Ohio it 1041 2017-2026

What is the Ohio IT 1041?

The Ohio IT 1041 is a tax form used by fiduciaries to report income earned by estates and trusts in the state of Ohio. This form is essential for ensuring compliance with state tax laws and allows fiduciaries to accurately report income, deductions, and credits on behalf of the estate or trust. Understanding the purpose of the Ohio IT 1041 is crucial for managing the tax obligations associated with these entities.

Steps to Complete the Ohio IT 1041

Completing the Ohio IT 1041 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents related to the estate or trust, including income statements and expense records. Next, fill out the form by providing information about the fiduciary, the estate or trust, and its income. Be sure to include any applicable deductions and credits. Once completed, review the form for accuracy before submitting it to the appropriate state tax authority.

Filing Deadlines / Important Dates

Timely filing of the Ohio IT 1041 is essential to avoid penalties. The deadline for submitting this form typically aligns with the federal tax return deadline for estates and trusts, which is usually the fifteenth day of the fourth month following the close of the tax year. For estates and trusts operating on a calendar year, this means the form is due by April fifteenth. It is important to stay informed about any changes to deadlines that may occur due to state regulations.

Legal Use of the Ohio IT 1041

The Ohio IT 1041 is legally binding when completed and submitted in accordance with state tax laws. To ensure its legal validity, the form must be signed by the fiduciary and submitted by the designated deadline. Additionally, it is important to retain copies of the completed form and any supporting documents for record-keeping purposes, as these may be required for future reference or in the event of an audit.

Required Documents

When preparing to complete the Ohio IT 1041, certain documents are necessary to provide accurate information. These documents typically include:

- Income statements for the estate or trust

- Records of any deductions or credits claimed

- Previous tax returns for the estate or trust, if applicable

- Documentation of any distributions made to beneficiaries

Having these documents on hand will facilitate a smoother completion process and help ensure compliance with state tax regulations.

Form Submission Methods

The Ohio IT 1041 can be submitted through various methods, providing flexibility for fiduciaries. The options include:

- Online submission through the Ohio Department of Taxation's e-file system

- Mailing a paper copy of the completed form to the appropriate tax office

- In-person submission at designated tax offices, if available

Each method has its own advantages, and fiduciaries should choose the one that best suits their needs while ensuring timely submission.

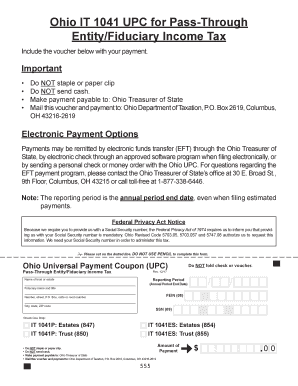

Key Elements of the Ohio IT 1041

Understanding the key elements of the Ohio IT 1041 is vital for accurate completion. Important components of the form include:

- Fiduciary information, including name and contact details

- Details about the estate or trust, such as its name and tax identification number

- Income and expense reporting sections

- Signature line for the fiduciary

Each section must be filled out carefully to ensure compliance and avoid delays in processing.

Quick guide on how to complete ohio it 1041

Effortlessly Prepare Ohio It 1041 on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can locate the necessary form and securely keep it online. airSlate SignNow supplies you with all the resources required to create, modify, and electronically sign your papers promptly without hold-ups. Manage Ohio It 1041 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Modify and Electronically Sign Ohio It 1041 with Ease

- Obtain Ohio It 1041 and click on Get Form to begin.

- Utilize the tools available to finalize your document.

- Emphasize important sections of your papers or obscure sensitive information using tools specifically designated for that by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Ohio It 1041 and ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ohio it 1041

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ohio it 1041 upc and how does it work?

The ohio it 1041 upc is a specific form used for reporting income and expenses related to trusts and estates. This form allows businesses and individuals in Ohio to accurately report their financial information. Understanding how to fill it correctly is essential for compliance, and airSlate SignNow can simplify this process through easy electronic signatures.

-

How can airSlate SignNow assist with completing the ohio it 1041 upc?

With airSlate SignNow, users can easily create, sign, and send the ohio it 1041 upc electronically. Our platform provides templates and tools that streamline document management, ensuring that all required signatures are obtained in a timely manner. This feature signNowly speeds up the submission process for taxpayers in Ohio.

-

Is airSlate SignNow a cost-effective solution for handling the ohio it 1041 upc?

Yes, airSlate SignNow offers competitive pricing that makes it a cost-effective solution for managing the ohio it 1041 upc. Our subscription plans are designed to fit various business needs and budgets. By using our service, you can save both time and money on document processing.

-

What features does airSlate SignNow offer for the ohio it 1041 upc?

airSlate SignNow includes features such as electronic signatures, document templates, and real-time tracking specifically tailored for forms like the ohio it 1041 upc. These functionalities enhance efficiency and reduce the likelihood of errors during the signing process. Our user-friendly interface also helps users navigate their document needs effortlessly.

-

Can I integrate airSlate SignNow with other software for ohio it 1041 upc submissions?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, enhancing the workflow for ohio it 1041 upc submissions. These integrations allow users to connect with accounting software, CRMs, and cloud storage services, making it easier to manage and track documents in one place.

-

What are the benefits of using airSlate SignNow for the ohio it 1041 upc?

The primary benefits of using airSlate SignNow for the ohio it 1041 upc include enhanced speed, security, and ease of use. Electronic signatures are legally binding, ensuring compliance with state requirements. Additionally, our platform minimizes the risk of lost documents and reduces the time spent in traditional paper handling.

-

Is technical support available for users of airSlate SignNow working on the ohio it 1041 upc?

Yes, airSlate SignNow offers comprehensive technical support for users completing the ohio it 1041 upc. Our support team is available to assist with any questions or challenges you may encounter. Whether you need help with technical issues or document preparation, we are here to ensure your success.

Get more for Ohio It 1041

- Furnished apartment addendum pdf form

- Emo form 248863641

- Ford eeoc scholarship university of louisville form

- Tax residency certificate saudi arabia form

- Notary association of pa form

- Forms applications city of dallas

- Now you are a 4 h cloverbud jackson county 4 h form

- 20190822 cvb rm block party application cover no cash pdf form

Find out other Ohio It 1041

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors