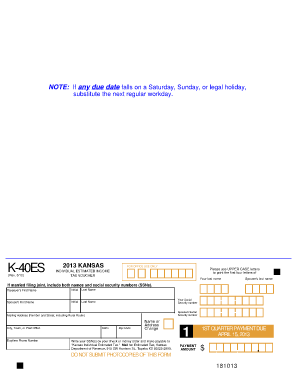

K 40es Form

What is the K-40ES Form

The K-40ES form is an estimated income tax payment form used by individuals and businesses in the United States. It is specifically designed for taxpayers who expect to owe tax of $500 or more when filing their annual tax return. This form allows taxpayers to make quarterly estimated tax payments to avoid penalties and interest charges for underpayment. The K-40ES form is essential for those who do not have taxes withheld from their income, such as self-employed individuals or those with significant investment income.

How to use the K-40ES Form

Using the K-40ES form involves a straightforward process. Taxpayers need to calculate their estimated tax liability for the year based on their expected income, deductions, and credits. Once the estimated tax amount is determined, the taxpayer can fill out the K-40ES form, indicating the payment amounts for each quarter. It is important to submit the form along with the payment by the specified deadlines to ensure compliance and avoid penalties.

Steps to complete the K-40ES Form

Completing the K-40ES form requires several steps:

- Estimate your annual income: Consider all sources of income, including wages, self-employment earnings, and investment income.

- Calculate your deductions: Determine any eligible deductions to reduce your taxable income.

- Determine your tax liability: Use the current tax rates to calculate your expected tax liability based on your estimated income and deductions.

- Fill out the K-40ES form: Enter your estimated tax amounts for each quarter on the form.

- Submit the form and payment: Send the completed K-40ES form along with your estimated tax payment by the due dates.

Legal use of the K-40ES Form

The K-40ES form is legally binding when filled out and submitted correctly. It complies with IRS regulations regarding estimated tax payments, ensuring that taxpayers fulfill their obligations to pay taxes throughout the year. To ensure the legal validity of the form, it is crucial to provide accurate information and meet all submission deadlines. Failure to do so may result in penalties or interest charges.

Filing Deadlines / Important Dates

Filing deadlines for the K-40ES form are critical to avoid penalties. Estimated tax payments are typically due on the following dates:

- April 15: First quarter payment

- June 15: Second quarter payment

- September 15: Third quarter payment

- January 15: Fourth quarter payment

Taxpayers should ensure that payments are postmarked by these dates to remain compliant with IRS regulations.

Who Issues the Form

The K-40ES form is issued by the Internal Revenue Service (IRS). The IRS provides the necessary guidelines and instructions for taxpayers to accurately complete and submit the form. It is important for taxpayers to refer to the official IRS documentation to ensure they are using the most current version of the form and following all required procedures.

Quick guide on how to complete k 40es form

Complete K 40es Form effortlessly on any device

Online document management has become popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, edit, and eSign your documents swiftly without delays. Manage K 40es Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

Steps to edit and eSign K 40es Form effortlessly

- Locate K 40es Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require new document copies. airSlate SignNow fulfills your document management requirements with just a few clicks from your preferred device. Modify and eSign K 40es Form and ensure excellent communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the k 40es form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the K 40es Form?

The K 40es Form is a tax document used for estimating income tax payments. This form is crucial for individuals and businesses to accurately report their tax obligations. Understanding the K 40es Form can help you efficiently manage your tax responsibilities and avoid penalties.

-

How can airSlate SignNow help with the K 40es Form?

airSlate SignNow streamlines the process of sending and eSigning the K 40es Form. Our platform allows you to quickly fill out, sign, and distribute the form securely online. This reduces paperwork and enhances efficiency for both individuals and businesses dealing with tax forms.

-

Is there a cost associated with using airSlate SignNow for the K 40es Form?

Yes, airSlate SignNow offers various pricing plans designed to fit different business needs. Each plan provides access to essential features for handling the K 40es Form and other documents. You can choose a subscription that best suits your requirements.

-

What features does airSlate SignNow provide for managing the K 40es Form?

airSlate SignNow offers features like template creation, customizable signing workflows, and document tracking for the K 40es Form. These tools facilitate a smoother signing experience and ensure that all necessary signatures are collected in a timely manner. Additionally, you can store and manage your forms securely in one place.

-

Can I integrate airSlate SignNow with other tools for managing the K 40es Form?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications. This allows you to connect your existing software tools to enhance how you handle the K 40es Form and other important documents, improving your overall workflow.

-

How secure is the information I submit through the K 40es Form with airSlate SignNow?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your sensitive information submitted through the K 40es Form. You can be confident that your data is safe during transmission and storage.

-

What are the benefits of using airSlate SignNow for the K 40es Form?

Using airSlate SignNow for the K 40es Form offers numerous benefits, including efficiency, cost-effectiveness, and enhanced compliance. The easy-to-use interface saves time in processing tax documentation, while our reliable security measures ensure your data stays protected. Overall, it simplifies tax management for both individuals and businesses.

Get more for K 40es Form

Find out other K 40es Form

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement