Printable Texas Tax Exempt Form

What is the Printable Texas Tax Exempt Form

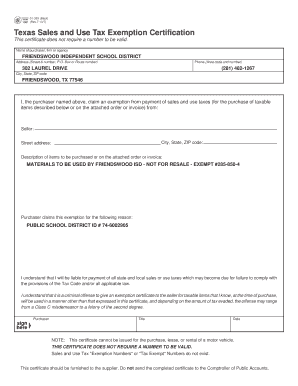

The Printable Texas Tax Exempt Form is a document that allows qualifying entities to purchase items without paying sales tax in Texas. This form is essential for organizations that meet specific criteria, such as non-profit organizations, educational institutions, and government entities. By providing this form to vendors, these entities can exempt themselves from sales tax on eligible purchases, ensuring compliance with Texas tax regulations.

How to use the Printable Texas Tax Exempt Form

To use the Printable Texas Tax Exempt Form, first ensure that your organization qualifies for tax exemption under Texas law. Once verified, fill out the form accurately, including the name of the organization, address, and the reason for the exemption. After completing the form, present it to the seller at the time of purchase. It is important to retain a copy for your records, as it may be required for audits or verification by tax authorities.

Steps to complete the Printable Texas Tax Exempt Form

Completing the Printable Texas Tax Exempt Form involves several key steps:

- Obtain the form from a reliable source, ensuring it is the most current version.

- Fill in the organization’s name and address accurately.

- Specify the reason for the tax exemption, referring to the appropriate Texas tax code.

- Include the signature of an authorized representative of the organization.

- Make copies of the completed form for your records before submitting it to the vendor.

Legal use of the Printable Texas Tax Exempt Form

The legal use of the Printable Texas Tax Exempt Form is governed by Texas tax laws. To be valid, the form must be completed accurately and used only by organizations that qualify for tax exemption. Misuse of the form, such as using it for personal purchases or by ineligible entities, can result in penalties, including fines or back taxes owed. It is crucial to understand the legal implications and ensure compliance with all applicable regulations.

Key elements of the Printable Texas Tax Exempt Form

Key elements of the Printable Texas Tax Exempt Form include:

- Organization Name: The legal name of the entity claiming the exemption.

- Address: The physical address of the organization.

- Reason for Exemption: A clear statement indicating the basis for tax exemption.

- Authorized Signature: The signature of a representative authorized to act on behalf of the organization.

Examples of using the Printable Texas Tax Exempt Form

Examples of using the Printable Texas Tax Exempt Form include:

- A non-profit organization purchasing office supplies for its operations.

- A school district acquiring educational materials for classrooms.

- A government agency procuring equipment for public services.

Quick guide on how to complete printable texas tax exempt form

Complete Printable Texas Tax Exempt Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Printable Texas Tax Exempt Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Printable Texas Tax Exempt Form with ease

- Locate Printable Texas Tax Exempt Form and then click Get Form to begin.

- Utilize the tools we offer to submit your document.

- Emphasize signNow portions of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Printable Texas Tax Exempt Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the printable texas tax exempt form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Texas tax exempt form PDF?

A Texas tax exempt form PDF is a document used by organizations to claim exemption from sales tax in Texas. This form is essential for nonprofits, educational institutions, and other qualifying entities to avoid paying sales tax on purchases related to their exempt purpose. It is typically required by vendors to validate tax-exempt transactions.

-

How can I obtain a Texas tax exempt form PDF?

You can obtain a Texas tax exempt form PDF by visiting the Texas Comptroller's website, where you can download the form directly. Additionally, airSlate SignNow allows you to create and manage your own forms efficiently, simplifying the process of obtaining and utilizing the Texas tax exempt form PDF.

-

Can airSlate SignNow help in filling out the Texas tax exempt form PDF?

Yes, airSlate SignNow provides an intuitive platform that allows users to fill out the Texas tax exempt form PDF easily. With its customizable templates and eSignature capabilities, you can complete and send your form without hassle, ensuring that all required information is accurately entered.

-

Are there any fees associated with using airSlate SignNow for Texas tax exempt form PDFs?

While airSlate SignNow offers a free trial, there are subscription plans available that may incur fees. Pricing varies based on the features you need, but using airSlate SignNow can be a cost-effective solution for managing and sending Texas tax exempt form PDFs effectively.

-

Is it safe to use airSlate SignNow to send Texas tax exempt form PDFs?

Absolutely, airSlate SignNow prioritizes security and complies with industry standards to protect your documents. By using advanced encryption and secure servers, you can send your Texas tax exempt form PDFs with confidence, ensuring that your sensitive information remains safe.

-

What integrations does airSlate SignNow offer for managing Texas tax exempt form PDFs?

airSlate SignNow offers various integrations with popular business applications such as Google Drive, Dropbox, and Salesforce. This functionality helps streamline the management of Texas tax exempt form PDFs, allowing you to access and share your documents seamlessly across different platforms.

-

How does airSlate SignNow enhance the process of using Texas tax exempt form PDFs?

airSlate SignNow enhances the process by allowing you to electronically sign and send Texas tax exempt form PDFs quickly. Its user-friendly interface and powerful features, such as automated reminders and tracking, ensure that the process is efficient and reduces turnaround time.

Get more for Printable Texas Tax Exempt Form

Find out other Printable Texas Tax Exempt Form

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form