignNow for my form 15G filled sample submissions?

Yes, airSlate SignNow prioritizes security and uses advanced encryption technology to protect your documents, including your form 15G filled sample. You can have peace of mind knowing that your sensitive information is secure. They also comply with international security standards, further ensuring safety in your transactions.

Get more for Tmb Form 15h

Find out other Tmb Form 15h

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation