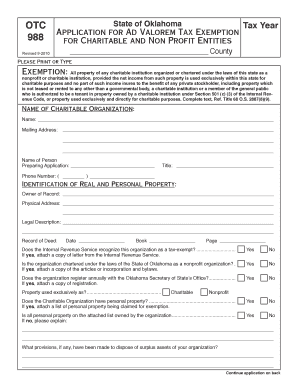

Otc 988 Form

What is the OTC 988?

The OTC 988 form is a specific document used primarily for tax purposes in the United States. It is designed to facilitate the reporting of certain transactions or events that may have tax implications. Understanding the purpose and function of this form is essential for individuals and businesses to ensure compliance with federal tax regulations.

How to Use the OTC 988

Using the OTC 988 form involves several steps to ensure accurate completion and submission. First, gather all necessary information related to the transactions being reported. This may include financial records, identification numbers, and any relevant documentation. Next, fill out the form carefully, ensuring that all fields are completed accurately. Once finished, review the form for any errors before submitting it to the appropriate tax authority.

Steps to Complete the OTC 988

Completing the OTC 988 form requires attention to detail. Follow these steps for successful submission:

- Gather necessary documentation and information.

- Fill out the form with accurate details, ensuring all required fields are completed.

- Double-check for any errors or omissions.

- Submit the completed form to the designated tax authority, either online or via mail.

Legal Use of the OTC 988

The OTC 988 form must be used in accordance with U.S. tax laws. It is essential to adhere to the guidelines set forth by the IRS to ensure that the information provided is accurate and compliant. Failure to use the form legally can result in penalties or additional scrutiny from tax authorities.

Key Elements of the OTC 988

Several key elements make up the OTC 988 form. These include:

- Identification information of the taxpayer.

- Details of the transaction being reported.

- Signature and date to validate the submission.

- Any additional information required by the IRS for specific situations.

Required Documents

When preparing to submit the OTC 988 form, certain documents may be required. These can include:

- Financial statements related to the transactions.

- Identification numbers such as Social Security or Employer Identification Numbers.

- Any correspondence from the IRS regarding the transactions.

Form Submission Methods

The OTC 988 form can be submitted through various methods, including:

- Online submission via the IRS website or approved e-filing services.

- Mailing a physical copy to the appropriate tax authority.

- In-person submission at designated IRS offices, if applicable.

Quick guide on how to complete otc 988

Effortlessly prepare Otc 988 on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents quickly and without delay. Handle Otc 988 on any platform with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Otc 988

- Obtain Otc 988 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Otc 988 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the otc 988

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is otc 988, and how does it relate to airSlate SignNow?

OTC 988 refers to a specific feature or product associated with airSlate SignNow that enhances the electronic signature process. This feature is designed to streamline document management while ensuring compliance and security. With otc 988, users can experience increased efficiency in their workflow.

-

What are the pricing options for airSlate SignNow with otc 988?

AirSlate SignNow offers several pricing tiers to accommodate various business needs. The plans come with different features, all including access to otc 988 to ensure a seamless eSigning experience. It's best to review the pricing page for detailed information on subscription levels.

-

What benefits does otc 988 provide for businesses?

OTC 988 streamlines the document signing process, allowing businesses to save time and reduce paperwork. The enhanced features of otc 988 also help improve the overall user experience, leading to higher customer satisfaction. Businesses can also expect improved security and compliance with eSigning regulations.

-

Can I integrate airSlate SignNow with existing software using otc 988?

Yes, airSlate SignNow with otc 988 supports integration with a variety of popular software applications. This flexibility allows businesses to seamlessly incorporate eSigning into their existing workflows. Whether you're using CRM, ERP, or project management tools, otc 988 can enhance functionalities.

-

Is training available for new users of airSlate SignNow with otc 988?

Absolutely! AirSlate SignNow offers comprehensive training and support for new users, including those utilizing otc 988. Training resources include live webinars, tutorials, and an extensive knowledge base to ensure users can easily adopt the platform.

-

How does airSlate SignNow with otc 988 ensure document security?

AirSlate SignNow implements robust security measures to protect documents signed using otc 988. These include encryption, two-factor authentication, and compliance with industry standards for securing electronic signatures. Users can trust that their sensitive information is safe and secure.

-

What types of documents can be signed using otc 988?

OTC 988 supports a wide range of document types, including contracts, agreements, and forms. Users can easily upload, send, and eSign any document format, streamlining the approval process for both personal and business needs. This versatility makes it an essential tool for various industries.

Get more for Otc 988

- Uscis barcode generator form

- Take your child to work day form

- E form punjab

- Changeling the lost character sheet form

- Printable chronic care management documentation template form

- Transition planning inventory report template form

- College evaluation form

- Spee dee delivery service inc instrucciones para el formulario w 7sp solicitud de n mero de identificaci n personal del

Find out other Otc 988

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation