1099 G Form Unemployment Michigan 2014

What is the 1099 G Form Unemployment Michigan

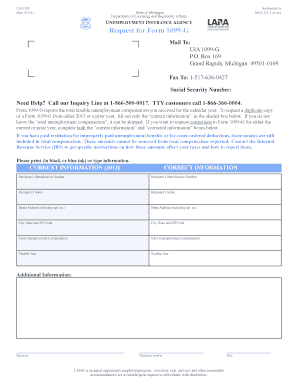

The 1099 G form for unemployment in Michigan is an official document issued by the Michigan Unemployment Insurance Agency (UIA). This form reports the total amount of unemployment benefits received by an individual during a specific tax year. It is essential for tax purposes, as the information provided on the form must be included in the recipient's annual tax return. The 1099 G form also indicates whether any state or federal taxes were withheld from the unemployment benefits, which affects the overall tax liability of the individual.

How to obtain the 1099 G Form Unemployment Michigan

To obtain the 1099 G form for unemployment in Michigan, individuals can access it through the Michigan Unemployment Insurance Agency's online portal. Users must log into their account to view and download the form. Alternatively, if a user does not have online access, they can request a paper copy by contacting the UIA directly. It is important to ensure that the request is made promptly, as the form is typically available after the end of the tax year, around January.

Steps to complete the 1099 G Form Unemployment Michigan

Completing the 1099 G form for unemployment in Michigan involves several straightforward steps. First, ensure that all personal information, such as name, address, and Social Security number, is accurately filled in. Next, report the total amount of unemployment benefits received, as indicated on the form. If applicable, include any amounts withheld for state or federal taxes. Finally, review the completed form for accuracy before submitting it with your tax return. It is advisable to keep a copy for personal records.

Legal use of the 1099 G Form Unemployment Michigan

The 1099 G form for unemployment in Michigan is legally binding and must be used in compliance with federal and state tax laws. Recipients are required to report the income listed on the form when filing their federal tax returns. Failure to accurately report this income can result in penalties from the IRS. Additionally, the form must be filled out correctly to ensure that the information is valid and accepted by tax authorities. Utilizing a reliable eSignature platform can enhance the legal validity of electronically submitted forms.

Key elements of the 1099 G Form Unemployment Michigan

Key elements of the 1099 G form for unemployment in Michigan include the recipient's personal information, the total unemployment benefits paid during the tax year, and any taxes withheld. The form also contains a unique identification number assigned by the UIA, which helps in tracking the benefits issued. Understanding these elements is crucial for accurately reporting income and ensuring compliance with tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 G form in Michigan typically align with federal tax deadlines. The form must be submitted along with your tax return by April 15 of the following year. It is essential to keep track of any changes in deadlines, as they can vary based on state regulations or federal guidelines. Recipients should ensure they have their 1099 G form in hand before filing to avoid delays or complications.

Quick guide on how to complete 1099 g form unemployment michigan

Complete 1099 G Form Unemployment Michigan effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed forms, enabling you to obtain the necessary document and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage 1099 G Form Unemployment Michigan on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign 1099 G Form Unemployment Michigan with ease

- Find 1099 G Form Unemployment Michigan and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and bears the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, time-consuming form searching, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your chosen device. Edit and eSign 1099 G Form Unemployment Michigan to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1099 g form unemployment michigan

Create this form in 5 minutes!

How to create an eSignature for the 1099 g form unemployment michigan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1099 G form in Michigan?

The 1099 G form in Michigan is a tax document used to report certain government payments, such as unemployment benefits and state tax refunds. It's important for residents to understand its purpose to ensure accurate tax reporting. If you receive a 1099 G form michigan, you must include it when filing your taxes to avoid issues with the IRS.

-

How can airSlate SignNow help me with the 1099 G form michigan?

airSlate SignNow offers an easy-to-use platform for electronically signing and sending documents, including the 1099 G form michigan. With our solution, you can streamline the process of gathering signatures and ensure your forms signNow the appropriate parties securely. This simplifies your workflow and helps maintain compliance with state regulations.

-

Is there a cost associated with using airSlate SignNow for the 1099 G form michigan?

Yes, airSlate SignNow provides various pricing plans tailored to different business needs, including affordable options for occasional users. By investing in our service, you'll enjoy an efficient method to manage your documents, including the 1099 G form michigan, with features designed for efficiency. Consider our pricing plans to find one that fits your budget.

-

Can I track the status of my 1099 G form michigan document with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for all documents, including the 1099 G form michigan. You will receive notifications when your document is viewed and signed, which enhances your confidence in the completion of your paperwork. Keeping track of your documents helps ensure timely tax filing.

-

What features does airSlate SignNow offer for handling the 1099 G form michigan?

Our platform offers a range of features suitable for handling the 1099 G form michigan, including templates for quick preparation and electronic signature capabilities. Additionally, we ensure compliance with legal standards and provide a secure environment for document handling. These features help streamline your document management process efficiently.

-

Is airSlate SignNow compatible with other software I use for tax preparation?

Yes, airSlate SignNow integrates with various software commonly used for tax preparation, enhancing your efficiency when processing the 1099 G form michigan. Our platform supports seamless integration with popular accounting and tax software, allowing for a cohesive workflow. This compatibility makes it easier to gather necessary documents and information for tax filing.

-

What are the benefits of using airSlate SignNow for the 1099 G form michigan?

Using airSlate SignNow for the 1099 G form michigan provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies document signing processes, minimizes the risk of errors, and ensures fast delivery of completed forms. Opting for our solution saves you time and helps you stay organized throughout tax season.

Get more for 1099 G Form Unemployment Michigan

Find out other 1099 G Form Unemployment Michigan

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free