Iht35 Form 2012

What is the Iht35 Form

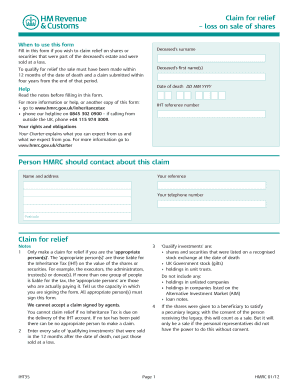

The Iht35 form is a crucial document used in the context of estate administration in the United States. It is primarily utilized for reporting the value of an estate for tax purposes. This form helps ensure that the estate is assessed accurately, allowing for the proper calculation of any inheritance tax that may be owed. By providing detailed information about the deceased's assets and liabilities, the Iht35 form plays a vital role in the estate settlement process.

How to use the Iht35 Form

Using the Iht35 form involves several key steps to ensure compliance and accuracy. First, gather all necessary information regarding the deceased's assets, including real estate, bank accounts, investments, and personal property. Next, fill out the form with this information, ensuring that all values are current and accurately reflect the estate's worth. Once completed, the form must be submitted to the appropriate tax authority, along with any required documentation to support the reported values.

Steps to complete the Iht35 Form

Completing the Iht35 form involves a systematic approach to ensure all sections are filled out correctly. Begin by entering the decedent's personal information, including name, date of birth, and date of death. Then, list all assets, categorizing them as necessary, and provide their estimated values. Be sure to include any debts or liabilities that the estate may owe. After reviewing the form for accuracy, sign and date it before submission.

Legal use of the Iht35 Form

The legal use of the Iht35 form is essential for ensuring that the estate is settled according to state laws. This form must be completed accurately to avoid potential legal issues, such as disputes over the estate's value or tax liabilities. Compliance with the relevant tax laws is crucial, as failure to submit the form correctly can result in penalties or delays in the estate administration process.

Required Documents

When completing the Iht35 form, several supporting documents may be required to substantiate the information provided. These documents can include death certificates, property deeds, bank statements, and investment account statements. It is important to gather all necessary documentation before starting the form to ensure a smooth completion process.

Form Submission Methods

The Iht35 form can typically be submitted through various methods, depending on the jurisdiction. Common submission methods include online filing through the appropriate tax authority's website, mailing a physical copy of the form, or submitting it in person at designated offices. Each method has its own requirements and processing times, so it is advisable to check the specific guidelines for your area.

Key elements of the Iht35 Form

Key elements of the Iht35 form include sections for personal information, asset valuation, and liabilities. The form requires detailed descriptions of each asset, including their estimated market values at the time of the decedent's death. Additionally, it may require information on any debts owed by the estate, which can affect the overall value and tax implications. Ensuring that all key elements are accurately reported is vital for compliance and proper estate administration.

Quick guide on how to complete iht35 form

Effortlessly prepare Iht35 Form on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly and without delays. Manage Iht35 Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to edit and electronically sign Iht35 Form with ease

- Locate Iht35 Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Iht35 Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct iht35 form

Create this form in 5 minutes!

How to create an eSignature for the iht35 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is iht35 and how does it benefit businesses?

iht35 is an innovative solution that streamlines the eSigning process for businesses. By using iht35, companies can enhance efficiency, reduce paper usage, and ensure the security of their documents. This cost-effective approach to document management is perfect for organizations looking to improve their workflow.

-

How does pricing for iht35 work?

The pricing for iht35 is designed to be flexible to accommodate various business needs. Businesses can choose from different plans depending on their volume of document signing and required features. This ensures that every company can find a solution that fits their budget and needs.

-

What features does the iht35 solution offer?

iht35 offers a range of features including customizable templates, robust API integrations, and secure cloud storage. These features are designed to make the eSigning experience seamless and efficient. It also provides advanced tracking capabilities, enabling users to monitor document statuses in real-time.

-

Is iht35 suitable for small businesses?

Absolutely, iht35 is particularly suitable for small businesses looking to elevate their document management processes. With its affordable pricing and user-friendly interface, even those with limited resources can adopt efficient eSigning practices. This makes iht35 a great investment for small businesses aiming for growth.

-

Can I integrate iht35 with other software systems?

Yes, iht35 supports integrations with various popular software systems such as CRM platforms and cloud services. This integration capability allows businesses to streamline their operations further and enhance the functionality of their existing tools. Custom API options are also available for more tailored solutions.

-

What are the key benefits of using iht35 for document management?

Using iht35 for document management provides multiple benefits including improved turnaround times for document signing and enhanced security measures. It reduces the reliance on paper, helping organizations to go green while simplifying the signing process. This leads to better productivity and customer satisfaction.

-

How secure is the iht35 platform?

The iht35 platform prioritizes security by employing advanced encryption methods and secure cloud storage. This ensures that sensitive documents are protected at all times during the signing process. Additionally, compliance with industry standards further guarantees the safety of your information.

Get more for Iht35 Form

Find out other Iht35 Form

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free