Assignment of Real Estate Purchase and Sale Agreement PDF Form

What is the Assignment of Real Estate Purchase and Sale Agreement PDF

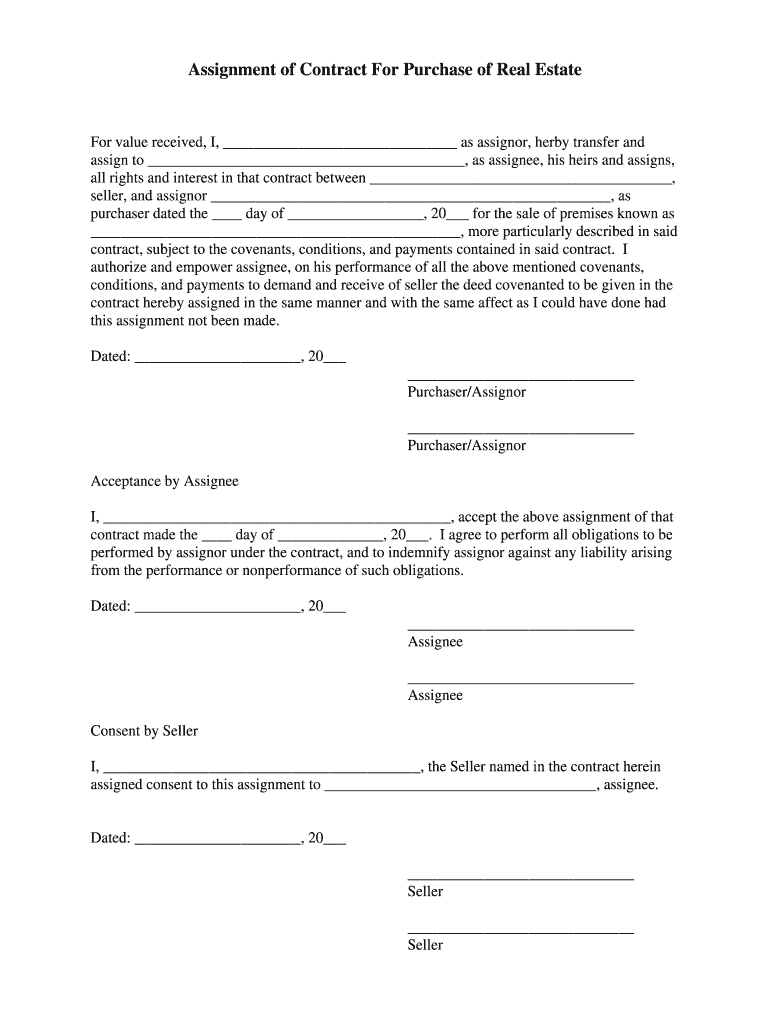

The Assignment of Real Estate Purchase and Sale Agreement PDF is a legal document that allows a buyer to transfer their rights and obligations under a real estate purchase agreement to another party. This document is essential in real estate transactions, particularly in wholesale deals, where the original buyer may not intend to close on the property themselves but rather assign their interest to another buyer. The PDF format ensures that the document is easily shareable and can be printed or filled out digitally.

How to Use the Assignment of Real Estate Purchase and Sale Agreement PDF

Using the Assignment of Real Estate Purchase and Sale Agreement PDF involves several steps. First, the original buyer must complete the document by filling in the necessary details, such as the names of the parties involved, property description, and purchase price. Next, both the assignor (the original buyer) and the assignee (the new buyer) must sign the document to validate the assignment. Once signed, the completed document should be provided to all parties involved in the transaction, ensuring everyone has a copy for their records.

Key Elements of the Assignment of Real Estate Purchase and Sale Agreement PDF

Several key elements must be included in the Assignment of Real Estate Purchase and Sale Agreement PDF to ensure its legality and effectiveness:

- Parties Involved: Clearly state the names and addresses of the assignor and assignee.

- Property Description: Include a detailed description of the property being assigned.

- Purchase Price: Specify the agreed-upon purchase price for the assignment.

- Effective Date: Indicate the date when the assignment becomes effective.

- Signatures: Both parties must sign the document to validate the assignment.

Steps to Complete the Assignment of Real Estate Purchase and Sale Agreement PDF

Completing the Assignment of Real Estate Purchase and Sale Agreement PDF involves a systematic approach:

- Obtain the template in PDF format.

- Fill in the necessary details, including the names of the parties and property information.

- Review the document for accuracy and completeness.

- Both parties should sign and date the document.

- Distribute copies of the signed document to all relevant parties.

Legal Use of the Assignment of Real Estate Purchase and Sale Agreement PDF

The legal use of the Assignment of Real Estate Purchase and Sale Agreement PDF is crucial for ensuring that the transfer of rights is recognized by all parties and complies with state laws. It is advisable to consult with a legal professional to confirm that the document meets all legal requirements in the specific jurisdiction where the property is located. This ensures that the assignment is enforceable and protects the interests of both the assignor and assignee.

State-Specific Rules for the Assignment of Real Estate Purchase and Sale Agreement PDF

Each state in the U.S. may have specific rules and regulations governing the use of the Assignment of Real Estate Purchase and Sale Agreement PDF. These rules can include requirements for notarization, specific disclosures, or additional documentation that must accompany the assignment. It is essential for parties involved in the transaction to familiarize themselves with their state's laws to ensure compliance and avoid potential legal issues.

Quick guide on how to complete assignment of contract for purchase of real estate judicial title

The optimal method to obtain and endorse Assignment Of Real Estate Purchase And Sale Agreement Pdf

On a company-wide scale, ineffective procedures surrounding document approval can waste considerable working hours. Endorsing documents such as Assignment Of Real Estate Purchase And Sale Agreement Pdf is an essential function across all sectors, which is why the effectiveness of each contract's lifecycle signNowly impacts the overall productivity of the organization. With airSlate SignNow, endorsing your Assignment Of Real Estate Purchase And Sale Agreement Pdf is as straightforward and swift as possible. This platform provides you with the latest version of nearly every document. Furthermore, you can endorse it immediately without having to install additional software on your computer or print anything as physical copies.

Steps to obtain and endorse your Assignment Of Real Estate Purchase And Sale Agreement Pdf

- Browse our collection by category or use the search bar to find the document you require.

- Check the document preview by clicking on Learn more to confirm it’s the correct one.

- Click Get form to begin editing right away.

- Fill out your document and include any essential information using the toolbar.

- When finished, click the Sign tool to endorse your Assignment Of Real Estate Purchase And Sale Agreement Pdf.

- Choose the signature method that suits you best: Draw, Create initials, or upload a picture of your handwritten signature.

- Click Done to finalize editing and move on to sharing options as needed.

With airSlate SignNow, you have everything necessary to handle your paperwork efficiently. You can find, complete, modify, and even send your Assignment Of Real Estate Purchase And Sale Agreement Pdf all in one tab without any difficulty. Enhance your workflows by utilizing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How likely is it for me to win a lawsuit where a seller wants to back out of a signed commercial real estate offer/contract?

Obligatory legalese: I’m not a lawyer and you should consult one for legal advice.Generally speaking, if you have performed as specified in the contract, including putting in deposit, removing any applicable contingencies, and informing seller of your intent to close, then I think you have a pretty good case.However, in practical terms, it’s not clear if you should go to court. Lawyers are expensive and, depending on the contract and the state you’re in, you may not be able to get back your expenses, even if you win. And any case, even a winning one, is going to take a long time to complete; is it really worth your time and aggravation?

-

Real Estate: How do I best structure a rental property if the bank refuses to title it to an LLC but I still want to operate it out of an LLC?

The bank doesn’t have anything to do with the title to the property.The bank makes loans.What you seem to be saying is that you are buying the property with a partner and you want the bank to loan money to an LLC.Why would the bank do that?The bank needs a first lien on the property to secure the loan. Only the owner of the property can give the bank a first lien. That is you and your partner.If you are saying that you want to create a Limited Liability Company (LLC) with you and your partner as the sole owners, and then have the LLC purchase the property, and you want the bank to loan the money to the LLC to purchase the property, then the answer is simple.The bank is the one who makes the decision about loaning money.If the bank is not comfortable loaning money to a company that, by its very nature and name, has no liability for paying it back, beyond foreclosure on the property, then the bank will not loan the money.The bank would prefer that you and your partner borrow the money.That way, if you do not pay it back, the bank will foreclose on the property and sell it at auction and apply the net proceeds to satisfy your loan.And then, the bank will sue you for the remaining balance and get a deficiency judgment against you for the unpaid part of the loan.And that’s why banks will not loan to an LLC, but will loan to the owner of the LLC.Plus, and I don’t want to scare you with this, if you try to pull some stunt to get around this, you are operating in the area that is called “fraud” and you really don’t want to go there.Accept the decision of the bank, and look for a commercial loan, or to private “hard money lenders” to provide the funds.I hope this helps.Good Luck.Michael Lantrip, Author “How To Do A Section 1031 Like Kind Exchange.”

-

How can I get out of a real estate contract when I priced the property too low and really feel it is a mistake to sell it?

Number one thing is to step back and think objectively talking to your listing agent. Hopefully, you did use an experienced Realtor to help you set the price. If a home is priced correctly, you should expect to have interest and offers early. You may have to wait a while before you get another similar offer. When a home first goes on the market, you get both the people who’ve been looking for possibly weeks or more plus new buyers just starting.If you truly want to get out of the contract talk to a real estate attorney. As a seller contracts really don’t give you much out unless a buyer defaults. If this your homesteaded home, you may be able to avoid being forced to sell but could be held liable for buyers costs and possibly damages. Your home may even be held up from being sold to someone else. If you have a listing agreement, you may be responsible for commissions.Think carefully, then talk to an attorney.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

How can I get a lot of people to fill out my Google form survey for a research paper?

First of all, to get a lot of responses for your survey don't forget to follow main rules of creating a survey. Here are some of them:Create and design an invitation page, sett the information about why it is so important for you to get the answers there; also write the purpose of your survey.Make your survey short. Remember that people spend their time answering questions.Preset your goal, decide what information you want to get in the end. Prepare list of questions, which would be the most important for you.Give your respondents enough time to answer a survey.Don't forget to say "Thank you!", be polite.Besides, if you want to get more responses, you can use these tips:1.The first one is to purchase responses from survey panel. You can use MySurveyLab’s survey panel for it. In this case you will get reliable and useful results. You can read more about it here.2.If you don’t want to spent money for responses, you can use the second solution. The mentioned tool enables sharing the survey via different channels: email (invitations and e-mail embedded surveys, SMS, QR codes, as a link.You can share the link on different social media, like Twitter, Facebook, Facebook groups, different forums could be also useful, Pinterest, LinkedIn, VKontakte and so on… I think that if you use all these channels, you could get planned number of responses.Hope to be helpful! Good luck!

-

I booked a rental for beach vacation NC, the owner sold to a real estate co. Can I get out of the contract since other party is no longer the owner?

Probably not. The debts, obligations and future involvements inure to the buyer. It is no different than the new owner cancelling your reservation for no good reason. If you have already paid the party as prior owner, you may have a problem with the new owner if the proceeds of the rental were not transferred. Good luck with that..it can be an expensive event and you have little recourse.

Create this form in 5 minutes!

How to create an eSignature for the assignment of contract for purchase of real estate judicial title

How to make an electronic signature for your Assignment Of Contract For Purchase Of Real Estate Judicial Title in the online mode

How to generate an electronic signature for the Assignment Of Contract For Purchase Of Real Estate Judicial Title in Google Chrome

How to create an eSignature for signing the Assignment Of Contract For Purchase Of Real Estate Judicial Title in Gmail

How to make an eSignature for the Assignment Of Contract For Purchase Of Real Estate Judicial Title right from your smartphone

How to make an electronic signature for the Assignment Of Contract For Purchase Of Real Estate Judicial Title on iOS devices

How to make an eSignature for the Assignment Of Contract For Purchase Of Real Estate Judicial Title on Android

People also ask

-

What is an assignment of purchase and sale agreement?

An assignment of purchase and sale agreement is a legal document that allows a buyer to transfer their rights and obligations under a purchase agreement to another party. This process facilitates smooth transactions in real estate or other sales, providing clarity on the terms involved. Using airSlate SignNow can help streamline the signing process for this important document.

-

How can airSlate SignNow assist with the assignment of purchase and sale agreement?

airSlate SignNow offers an easy-to-use platform for creating and eSigning an assignment of purchase and sale agreement. Users can quickly upload documents, add necessary fields, and send them for signatures, ensuring compliance and efficiency. This solution reduces paperwork and accelerates the transaction process.

-

What is the pricing for airSlate SignNow specifically for real estate documents?

airSlate SignNow offers various pricing plans that cater to different business sizes and needs, including those for real estate document management like the assignment of purchase and sale agreement. Our plans are competitively priced and designed to provide maximum value for features such as eSigning, document sharing, and templates. Contact us to find the best plan for your requirements.

-

Are there any integrations available for managing assignments of purchase and sale agreements?

Yes, airSlate SignNow integrates seamlessly with various tools and platforms that enhance the management of assignments of purchase and sale agreements. Popular integrations include CRM systems, cloud storage services, and productivity tools. These integrations help streamline workflows and maintain organized records.

-

What features does airSlate SignNow provide for creating an assignment of purchase and sale agreement?

airSlate SignNow includes features specifically designed for creating an assignment of purchase and sale agreement, such as customizable templates, electronic signatures, and secure storage. These features ensure that you can create legally binding documents while maintaining a user-friendly experience. Additionally, you can track document status in real time.

-

Can I use airSlate SignNow on mobile devices for signing agreements?

Absolutely! airSlate SignNow is fully optimized for mobile devices, allowing you to manage your assignment of purchase and sale agreement on the go. This functionality ensures that you can eSign and send documents without the need for a desktop, providing flexibility and convenience. Our mobile app is easy to navigate and highly efficient.

-

What benefits can I expect from using airSlate SignNow for my agreements?

Using airSlate SignNow for your assignment of purchase and sale agreement comes with several benefits, including time savings, cost efficiency, and improved workflow management. Our platform simplifies the document signing process, reducing the likelihood of errors and ensuring fast turnaround times. Enjoy the peace of mind that comes from using a secure and compliant eSigning solution.

Get more for Assignment Of Real Estate Purchase And Sale Agreement Pdf

- Hospital birth certificate format pdf

- Soc 342 form

- Australia review form

- Da form 5988 e example

- Standard and personalized professional fire fighter license plates may be issued for passenger vehicles light commercial form

- Certificate of inspectionaffidavit of vehicle construction form

- Abandoned vehicle lien transfer vp 262 dmv nv form

- Ec 018 odometer certification for emission exemption form

Find out other Assignment Of Real Estate Purchase And Sale Agreement Pdf

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT