Lee County Tourist Tax 2022

What is the Lee County Tourist Tax

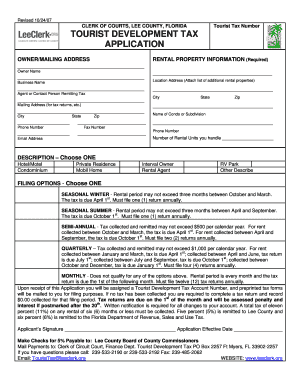

The Lee County Tourist Tax, often referred to as the tourist tax, is a tax imposed on short-term rentals and accommodations in Lee County, Florida. This tax is typically levied on visitors staying in hotels, motels, and rental properties for six months or less. The funds collected from this tax are used to promote tourism in the area, support local infrastructure, and enhance public services that benefit both residents and visitors.

Steps to complete the Lee County Tourist Tax

Completing the Lee County Tourist Tax involves several key steps to ensure compliance and accuracy. First, gather all necessary information regarding your rental property, including the address, rental rates, and duration of stays. Next, calculate the total amount of tax due based on the applicable rate, which is a percentage of the rental income. After determining the amount, fill out the required form accurately, ensuring all details are correct. Finally, submit the completed form along with payment to the appropriate county office, either online or by mail.

Legal use of the Lee County Tourist Tax

The legal use of the Lee County Tourist Tax is governed by local regulations and state laws. It is essential for property owners and managers to understand their obligations under these laws to avoid penalties. The tax must be collected from guests and reported to the county in a timely manner. Failure to comply with these regulations can result in fines and other legal repercussions. It is advisable to stay informed about any changes in legislation that may affect the tax rate or reporting requirements.

Form Submission Methods

There are several methods available for submitting the Lee County Tourist Tax form. Property owners can choose to file online, which is often the most convenient and efficient option. Alternatively, forms can be submitted by mail or in person at designated county offices. Each method has its own processing times, so it is important to consider which option best suits your needs and to ensure timely submission to avoid late fees.

Required Documents

To complete the Lee County Tourist Tax form, certain documents are required. These typically include proof of ownership or management of the rental property, rental agreements, and any previous tax filings. It is important to have accurate records to support the information provided on the form. Keeping organized documentation can help streamline the filing process and ensure compliance with local tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Lee County Tourist Tax are crucial to avoid penalties. Typically, the tax must be filed monthly, with specific due dates set by the county. It is important for property owners to be aware of these dates and plan accordingly to ensure timely submissions. Keeping a calendar of important dates can help prevent missed deadlines and associated fees.

Quick guide on how to complete lee county tourist tax

Effortlessly prepare Lee County Tourist Tax on any device

Managing documents online has gained popularity among companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paper documents, allowing you to obtain the correct form and securely keep it in the cloud. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your files swiftly without any hold-ups. Manage Lee County Tourist Tax on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest method to alter and eSign Lee County Tourist Tax seamlessly

- Locate Lee County Tourist Tax and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your files or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Lee County Tourist Tax while ensuring clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the lee county tourist tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is leeclerk and how does it relate to airSlate SignNow?

Leeclerk is a powerful tool that integrates with airSlate SignNow, allowing users to manage legal documents effortlessly. By using leeclerk, businesses can streamline their document workflows, optimizing the signing process through airSlate SignNow's features.

-

How much does it cost to use airSlate SignNow with leeclerk?

The pricing for using airSlate SignNow in conjunction with leeclerk is designed to be budget-friendly. Various plans are available, allowing businesses to choose the best option that fits their needs without overspending.

-

What features does airSlate SignNow offer when integrated with leeclerk?

When integrated with leeclerk, airSlate SignNow offers features such as document templates, real-time tracking, and advanced notifications. These functionalities enhance the signing experience while ensuring legal compliance and efficiency.

-

Can I use airSlate SignNow and leeclerk on mobile devices?

Yes, both airSlate SignNow and leeclerk have mobile-friendly applications. This allows users to eSign and manage documents conveniently from their smartphones or tablets, enhancing productivity on the go.

-

What are the benefits of using airSlate SignNow with leeclerk?

Using airSlate SignNow in conjunction with leeclerk provides signNow benefits, such as improved workflow efficiency and reduced turnaround time for document signing. This combination helps businesses operate more smoothly and increases customer satisfaction.

-

Is it easy to integrate leeclerk with airSlate SignNow?

Absolutely! The integration process of leeclerk with airSlate SignNow is straightforward and user-friendly. Detailed guides and customer support are available to help you seamlessly connect the two platforms.

-

What types of businesses can benefit from using leeclerk with airSlate SignNow?

Businesses of all sizes, including law firms, real estate agencies, and corporations, can benefit from using leeclerk with airSlate SignNow. This powerful combination is perfect for any organization that requires secure and efficient document management.

Get more for Lee County Tourist Tax

- Previous pre employment a d test statement form

- Bric housing application form

- 704 georgia department of early care and learning dfcs form

- Juror affidavit questionnaire form

- Furniture cutout scale 316 1 form

- Patient consent for observer form

- Student media release form shelby county schools scsk12

- Maxs good habit form

Find out other Lee County Tourist Tax

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy