Ohio Tax Forms Printable

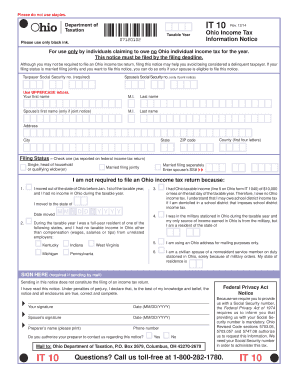

What is the Ohio IT 10 Form?

The Ohio IT 10 form is a tax document used by individuals and businesses to report income and calculate their state tax obligations. This form is specifically designed for taxpayers who have income from sources within Ohio. It is essential for ensuring compliance with state tax laws and for determining the correct amount of tax owed. Completing the Ohio IT 10 accurately is crucial for avoiding penalties and ensuring that all income is reported correctly.

How to Use the Ohio IT 10 Form

Using the Ohio IT 10 form involves several steps to ensure that all information is reported accurately. Taxpayers must gather all necessary documentation, including W-2s, 1099s, and other income statements. Once the form is obtained, it should be filled out carefully, ensuring that all income sources are reported. After completing the form, taxpayers can submit it electronically or by mail, depending on their preference and the options available.

Steps to Complete the Ohio IT 10 Form

Completing the Ohio IT 10 form involves a systematic approach:

- Gather all relevant income documents, such as W-2s and 1099s.

- Obtain the latest version of the Ohio IT 10 form from an authorized source.

- Fill in personal information, including name, address, and Social Security number.

- Report all sources of income accurately, ensuring that no income is omitted.

- Calculate the total tax owed based on the provided instructions.

- Review the form for accuracy before submission.

- Submit the completed form electronically or by mail, keeping a copy for personal records.

Legal Use of the Ohio IT 10 Form

The Ohio IT 10 form is legally recognized for reporting income and fulfilling tax obligations in the state of Ohio. It must be completed in accordance with state tax regulations to ensure that it is valid. Failure to use the form correctly can result in penalties or legal issues. Additionally, electronic submissions are accepted, provided they comply with the state's eSignature laws, ensuring that the form is submitted securely and legally.

Filing Deadlines / Important Dates

Filing deadlines for the Ohio IT 10 form are crucial for taxpayers to observe. Typically, the form must be submitted by the tax deadline, which is usually April 15 for individual taxpayers. It is important to check for any changes in deadlines or extensions that may be applicable for specific tax years. Missing the deadline can lead to penalties and interest on unpaid taxes.

Who Issues the Ohio IT 10 Form

The Ohio IT 10 form is issued by the Ohio Department of Taxation. This agency is responsible for overseeing tax collection and ensuring compliance with state tax laws. Taxpayers can access the form through the department's official website or through authorized tax preparation services. It is important to ensure that the most current version of the form is used to avoid any issues during the filing process.

Quick guide on how to complete ohio tax forms printable

Complete Ohio Tax Forms Printable effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Ohio Tax Forms Printable on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to edit and eSign Ohio Tax Forms Printable with ease

- Obtain Ohio Tax Forms Printable and click on Get Form to begin.

- Use the tools provided to complete your form.

- Highlight important sections of the documents or redact sensitive information using the features specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and has the same legal validity as a conventional handwritten signature.

- Review all information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, monotonous form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Edit and eSign Ohio Tax Forms Printable to ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ohio tax forms printable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to ohio it 10?

airSlate SignNow is a versatile electronic signature solution that enables businesses to send and eSign documents efficiently. In the context of ohio it 10, this tool streamlines document management processes, making it an ideal choice for organizations looking to enhance productivity and compliance within the state.

-

How much does airSlate SignNow cost for users in Ohio?

The pricing of airSlate SignNow is competitive and offers various plans to cater to different business needs. For businesses in Ohio, the flexible pricing structure ensures access to the essential features of ohio it 10 without overspending, making it a cost-effective solution.

-

What features does airSlate SignNow offer for managing documents?

airSlate SignNow offers a range of features designed to improve document workflows, such as customizable templates, advanced security measures, and real-time tracking. These features align perfectly with the requirements of ohio it 10, ensuring that businesses can efficiently manage their paperwork.

-

Can airSlate SignNow integrate with other software platforms?

Yes, airSlate SignNow supports integrations with numerous software platforms, enhancing its usability for businesses. Companies exploring ohio it 10 will benefit from these integrations, as they can streamline their operations by connecting with tools they already use.

-

How does airSlate SignNow enhance collaboration among teams in Ohio?

With features like shared access and real-time updates, airSlate SignNow fosters collaboration among participants on signed documents. This capability is particularly beneficial for teams working on ohio it 10 projects, enabling seamless communication and document sharing.

-

Is airSlate SignNow compliant with legal standards in Ohio?

Absolutely. airSlate SignNow complies with all federal and state laws concerning electronic signatures, ensuring that documents signed through the platform are legally binding in Ohio. This aspect is crucial for businesses operating under the regulations of ohio it 10.

-

What are the benefits of using airSlate SignNow for small businesses in Ohio?

For small businesses in Ohio, airSlate SignNow offers a range of benefits, including increased efficiency, reduced paper usage, and lower operational costs. By implementing a solution like ohio it 10, these businesses can focus more on their core activities while simplifying their documentation processes.

Get more for Ohio Tax Forms Printable

- Begin privacy enhanced message proc type 2001mic form

- Request for copy of tax return dr 841 r 0311 form

- Dr 312 2002 form

- General instructions formupack

- Florida temporary fuel tax application florida department of form

- Form dr 309640 florida department of revenue

- Flrules form

- Agenda keys energy services form

Find out other Ohio Tax Forms Printable

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure