Printable Federal Tax Forms

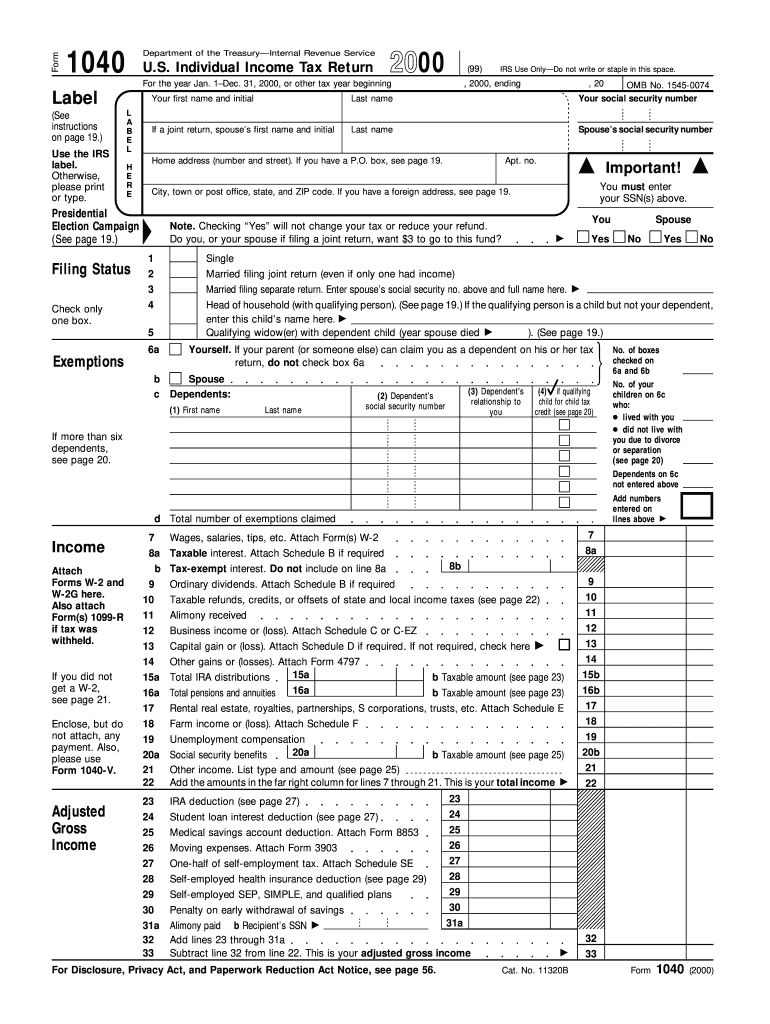

What is the 2000 Form 1040?

The 2000 Form 1040 is a federal income tax return used by individuals in the United States to report their income, calculate their tax liability, and claim any applicable deductions or credits. This form is essential for taxpayers who need to file their annual tax returns with the Internal Revenue Service (IRS). The 2000 tax return allows individuals to detail their income sources, such as wages, dividends, and interest, and to account for various deductions, including those for mortgage interest and charitable contributions.

Steps to Complete the 2000 Form 1040

Completing the 2000 Form 1040 involves several key steps to ensure accuracy and compliance with IRS regulations. Here is a step-by-step guide:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your filing status, which affects your tax rates and eligibility for certain deductions.

- Report all sources of income on the form, ensuring that each source is accurately documented.

- Calculate your adjusted gross income (AGI) by subtracting allowable deductions from your total income.

- Apply any tax credits you may qualify for, such as the Earned Income Tax Credit or Child Tax Credit.

- Review your calculations and ensure all information is complete before signing and dating the form.

Legal Use of the 2000 Form 1040

The 2000 Form 1040 is legally binding when completed and submitted according to IRS guidelines. To ensure its legal standing, taxpayers must provide accurate information and comply with all applicable laws. Electronic signatures are accepted, provided they meet the requirements set forth by the IRS and relevant eSignature regulations. It is crucial for taxpayers to retain copies of their submitted forms and any supporting documentation for future reference and potential audits.

Filing Deadlines / Important Dates

Taxpayers must adhere to specific deadlines when filing the 2000 tax return to avoid penalties. The standard deadline for submitting the Form 1040 is typically April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers can request an extension to file, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

How to Obtain the 2000 Form 1040

The 2000 Form 1040 can be obtained through various methods. Taxpayers can download a printable version directly from the IRS website or request a physical copy by calling the IRS. Many tax preparation software programs also provide access to the form, allowing users to complete their returns digitally. It is essential to ensure that the correct version of the form is used, as outdated forms may not be accepted by the IRS.

Form Submission Methods

Taxpayers have several options for submitting the 2000 Form 1040. The form can be filed electronically using e-filing services, which is often faster and more secure. Alternatively, taxpayers may choose to mail their completed forms to the appropriate IRS address based on their state of residence. In-person submissions are generally not available; however, taxpayers can seek assistance at IRS offices or authorized tax preparation locations.

Quick guide on how to complete printable federal tax forms

Prepare Printable Federal Tax Forms effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-conscious alternative to conventional printed and signed documents, as you can obtain the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Printable Federal Tax Forms on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign Printable Federal Tax Forms effortlessly

- Locate Printable Federal Tax Forms and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, and mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Modify and eSign Printable Federal Tax Forms and ensure excellent communication at every stage of the form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the printable federal tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2000 form 1040, and why is it important?

The 2000 form 1040 is the standard individual income tax return form used by U.S. taxpayers. It is crucial because it helps individuals report their income, claim deductions, and calculate any tax owed for the fiscal year. Understanding how to fill out this form accurately ensures compliance with tax regulations and can help maximize your tax refund.

-

How does airSlate SignNow simplify the process of signing the 2000 form 1040?

airSlate SignNow simplifies the signing process for the 2000 form 1040 by providing a user-friendly electronic signature solution. With easy document uploads and secure signing options, you can complete your tax forms efficiently, reducing the time spent on paperwork and ensuring legal compliance. This can be especially beneficial during tax season.

-

What features does airSlate SignNow offer for managing the 2000 form 1040?

airSlate SignNow offers features such as document templates, cloud storage, and interactive fillable forms, which are valuable for managing the 2000 form 1040. These tools allow you to prepare, sign, and store your tax documents all in one place, resulting in improved organization. Additionally, you can track the status of your documents in real-time.

-

Is there a cost associated with using airSlate SignNow for the 2000 form 1040?

Yes, using airSlate SignNow does come with associated costs; however, it is designed to be cost-effective. Pricing plans vary depending on your needs, with options suitable for individuals and businesses alike. Investing in airSlate SignNow can save you time and money compared to traditional paper-based signing methods.

-

Can I integrate airSlate SignNow with my tax software for the 2000 form 1040?

Absolutely! airSlate SignNow offers integrations with various tax software solutions. By integrating with your preferred tax software, you can streamline the workflow for preparing and signing the 2000 form 1040, making the entire process more efficient and minimizing the risk of errors.

-

What security measures does airSlate SignNow implement for the 2000 form 1040?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and compliance measures to ensure that all documents, including the 2000 form 1040, are securely processed and stored. This means that your sensitive information remains protected during the signing and sharing process.

-

How can airSlate SignNow help me track my 2000 form 1040 signatures?

airSlate SignNow provides tracking features that allow you to monitor the signing status of your 2000 form 1040 in real-time. You will receive notifications when recipients view and sign your documents, ensuring you are always updated on the progress. This feature enhances accountability and helps you meet your submission deadlines.

Get more for Printable Federal Tax Forms

Find out other Printable Federal Tax Forms

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF