Missouri Form 4757

What is the Missouri Form 4757

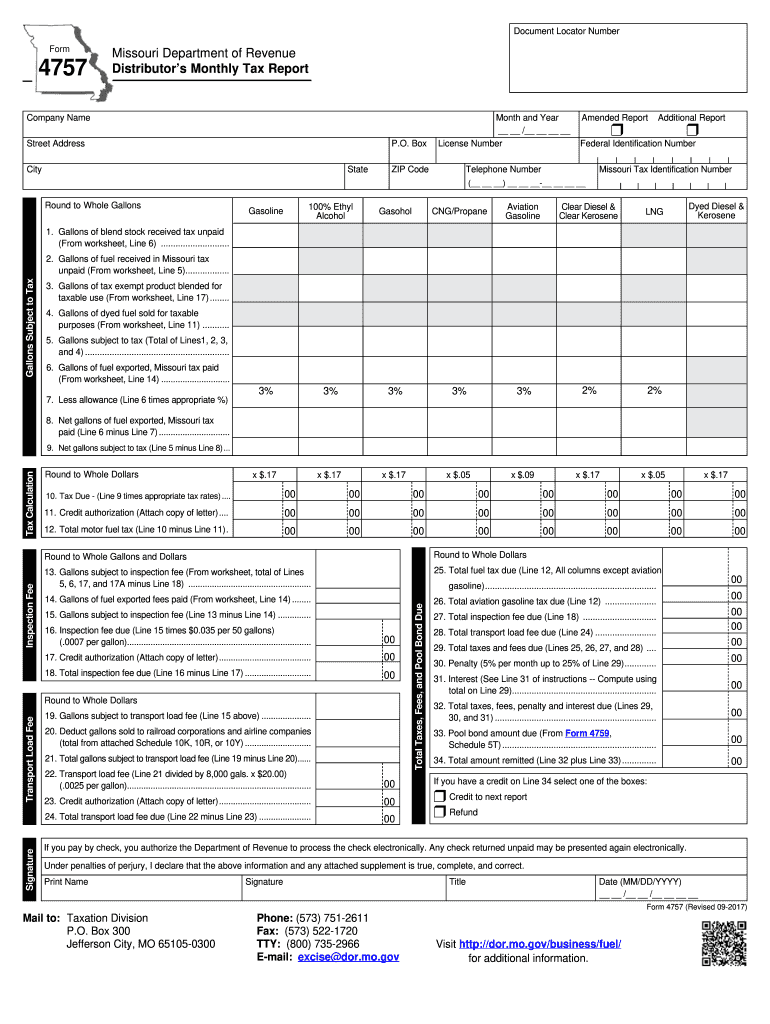

The Missouri Form 4757, also known as the state of Missouri fuel form 4757, is a document used for reporting fuel tax credits and refunds. This form is essential for businesses and individuals who purchase fuel for specific purposes and seek to reclaim the taxes paid. It is particularly relevant for those involved in agriculture, manufacturing, and other industries where fuel use is exempt from certain taxes. Understanding the function and requirements of this form is crucial for compliance with Missouri tax regulations.

How to use the Missouri Form 4757

Using the Missouri Form 4757 involves several steps to ensure accurate reporting and compliance. First, gather all necessary documentation, including receipts and records of fuel purchases. Next, accurately fill out the form, providing details such as the type and amount of fuel purchased, the intended use, and any applicable exemptions. After completing the form, review it for accuracy before submission. This careful approach helps prevent delays in processing and potential penalties.

Steps to complete the Missouri Form 4757

Completing the Missouri Form 4757 requires attention to detail. Follow these steps:

- Gather all relevant documentation, including proof of fuel purchases.

- Fill in the required fields on the form, ensuring all information is accurate.

- Specify the type of fuel and its intended use, noting any exemptions.

- Double-check the calculations and totals to avoid errors.

- Sign and date the form before submission.

By following these steps, you can ensure that your form is completed correctly and submitted on time.

Legal use of the Missouri Form 4757

The Missouri Form 4757 is legally binding when completed and submitted in accordance with state regulations. To ensure its legal standing, the form must be filled out accurately, and all claims for tax credits or refunds must be substantiated with appropriate documentation. Additionally, the use of electronic signatures through platforms like signNow can enhance the legal validity of the submission, as long as they comply with the ESIGN and UETA acts.

Filing Deadlines / Important Dates

Filing deadlines for the Missouri Form 4757 are critical to ensure compliance and avoid penalties. Typically, the form must be submitted by the end of the month following the quarter in which the fuel was purchased. For example, if fuel was purchased in the first quarter (January to March), the form should be filed by April 30. It is essential to stay informed about any changes to these deadlines, as they can vary based on state regulations.

Form Submission Methods (Online / Mail / In-Person)

The Missouri Form 4757 can be submitted through various methods, providing flexibility for users. Options include:

- Online Submission: Many users prefer to file electronically, which can expedite processing times.

- Mail: Completed forms can be mailed to the appropriate state department, ensuring they are postmarked by the deadline.

- In-Person: For those who prefer direct interaction, forms can be submitted at designated state offices.

Choosing the right submission method can help streamline the process and ensure timely compliance.

Quick guide on how to complete missouri form 4757

Complete Missouri Form 4757 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly and efficiently. Manage Missouri Form 4757 on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Missouri Form 4757 without hassle

- Find Missouri Form 4757 and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that necessitate creating new document copies. airSlate SignNow satisfies your document management needs with just a few clicks from any device you choose. Edit and electronically sign Missouri Form 4757 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the missouri form 4757

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Missouri Form 4757 and how is it used?

The Missouri Form 4757 is a crucial document for businesses and individuals alike, often used for tax purposes. It is essential for reporting various tax-related information to the state of Missouri. Understanding how to fill out the Missouri Form 4757 accurately can save you time and ensure compliance.

-

How can airSlate SignNow simplify the process of signing the Missouri Form 4757?

AirSlate SignNow provides an intuitive platform that allows users to easily create, send, and eSign the Missouri Form 4757. With just a few clicks, you can securely sign documents and manage all your paperwork in one place. This streamlines the process, making it both quick and efficient.

-

Are there any costs associated with using airSlate SignNow for the Missouri Form 4757?

AirSlate SignNow offers flexible pricing plans designed to meet the needs of individuals and businesses. Most plans include features that allow you to electronically sign the Missouri Form 4757 without any additional fees. You can choose what best fits your signature needs and budget.

-

Can I integrate airSlate SignNow with other tools for managing the Missouri Form 4757?

Yes, airSlate SignNow offers integrations with various applications, including CRM systems and cloud storage services. This allows you to manage the Missouri Form 4757 seamlessly with your existing software. Interoperability enhances your workflow, ensuring all your documents are readily accessible.

-

What security features does airSlate SignNow offer for the Missouri Form 4757?

AirSlate SignNow prioritizes the security of your documents, including the Missouri Form 4757. The platform uses advanced encryption and secure servers to protect all of your sensitive information. Additionally, it complies with industry standards, ensuring that your data remains confidential.

-

Is it easy to access the Missouri Form 4757 on airSlate SignNow?

Absolutely! AirSlate SignNow makes it incredibly easy to access important documents like the Missouri Form 4757. Users can quickly find and manage their forms through a user-friendly interface designed for convenience and accessibility.

-

What are the benefits of using airSlate SignNow for the Missouri Form 4757?

Using airSlate SignNow for the Missouri Form 4757 offers numerous benefits, including speed and efficiency in document management. It eliminates the hassle of paper-based signatures and enhances collaboration with instant notifications and tracking. Overall, it streamlines the workflow for quicker completion.

Get more for Missouri Form 4757

Find out other Missouri Form 4757

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now