Form 4669 Instructions

What is the Form 4669 Instructions

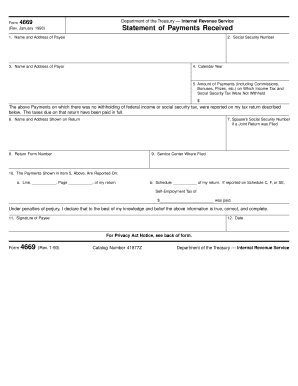

The Form 4669, officially known as the IRS Form 4669 Instructions, is designed to assist taxpayers in reporting specific information related to their tax filings. This form is particularly relevant for individuals who receive a refund of overpaid taxes, allowing them to provide necessary details to the IRS. Understanding the instructions is crucial for ensuring accurate completion and compliance with federal tax regulations.

Steps to complete the Form 4669 Instructions

Completing the Form 4669 requires careful attention to detail. Here are the essential steps to follow:

- Gather necessary information: Collect all relevant documents, such as previous tax returns and any notices received from the IRS.

- Fill out personal information: Enter your name, address, and Social Security number accurately to avoid processing delays.

- Report the refund details: Clearly indicate the amount of overpayment and any other relevant financial information as specified in the instructions.

- Review your entries: Double-check all information for accuracy to prevent errors that could lead to delays or penalties.

- Sign and date the form: Ensure that you provide your signature and the date of completion to validate the submission.

How to obtain the Form 4669 Instructions

The Form 4669 Instructions can be obtained directly from the IRS website or through various tax preparation resources. It is essential to use the most current version to ensure compliance with any recent updates or changes in tax laws. Additionally, tax professionals can provide guidance and access to the form as part of their services.

Legal use of the Form 4669 Instructions

The legal use of the Form 4669 is governed by IRS regulations. It is important to understand that this form must be completed accurately to maintain its validity. Failure to adhere to the instructions can result in penalties or delays in processing your tax refund. Utilizing electronic tools, such as e-signature platforms, can enhance the legal standing of the form by ensuring compliance with e-signature laws.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of the Form 4669. These guidelines include detailed instructions on the information required, filing deadlines, and any supporting documentation that may be necessary. Adhering to these guidelines is crucial for ensuring that your submission is accepted and processed in a timely manner.

Filing Deadlines / Important Dates

Filing deadlines for the Form 4669 can vary based on individual circumstances, such as the type of tax return being filed. Generally, it is advisable to submit the form as soon as you become aware of an overpayment to avoid potential penalties. Keeping track of important dates, such as the end of the tax year and the due date for tax returns, can help ensure timely submission.

Required Documents

When completing the Form 4669, several documents may be required to support your claim. These can include:

- Previous tax returns

- IRS notices regarding overpayments

- Proof of payment, such as bank statements or payment confirmations

Having these documents readily available can streamline the completion process and enhance the accuracy of your submission.

Quick guide on how to complete form 4669 instructions

Effortlessly Complete Form 4669 Instructions on Any Device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing users to find the necessary form and securely store it online. airSlate SignNow provides all the tools required to draft, modify, and electronically sign your documents quickly and efficiently. Handle Form 4669 Instructions on any device using the airSlate SignNow applications for Android or iOS and enhance any document-focused workflow today.

The easiest way to modify and electronically sign Form 4669 Instructions with minimal effort

- Locate Form 4669 Instructions and then select Get Form to begin.

- Take advantage of the tools available to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using tools provided by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign tool, which requires just seconds and holds the same legal validity as a traditional ink signature.

- Review the details and then click on the Done button to save your updates.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 4669 Instructions and guarantee outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4669 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 4669 and how is it used in airSlate SignNow?

Form 4669 is a crucial document for businesses that need to streamline their signing processes. With airSlate SignNow, you can easily integrate form 4669 into your workflow, ensuring quick and secure electronic signatures without hassles. This enhances efficiency in document management and compliance.

-

How does airSlate SignNow facilitate the completion of form 4669?

AirSlate SignNow provides an intuitive platform for completing form 4669 electronically. Users can fill out the form directly and send it for eSignature, making the process faster and reducing turnaround time. The platform’s user-friendly interface simplifies every step, ensuring all necessary details are accurately captured.

-

What are the pricing options for using airSlate SignNow with form 4669?

AirSlate SignNow offers flexible pricing plans to accommodate various business needs when handling form 4669. Whether you are a small team or a large enterprise, you can choose a plan that fits your budget and requirements. Sign up today to get started on a cost-effective solution for your document management.

-

Can I integrate form 4669 with other applications using airSlate SignNow?

Yes, airSlate SignNow allows for seamless integration with various applications when handling form 4669. This means you can connect your existing tools such as CRM, cloud storage, and productivity applications to create a synchronized workflow. Such integrations save time and enhance productivity across teams.

-

What security features does airSlate SignNow provide for form 4669?

When managing form 4669, airSlate SignNow ensures top-tier security measures to protect your sensitive information. The platform includes encryption, secure access controls, and compliance with industry standards. This guarantees that your signed documents are kept safe and your business remains compliant.

-

Is there a mobile app for managing form 4669 with airSlate SignNow?

Absolutely! AirSlate SignNow provides a mobile app to handle form 4669 on the go. This allows users to fill out, send, and sign documents from their smartphones or tablets, enhancing accessibility and convenience. Stay productive regardless of where you are with our powerful mobile solution.

-

What are the benefits of using airSlate SignNow for form 4669?

Using airSlate SignNow for form 4669 offers numerous benefits, including increased efficiency, reduced paper usage, and faster transaction times. The electronic signature feature streamlines the signing process, making it easier to get documents reviewed and approved. This results in improved workflow and better customer satisfaction.

Get more for Form 4669 Instructions

Find out other Form 4669 Instructions

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors