Bc Pst Exemption Form

What is the BC PST Exemption Form?

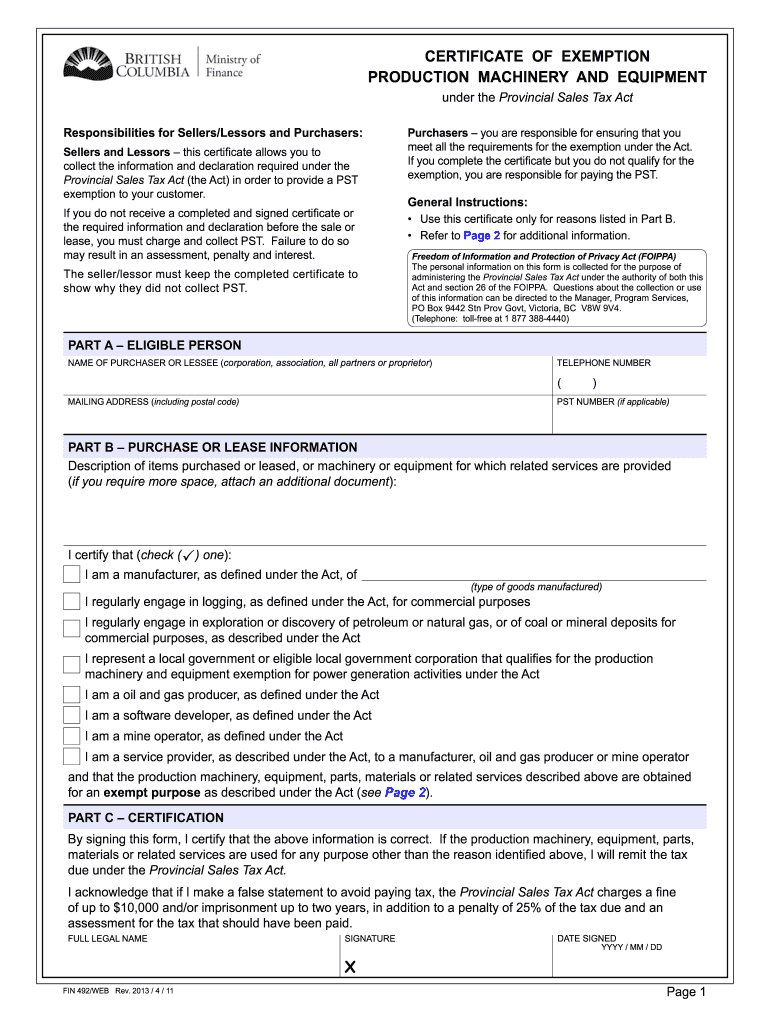

The BC PST exemption form is a document used to claim an exemption from the Provincial Sales Tax (PST) in British Columbia, Canada. This form is particularly relevant for businesses and individuals who purchase goods or services that are exempt from PST. By completing this form, the purchaser can provide proof to the seller that no tax should be charged on the transaction. Common exemptions include purchases for resale, certain types of machinery, and goods used in manufacturing. Understanding the specifics of this form is crucial for ensuring compliance with tax regulations.

How to Use the BC PST Exemption Form

Using the BC PST exemption form involves several steps to ensure that it is filled out correctly and submitted appropriately. First, identify the type of exemption applicable to your purchase. Next, complete the form by providing accurate information, including your PST number, the nature of the goods or services being purchased, and the reason for the exemption. After filling out the form, present it to the seller at the time of purchase. This process helps avoid unnecessary tax charges and ensures that the transaction complies with provincial tax laws.

Steps to Complete the BC PST Exemption Form

Completing the BC PST exemption form requires attention to detail. Follow these steps:

- Gather necessary information, including your PST number and details about the purchase.

- Clearly indicate the type of exemption you are claiming.

- Fill in all required fields accurately, ensuring that there are no errors.

- Review the completed form for accuracy before submission.

- Submit the form to the seller at the point of sale.

By following these steps, you can effectively utilize the exemption form to avoid PST charges on eligible purchases.

Key Elements of the BC PST Exemption Form

Several key elements must be included in the BC PST exemption form for it to be valid. These include:

- PST Number: The unique identifier assigned to the purchaser.

- Description of Goods or Services: A clear description of what is being purchased.

- Type of Exemption: The specific exemption category that applies to the transaction.

- Signature: The signature of the purchaser or authorized representative to validate the form.

Ensuring these elements are present will help in maintaining compliance and avoiding issues with tax authorities.

Eligibility Criteria for the BC PST Exemption Form

To qualify for using the BC PST exemption form, certain eligibility criteria must be met. Generally, the purchaser must be a registered business or an individual purchasing goods for specific exempt purposes. Common eligibility scenarios include:

- Businesses purchasing inventory for resale.

- Organizations acquiring goods for non-profit activities.

- Manufacturers purchasing machinery or equipment used in production.

Understanding these criteria ensures that only eligible transactions are exempt from PST, thereby minimizing the risk of non-compliance.

Legal Use of the BC PST Exemption Form

The legal use of the BC PST exemption form is governed by provincial tax laws. It is essential to use the form correctly to avoid potential penalties. The form serves as a legal document that verifies the exemption claim. If the form is misused or filled out incorrectly, it may lead to tax assessments, fines, or other legal consequences. Therefore, it is important to ensure that all information is accurate and that the form is used solely for legitimate exempt purchases.

Quick guide on how to complete bc pst exemption form 29381973

Effortlessly Prepare Bc Pst Exemption Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as a sustainable alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Bc Pst Exemption Form on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

Simple Ways to Modify and Electronically Sign Bc Pst Exemption Form with Ease

- Find Bc Pst Exemption Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important parts of the documents or obscure sensitive information using tools that airSlate SignNow has specifically designed for this task.

- Craft your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, SMS, invite link, or download it to your computer.

Wave goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Bc Pst Exemption Form to guarantee exceptional communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bc pst exemption form 29381973

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PST exemption form B C vehicle?

The PST exemption form B C vehicle is a document that allows eligible individuals and organizations in British Columbia to claim an exemption from the Provincial Sales Tax (PST) on qualifying vehicle purchases. This form is essential for tax savings on vehicles used for specific business purposes or in certain situations.

-

How can airSlate SignNow help with the PST exemption form B C vehicle?

airSlate SignNow streamlines the process of completing and signing the PST exemption form B C vehicle by providing an easy-to-use platform for eSigning and document management. This eliminates the hassle of printing, faxing, or mailing, ensuring a faster and more efficient submission.

-

Is there a cost associated with using airSlate SignNow for the PST exemption form B C vehicle?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan that best fits your budget and includes features like document templates and unlimited eSignatures, making it a cost-effective solution for managing the PST exemption form B C vehicle.

-

What features does airSlate SignNow offer for the PST exemption form B C vehicle?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure eSignatures for the PST exemption form B C vehicle. These features ensure that you can efficiently create, send, and manage your documents while maintaining compliance and security.

-

What are the benefits of using airSlate SignNow for tax exemption forms?

Using airSlate SignNow for tax exemption forms like the PST exemption form B C vehicle offers numerous benefits, including reduced processing time, improved accuracy, and enhanced document security. Streamlining your signing process reduces delays and increases productivity for your business.

-

Can I integrate airSlate SignNow with other software to manage the PST exemption form B C vehicle?

Yes, airSlate SignNow offers integrations with a wide range of software, including CRM and project management tools. This flexibility allows you to seamlessly incorporate the PST exemption form B C vehicle into your existing workflows, enhancing your overall efficiency.

-

Is airSlate SignNow user-friendly for those unfamiliar with digital forms?

Absolutely! airSlate SignNow is designed for ease of use, even for those not familiar with digital forms. The intuitive interface and step-by-step guidance make completing and submitting the PST exemption form B C vehicle a straightforward process for everyone.

Get more for Bc Pst Exemption Form

- Ration card application form

- How to terminate temporary guardianship without court form

- London life beneficiary change form

- Ds 3053 form 08

- Chalan tr 6 challan form download

- Level i internet safety pledge pdf form

- Child care statement template form

- Prostate cancer radiation therapy treatment plan checklist form

Find out other Bc Pst Exemption Form

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now