New Mexico Tax Payment Voucher Form

What is the New Mexico Tax Payment Voucher

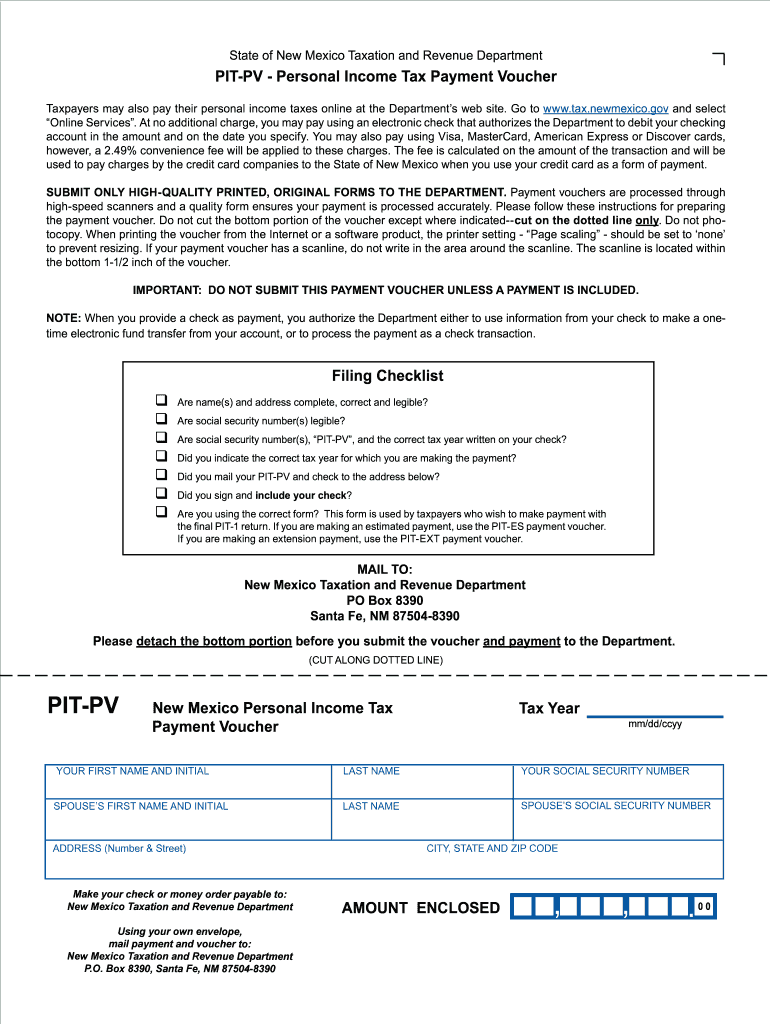

The New Mexico Tax Payment Voucher, often referred to as the PIT PV, is a crucial document used by individuals and businesses to remit tax payments to the New Mexico Taxation and Revenue Department. This form serves as a record of the payment made and is essential for ensuring compliance with state tax obligations. The PIT PV is specifically designed for personal income tax payments, providing taxpayers with a streamlined method to fulfill their financial responsibilities to the state.

How to use the New Mexico Tax Payment Voucher

Using the New Mexico Tax Payment Voucher involves several straightforward steps. First, taxpayers must accurately complete the form, ensuring that all required information is filled in correctly. This includes personal identification details, the amount being paid, and any relevant tax year information. Once completed, the voucher can be submitted along with the payment. It is important to keep a copy of the voucher for personal records, as it serves as proof of payment. This documentation may be needed for future reference or in case of any discrepancies with the tax authorities.

Steps to complete the New Mexico Tax Payment Voucher

Completing the New Mexico Tax Payment Voucher requires careful attention to detail. Here are the steps to follow:

- Obtain the PIT PV form from the New Mexico Taxation and Revenue Department website or a local office.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the amount you are paying and specify the tax year for which the payment is being made.

- Review the form for accuracy to avoid any errors that could delay processing.

- Sign and date the voucher to validate your submission.

Legal use of the New Mexico Tax Payment Voucher

The New Mexico Tax Payment Voucher is legally recognized as a valid method for submitting tax payments. To ensure its legal standing, taxpayers must adhere to the guidelines set forth by the New Mexico Taxation and Revenue Department. This includes submitting the voucher by the specified deadlines and ensuring that all information provided is accurate and complete. Failure to comply with these regulations could result in penalties or delays in processing payments.

Form Submission Methods

Taxpayers have several options for submitting the New Mexico Tax Payment Voucher. The form can be submitted online through the New Mexico Taxation and Revenue Department's website, allowing for a quick and efficient payment process. Alternatively, individuals can mail the completed voucher along with their payment to the appropriate address provided by the department. In-person submissions are also accepted at designated tax offices throughout the state. Each method has its own advantages, so taxpayers should choose the one that best fits their needs.

Filing Deadlines / Important Dates

Filing deadlines for the New Mexico Tax Payment Voucher are critical for taxpayers to observe. Typically, payments are due on the same date as the state income tax return, which is usually April 15 for most individuals. However, it is essential to verify specific deadlines each year, as they may vary or be adjusted due to holidays or other factors. Missing these deadlines can result in penalties, so staying informed is vital for compliance.

Quick guide on how to complete new mexico tax payment voucher

Accomplish New Mexico Tax Payment Voucher effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without holdups. Manage New Mexico Tax Payment Voucher on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign New Mexico Tax Payment Voucher without difficulty

- Locate New Mexico Tax Payment Voucher and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your adjustments.

- Decide how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choosing. Modify and electronically sign New Mexico Tax Payment Voucher and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new mexico tax payment voucher

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is pit pv and how does it relate to airSlate SignNow?

Pit pv is a term that refers to the valuable insights and data analysis that businesses can derive from signed documents. With airSlate SignNow, you can leverage pit pv by efficiently managing and organizing your signed e-documents, allowing for better decision-making and improved business outcomes.

-

How much does airSlate SignNow cost if I want to utilize pit pv functionalities?

airSlate SignNow offers various pricing plans tailored to meet different business needs. Depending on the features you require, including pit pv analytics, you can choose from basic to advanced plans, ensuring you only pay for what you need while gaining access to powerful document management capabilities.

-

What features does airSlate SignNow provide for enhancing pit pv?

airSlate SignNow includes features that enhance pit pv, such as automatic document tracking, customizable templates, and detailed analytics. These tools help you not only to send and eSign documents but also to analyze signing patterns and improve your business processes based on real data insights.

-

Can I integrate airSlate SignNow with other applications to enhance pit pv?

Yes, airSlate SignNow offers seamless integrations with numerous applications like CRM systems, cloud storage services, and project management tools. These integrations enhance your ability to utilize pit pv, by allowing you to pull in relevant data from various sources and streamline your document workflows effectively.

-

What are the benefits of using airSlate SignNow for managing pit pv?

Using airSlate SignNow for managing pit pv comes with numerous benefits, including cost savings, improved operational efficiency, and enhanced document control. By centralizing your e-signature process and document management, you can make data-driven decisions and raise your overall business efficiency.

-

Is airSlate SignNow user-friendly for new users interested in pit pv?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for new users to navigate the platform. The intuitive interface, combined with a wealth of support resources, ensures that even those new to pit pv can quickly learn how to manage their document workflows effectively.

-

How does airSlate SignNow ensure the security of documents related to pit pv?

airSlate SignNow prioritizes document security by implementing advanced encryption methods and secure server architecture. When utilizing pit pv functionalities, you can trust that your signed documents are protected, ensuring confidentiality and compliance with regulatory standards.

Get more for New Mexico Tax Payment Voucher

Find out other New Mexico Tax Payment Voucher

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile