Per Diem Invoice Template Form

What is the per diem invoice template

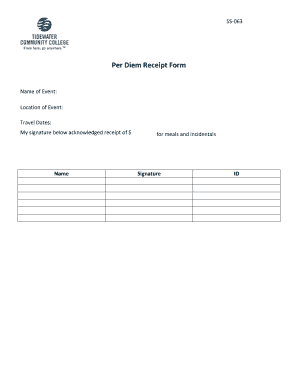

The per diem invoice template is a standardized document used to request reimbursement for daily expenses incurred while traveling for business purposes. This template helps employees and contractors itemize their expenses, making it easier for employers to process reimbursements. Typically, the per diem invoice includes sections for travel dates, locations, daily allowances, and any additional expenses that may not be covered by the per diem rates.

How to use the per diem invoice template

To effectively use the per diem invoice template, start by filling in your personal details, including your name, position, and contact information. Next, list the dates of travel and the locations visited. Indicate the per diem rates applicable for each day, ensuring they align with company policy or IRS guidelines. Include any additional expenses, such as meals or lodging, that exceed the per diem allowance. Finally, sign and date the invoice before submitting it for approval.

Key elements of the per diem invoice template

Essential components of the per diem invoice template include:

- Traveler Information: Name, employee ID, and contact details.

- Travel Details: Dates of travel, destinations, and purpose of the trip.

- Per Diem Rates: Daily allowances based on location and duration of stay.

- Expense Breakdown: Itemized list of expenses, including meals, lodging, and incidentals.

- Signature: A section for the traveler’s signature, confirming the accuracy of the information provided.

Steps to complete the per diem invoice template

Completing the per diem invoice template involves several straightforward steps:

- Gather all necessary travel documentation, including itineraries and receipts.

- Fill in your personal and travel details on the template.

- Calculate the total per diem based on the number of travel days and applicable rates.

- Itemize any additional expenses that exceed the per diem limits.

- Review the completed invoice for accuracy and completeness.

- Sign and date the invoice before submission.

Legal use of the per diem invoice template

The legal use of the per diem invoice template hinges on compliance with relevant tax regulations and company policies. It is crucial to ensure that the expenses claimed align with IRS guidelines regarding deductible travel expenses. Accurate record-keeping and transparent reporting are essential to avoid potential audits or disputes. Utilizing a trusted platform for electronic signatures can enhance the legal standing of the document.

IRS Guidelines

According to IRS guidelines, per diem rates are set based on the location of travel and are updated periodically. It is important for travelers to familiarize themselves with these rates, as they dictate the maximum allowable reimbursement. The IRS provides a per diem table that outlines these rates, which can vary significantly between different cities and states. Adhering to these guidelines ensures compliance and maximizes the chances of reimbursement approval.

Quick guide on how to complete per diem invoice template

Complete Per Diem Invoice Template effortlessly on any device

Online document management has become popular among businesses and individuals. It offers an ideal eco-friendly replacement for conventional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle Per Diem Invoice Template on any device using the airSlate SignNow Android or iOS apps and enhance any document-based process today.

The simplest way to edit and eSign Per Diem Invoice Template with ease

- Find Per Diem Invoice Template and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Per Diem Invoice Template and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the per diem invoice template

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a per diem receipt template?

A per diem receipt template is a standardized document used by employees to report daily expenses incurred while traveling for business. It simplifies the process of documenting expenses, ensuring that employees can easily request reimbursement. Using a well-designed per diem receipt template helps maintain organization and accuracy in financial reporting.

-

How can I create a per diem receipt template with airSlate SignNow?

Creating a per diem receipt template with airSlate SignNow is easy and efficient. You can start by selecting a pre-built template or create your own from scratch using our user-friendly editor. Once your template is set up, you can customize it to meet your specific needs, making expense reporting seamless.

-

Are there any costs associated with using the per diem receipt template in airSlate SignNow?

airSlate SignNow offers various pricing plans, including free trials, which allow you to explore the features of the per diem receipt template at no cost. Depending on your organization's size and requirements, you can choose a plan that fits your budget. There are no hidden fees, and the pricing is transparent.

-

What features are included in the per diem receipt template?

The per diem receipt template includes features like customizable fields, automatic calculations, and the ability to upload supporting documents. Additionally, it integrates smoothly with other airSlate SignNow tools for a streamlined workflow. These features help ensure accuracy and compliance in documenting travel expenses.

-

How does the per diem receipt template benefit businesses?

Using a per diem receipt template helps businesses maintain clear records of travel expenses, promoting transparency and reducing errors in reimbursement claims. It also saves time for employees and finance teams alike, leading to quicker processing of reimbursements. Ultimately, this enhances productivity and financial management within the organization.

-

Can I customize the per diem receipt template to suit my company's needs?

Yes, airSlate SignNow allows extensive customization of the per diem receipt template to align with your company’s specific requirements. You can modify fields, add logos, and change colors to reflect your brand identity. This flexibility ensures that the template not only meets compliance standards but also looks professional.

-

Does airSlate SignNow offer integrations with other applications for the per diem receipt template?

Absolutely! airSlate SignNow integrates with a variety of business applications, enhancing the usability of the per diem receipt template. You can easily connect tools like accounting software, project management systems, and more to streamline your expense reporting process and improve overall efficiency.

Get more for Per Diem Invoice Template

Find out other Per Diem Invoice Template

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online