Employee Health Insurance Responsibility Disclosure Form

What is the Employee Health Insurance Responsibility Disclosure Form

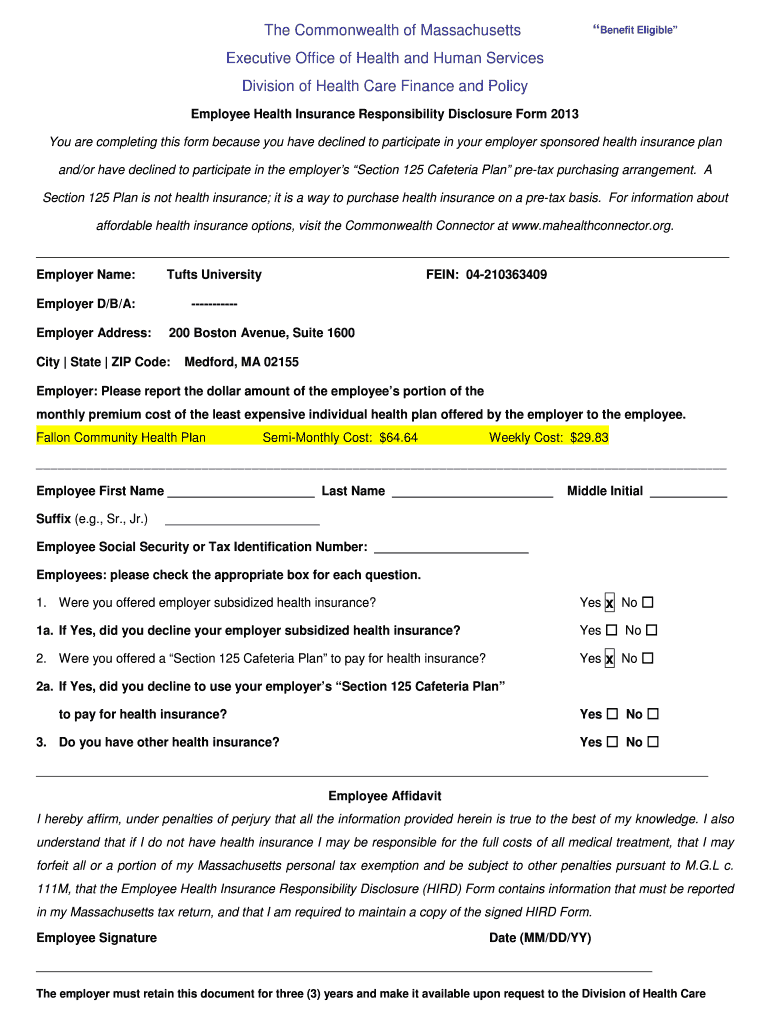

The Employee Health Insurance Responsibility Disclosure Form is a crucial document that outlines an employer's obligations regarding health insurance coverage for employees. This form is designed to ensure that both employers and employees understand their rights and responsibilities under the Affordable Care Act (ACA). It serves as a formal notification to employees about the health insurance options available to them, including details about coverage levels, costs, and eligibility criteria.

How to Use the Employee Health Insurance Responsibility Disclosure Form

Using the Employee Health Insurance Responsibility Disclosure Form involves several steps. First, employers must accurately complete the form with relevant information about the health insurance plans they offer. This includes specifying coverage options, costs, and any other pertinent details. Once completed, the form should be distributed to all eligible employees, ensuring they have access to the information necessary to make informed decisions about their health insurance. Employees should review the form carefully and retain it for their records.

Steps to Complete the Employee Health Insurance Responsibility Disclosure Form

Completing the Employee Health Insurance Responsibility Disclosure Form requires careful attention to detail. Here are the key steps involved:

- Gather necessary information about the health insurance plans offered by the employer.

- Fill in the employer's details, including name, address, and contact information.

- Provide a clear description of the health insurance coverage options available.

- Include information on the costs associated with each plan, such as premiums and deductibles.

- Ensure that the form is signed and dated by an authorized representative of the employer.

Legal Use of the Employee Health Insurance Responsibility Disclosure Form

The legal use of the Employee Health Insurance Responsibility Disclosure Form is governed by federal regulations, particularly those outlined in the Affordable Care Act. Employers are required to provide this form to employees to comply with these regulations, ensuring transparency in health insurance offerings. Failure to provide the form or to include accurate information may result in penalties for non-compliance, making it essential for employers to adhere to legal standards.

Key Elements of the Employee Health Insurance Responsibility Disclosure Form

Several key elements must be included in the Employee Health Insurance Responsibility Disclosure Form to ensure its effectiveness and compliance with legal requirements. These elements include:

- Employer's contact information and identification details.

- Comprehensive descriptions of the health insurance plans offered.

- Cost breakdowns for employees, including premiums, deductibles, and out-of-pocket maximums.

- Eligibility criteria for each health insurance option.

- Instructions for employees on how to enroll or opt out of coverage.

Penalties for Non-Compliance

Employers who fail to provide the Employee Health Insurance Responsibility Disclosure Form or who do not comply with the requirements set forth by the Affordable Care Act may face significant penalties. These penalties can include fines imposed by regulatory agencies, as well as potential legal actions from employees. It is critical for employers to understand their obligations and ensure that they meet all requirements to avoid these consequences.

Quick guide on how to complete employee health insurance responsibility disclosure form 2013

Complete Employee Health Insurance Responsibility Disclosure Form effortlessly on any device

Online document management has gained popularity among organizations and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely manage it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage Employee Health Insurance Responsibility Disclosure Form on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest method to modify and eSign Employee Health Insurance Responsibility Disclosure Form with ease

- Obtain Employee Health Insurance Responsibility Disclosure Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you want to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in a few clicks from any device you prefer. Modify and eSign Employee Health Insurance Responsibility Disclosure Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How much time and money does it take for a new startup (<50 employees) to fill out the paperwork to become a group for the purpose of negotiating for health insurance for their founders and employees?

I'm not sure if this is a purely exploratory question or if you're inferring that you're planning on navigating the group health insurance market without the assistance of a broker. If the latter, I'd caution against it for several reasons (which I'll omit for now for the sake of brevity).To get a group quote, generally all that's needed is an employee census. Some states apply a modifier to the rate depending on the overall health of the group members (for a very accurate quote, employees may need to fill out general health statements).Obtaining rates themselves can take a few minutes (for states like CA which don't have a signNow health modifier) to several days.I suspect your cor question is the time/effort required once you've determined the most appropriate plan design for your company. This is variable depending on how cohesive your employee base is.Best case scenario - if all employees are in one location and available at the same time, I could bring an enrollment team and get all the paperwork done in the course of 1-3 hours depending on the size of your group. In the vast majority of cases, the employer's paperwork is typically around 6 pages of information, and the employee applications about 4-8 pages. Individually none of them take more than several minutes to complete.Feel free to contact me directly if you have specific questions or concerns.

-

Do the HIPAA laws prohibit Health Insurance companies from allowing members to fill out and submit medical claim forms on line?

No, nothing in HIPAA precludes collecting the claim information online.However, the information needs to be protected at rest as well as in-flight. This is typically done by encrypting the connection (HTTPS) as well the storage media

-

Obamacare Rollout & Struggles (2013–14): Will employers have to cover 100% health insurance for full-time employees under Affordable Care Act? What is the current protocol/law? How much on average will health insurance cost employers and employees?

Employers are not required to provide Health Insurance for their employees. If they have over 50 employees working 30 hours or more then they are supposed to provide health insurance. If they don't they have to pay a fine per each employee. Penalty for not providing insurance: Employers with over 50 employees that do not provide insurance must pay a penalty of $2,000 for every employee in the company if even one employee opts to obtain insurance through an exchange. However, the first 30 employees are not counted in calculation of the penalty. Example: an employer with 75 employees would pay the penalty for 45 workers, or $90,000 (45 x $2.000).The Health Care Reform Bill Becomes Law: What It Means for EmployersHealth care insurance is not cheap. Most employers that offer it pay a large portion of the premium and the employee pays the difference. This even applies to dependent coverage. It therefore is not out of the realm of possibility for an employer licking in $400 a month per employee. From the example above, if the employer is NICE, 75 employees times $4,800 each per year comes to a cost of $360,000 for all 75 employees. 400 * 12 = 4800. $4800 * 75 = $360,000 If you were an employer struggling to make ends meet wood you choose to pay $360,000 for insurance for your employees or from the example above, $90,000?ObamaCare was set up to entice employers to go for the penalties. Why not? Doing this however drives the health insurance system to the single payer system which is Obama's plan for America. Socialized medicine like Europe and Canada which sucks is his fondest wish in his 'Hope and Change' agenda for the country.At least that's how I see and understand what's going down in the Affordable Care Act.

-

What are some reasons that a health insurance company would ask for a pre-authorization form to be filled out by a Dr. before filling a prescription?

One common reason would be that there is a cheaper, therapeutically equivalent drug that they would like you to try first before they approve a claim for the prescribed drug. Another reason is that they want to make sure the prescribed drug is medically necessary.Remember that nothing is stopping you from filling the prescribed drug. It just won't be covered by insurance until the pre-authorization process is complete.

-

Can someone provide me the property disclosure form which is to be filled out by the employees of the UP government as per the instructions by the new CM?

It will be available in the UP Government website. Further you can email or tweet to the Chief Minister of UP requesting for the particular information. The CM is a committed social worker and leads the life a yogi, so everything is transparent about him and his Government.

-

How do you justify obligating employers to buy their employees health insurance rather than phasing out the practice altogether?

We most certainly should phase out employer sponsored insurance through changes to the tax code. However, most people are satisfied with their health insurance because they get their insurance from their employer.In the 1940s, the government implemented price controls and froze wages in an effort to curb wartime inflation. What remained unfrozen and untaxed were fringe benefits that a worker received, so employers, desperate for decent labor, offered health insurance as a workplace perk. As a result, the United States ended up with a system in which most citizens receive their health insurance through their employer. No other country relies on an employer-based system to the extent that the U.S. does.This system works for many with full-time jobs; a 2009 CNN poll found that approximately eight in 10 Americans were satisfied with their health insurance. However, critics of the system would say that such an opinion is akin to "ignorance is bliss." Most workers likely have no idea of the full cost of their company's plan, and they may be unaware how much the cost of health insurance has been rising in the last few years. The money disappears before workers can even know it's gone, perhaps in the form of an increased premium withheld from a paycheck or by employers skimping on raises in order to make insurance payments.The unemployed, self-employed, part-time workers and those who work for companies that don't offer benefits probably have a better sense of how much health insurance truly costs. It's far more expensive for individuals and small groups to get health insurance because they constitute a small risk pool; a large company provides a large risk pool for the insurance company, which allows the company to charge smaller premiums.Since most Americans receive health care through insurance provided by their employer or the government (in the case of Medicare or Medicaid), they are removed from the cost. And not caring about the bottom line means that providers can raise prices without consumers noticing much.

Create this form in 5 minutes!

How to create an eSignature for the employee health insurance responsibility disclosure form 2013

How to create an electronic signature for your Employee Health Insurance Responsibility Disclosure Form 2013 online

How to create an eSignature for the Employee Health Insurance Responsibility Disclosure Form 2013 in Chrome

How to create an eSignature for signing the Employee Health Insurance Responsibility Disclosure Form 2013 in Gmail

How to create an eSignature for the Employee Health Insurance Responsibility Disclosure Form 2013 straight from your smart phone

How to make an eSignature for the Employee Health Insurance Responsibility Disclosure Form 2013 on iOS devices

How to generate an electronic signature for the Employee Health Insurance Responsibility Disclosure Form 2013 on Android

People also ask

-

What is the employee health insurance responsibility disclosure form?

The employee health insurance responsibility disclosure form is a document that employers use to communicate the health insurance coverage options available to their employees. This form details the responsibilities of both the employer and the employee regarding health insurance enrollment and coverage, ensuring compliance with regulations.

-

How can airSlate SignNow help with the employee health insurance responsibility disclosure form?

airSlate SignNow provides a streamlined platform for creating, sending, and signing the employee health insurance responsibility disclosure form. This ensures that the process is efficient, secure, and compliant, allowing businesses to manage their employee health insurance obligations with ease.

-

What features does airSlate SignNow offer for managing disclosure forms?

airSlate SignNow offers features such as customizable templates, secure eSignature capabilities, and document tracking for the employee health insurance responsibility disclosure form. These tools enhance the efficiency of managing important documents and reduce the risk of errors during the signing process.

-

Is there a mobile app for completing the employee health insurance responsibility disclosure form?

Yes, airSlate SignNow offers a mobile app that allows users to complete the employee health insurance responsibility disclosure form on the go. This provides flexibility for both employers and employees, enabling them to sign documents at their convenience from any device.

-

How much does it cost to use airSlate SignNow for disclosure forms?

airSlate SignNow offers competitive pricing plans tailored to fit various business needs, including features for managing the employee health insurance responsibility disclosure form. Pricing is flexible, allowing businesses to select a plan that suits their volume of document transactions.

-

What integrations does airSlate SignNow offer for enhancing workflow?

airSlate SignNow integrates seamlessly with various applications such as Google Drive, Salesforce, and Dropbox, enhancing the workflow for handling the employee health insurance responsibility disclosure form. This integration simplifies document management, ensuring that all team members can access the information they need.

-

Can I customize the employee health insurance responsibility disclosure form?

Absolutely! airSlate SignNow allows users to customize the employee health insurance responsibility disclosure form, tailoring it to meet specific company requirements and branding. This flexibility ensures that all essential information is captured accurately and effectively communicated to employees.

Get more for Employee Health Insurance Responsibility Disclosure Form

Find out other Employee Health Insurance Responsibility Disclosure Form

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement