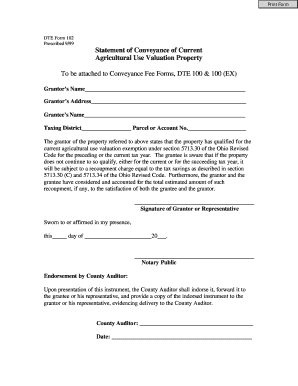

Dte 102 Form

What is the DTE 102?

The DTE 102 form, also known as the DTE Form 102, is a document used primarily for property tax exemption applications in the United States. This form is typically required by property owners seeking to qualify for specific tax exemptions, such as those related to charitable organizations or certain types of property use. The DTE 102 serves as a formal request to the local tax authority, providing essential information about the property and the exemption being sought.

How to use the DTE 102

Using the DTE 102 involves several key steps. First, ensure you have the correct version of the form, which can be obtained from your local tax authority's website or office. Next, fill out the form accurately, providing all required information such as property details, ownership information, and the specific exemption you are applying for. After completing the form, review it for accuracy before submitting it to the appropriate local authority. It is essential to keep a copy for your records.

Steps to complete the DTE 102

Completing the DTE 102 requires careful attention to detail. Follow these steps for successful completion:

- Gather necessary documents, including proof of ownership and any previous tax exemption approvals.

- Fill out the form, ensuring all fields are completed, including property address and owner information.

- Specify the type of exemption you are applying for and provide supporting details.

- Review the form for any errors or omissions.

- Submit the completed form to your local tax authority by the designated deadline.

Legal use of the DTE 102

The DTE 102 form is legally binding once submitted to the appropriate authorities. It is important to understand that providing false information or failing to meet the eligibility criteria can result in penalties, including denial of the exemption or additional fines. Therefore, it is crucial to ensure that all information provided is accurate and truthful.

Key elements of the DTE 102

Key elements of the DTE 102 include:

- Property Information: Details about the property for which the exemption is being requested.

- Owner Information: Name and contact details of the property owner.

- Exemption Type: The specific exemption being applied for, such as charitable or educational use.

- Supporting Documentation: Any required documents that validate the exemption claim.

Filing Deadlines / Important Dates

Filing deadlines for the DTE 102 can vary by state and local jurisdiction. It is essential to check with your local tax authority for specific deadlines to ensure timely submission. Missing these deadlines can result in the denial of your exemption request, so staying informed about important dates is crucial for property owners seeking tax relief.

Quick guide on how to complete dte 102

Effortlessly Complete Dte 102 on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-conscious alternative to traditional printed and signed documentation, allowing you to access the correct form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without any delays. Manage Dte 102 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and eSign Dte 102 with Ease

- Locate Dte 102 and click on Get Form to initiate the process.

- Use the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information using tools specifically offered by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal force as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Dte 102 while ensuring effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dte 102

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dte 102 and how does it relate to airSlate SignNow?

The dte 102 is a specific document type often used in business transactions. airSlate SignNow supports the seamless eSigning of dte 102 documents, ensuring compliance and ease of use. With our solution, you can quickly prepare and send these documents for signature, streamlining your processes.

-

How much does it cost to use airSlate SignNow for dte 102 documents?

airSlate SignNow offers competitive pricing plans that cater to different business sizes and needs. You can create, send, and eSign dte 102 documents at an affordable monthly rate. Check our pricing page for detailed plans and find the one that best fits your budget.

-

What features does airSlate SignNow provide for managing dte 102 documents?

With airSlate SignNow, you gain access to features like secure eSigning, document templates, and real-time tracking specifically designed for dte 102 documents. Our platform also provides drag-and-drop editing tools, ensuring your documents are user-friendly and professional. Explore these features to enhance your document workflow.

-

What are the benefits of using airSlate SignNow for dte 102 documents?

Using airSlate SignNow for dte 102 documents helps to reduce turnaround time, increase compliance, and improve document security. Our user-friendly interface makes it easy to manage and eSign your documents without the hassle of printing or scanning. Enjoy a more efficient and cost-effective approach to document management.

-

Can airSlate SignNow integrate with other software for dte 102 management?

Yes, airSlate SignNow offers various integration options with popular software tools for managing dte 102 documents. This allows you to sync your document workflows with your existing systems, enhancing productivity and collaboration. Connect with your favorite applications seamlessly to streamline your processes.

-

Is airSlate SignNow secure for handling dte 102 documents?

Absolutely! airSlate SignNow employs top-notch security protocols to protect your dte 102 documents. Our platform uses encryption and secure cloud storage to ensure your sensitive information remains safe and confidential throughout the signing process.

-

How can I get started with airSlate SignNow for dte 102 documents?

Getting started with airSlate SignNow for your dte 102 documents is easy! Simply sign up for a free trial on our website, create your account, and start uploading your dte 102 documents for eSigning. Our intuitive interface guides you through the process step-by-step.

Get more for Dte 102

- Six flags permission slip form

- Articles of incorporation and bylaws of dairy farmers of america inc form

- Ga renewal carry license form

- Trust distribution agreement sample form

- The tiny seed pdf no download needed form

- Pythagorean theorem worksheet pdf form

- Form 3400 application pdf

- Food handler certification study guide in this g form

Find out other Dte 102

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form