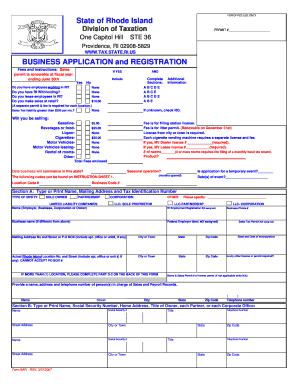

State of Rhode Island Division of Taxation Business Application and Registration Form

What is the State Of Rhode Island Division Of Taxation Business Application And Registration Form

The State Of Rhode Island Division Of Taxation Business Application And Registration Form is a crucial document for individuals and entities looking to establish a business in Rhode Island. This form serves as the official application for registering a new business, ensuring compliance with state tax regulations. It collects essential information about the business, including its name, structure, ownership details, and the nature of the business activities. Completing this form is a necessary step for obtaining the appropriate licenses and permits required to operate legally within the state.

Steps to Complete the State Of Rhode Island Division Of Taxation Business Application And Registration Form

Completing the State Of Rhode Island Division Of Taxation Business Application And Registration Form involves several key steps:

- Gather necessary information: Collect all required details, such as the business name, address, owner information, and type of business entity.

- Access the form: Obtain the form from the Rhode Island Division of Taxation website or through authorized sources.

- Fill out the form: Carefully complete each section of the form, ensuring accuracy and completeness.

- Review your submission: Double-check the information provided for any errors or omissions.

- Submit the form: Follow the submission guidelines, which may include online submission, mailing, or in-person delivery.

Legal Use of the State Of Rhode Island Division Of Taxation Business Application And Registration Form

The legal use of the State Of Rhode Island Division Of Taxation Business Application And Registration Form is essential for ensuring that businesses comply with state laws. The form must be filled out accurately and submitted to the appropriate authorities to establish the legal status of a business. It is important to note that submitting false information can result in penalties, including fines or revocation of business licenses. Utilizing a reliable method for signing and submitting the form, such as electronic signatures, can enhance the legal validity of the document.

Required Documents for the State Of Rhode Island Division Of Taxation Business Application And Registration Form

When completing the State Of Rhode Island Division Of Taxation Business Application And Registration Form, certain documents are typically required to support the application. These may include:

- Proof of identity for the business owner(s), such as a driver's license or passport.

- Business formation documents, if applicable, like Articles of Incorporation or Organization.

- Tax identification numbers, including the Employer Identification Number (EIN).

- Any relevant licenses or permits specific to the type of business being registered.

Form Submission Methods

The State Of Rhode Island Division Of Taxation Business Application And Registration Form can be submitted through various methods, providing flexibility for applicants. The available submission methods include:

- Online submission: Complete and submit the form electronically through the Rhode Island Division of Taxation's online portal.

- Mail: Print the completed form and send it to the designated address provided by the Division of Taxation.

- In-person: Deliver the form directly to the Division of Taxation office during business hours.

Eligibility Criteria for the State Of Rhode Island Division Of Taxation Business Application And Registration Form

To be eligible to complete the State Of Rhode Island Division Of Taxation Business Application And Registration Form, applicants must meet certain criteria. These include:

- Being a legal resident of the United States or a legally established entity.

- Having a valid Social Security Number or Employer Identification Number.

- Complying with all local, state, and federal regulations relevant to the business type.

- Ensuring that the business name is unique and not already registered in Rhode Island.

Quick guide on how to complete state of rhode island division of taxation business application and registration form

Effortlessly Prepare State Of Rhode Island Division Of Taxation Business Application And Registration Form on Any Device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without delays. Manage State Of Rhode Island Division Of Taxation Business Application And Registration Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Simplest Method to Modify and eSign State Of Rhode Island Division Of Taxation Business Application And Registration Form with Ease

- Obtain State Of Rhode Island Division Of Taxation Business Application And Registration Form and click on Get Form to begin.

- Make use of the tools available to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, via email, SMS, invitation link, or download it to your computer.

Leave behind the worries of lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign State Of Rhode Island Division Of Taxation Business Application And Registration Form and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state of rhode island division of taxation business application and registration form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the State Of Rhode Island Division Of Taxation Business Application And Registration Form?

The State Of Rhode Island Division Of Taxation Business Application And Registration Form is a crucial document that businesses must submit to legally operate in Rhode Island. This form ensures that your business is registered for tax purposes and complies with state regulations.

-

How can airSlate SignNow help with the State Of Rhode Island Division Of Taxation Business Application And Registration Form?

With airSlate SignNow, you can easily upload, sign, and send the State Of Rhode Island Division Of Taxation Business Application And Registration Form online. This streamlines the process, saving you time and ensuring that your forms are submitted accurately and promptly.

-

Is there a cost involved in using airSlate SignNow for the State Of Rhode Island Division Of Taxation Business Application And Registration Form?

Yes, there is a subscription fee for using airSlate SignNow, but it offers a cost-effective solution for managing documents like the State Of Rhode Island Division Of Taxation Business Application And Registration Form. The pricing is competitive and varies based on the features you choose.

-

What features does airSlate SignNow offer for completing the State Of Rhode Island Division Of Taxation Business Application And Registration Form?

airSlate SignNow provides features like eSignatures, document templates, and automated workflows to facilitate the completion of the State Of Rhode Island Division Of Taxation Business Application And Registration Form. These features enhance efficiency and minimize errors in the submission process.

-

Can I integrate airSlate SignNow with other software for the State Of Rhode Island Division Of Taxation Business Application And Registration Form?

Absolutely! airSlate SignNow offers seamless integrations with various software platforms, which allows you to incorporate the State Of Rhode Island Division Of Taxation Business Application And Registration Form into your existing workflows. This enhances productivity and simplifies document management.

-

What are the benefits of using airSlate SignNow for the State Of Rhode Island Division Of Taxation Business Application And Registration Form?

Using airSlate SignNow for the State Of Rhode Island Division Of Taxation Business Application And Registration Form provides benefits such as improved document security, faster processing times, and easier tracking of submissions. These advantages help businesses stay compliant with state regulations.

-

Is airSlate SignNow user-friendly for completing the State Of Rhode Island Division Of Taxation Business Application And Registration Form?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to navigate and complete the State Of Rhode Island Division Of Taxation Business Application And Registration Form. Its intuitive interface requires minimal training and provides a straightforward experience.

Get more for State Of Rhode Island Division Of Taxation Business Application And Registration Form

Find out other State Of Rhode Island Division Of Taxation Business Application And Registration Form

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy