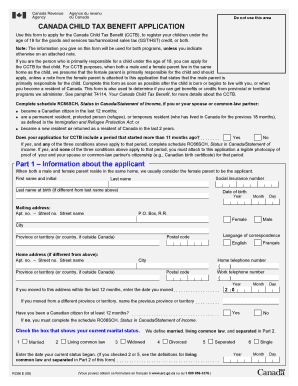

Rc66sch Form

What is the Rc66sch

The Rc66sch is a specific form used primarily for tax purposes in the United States. It serves as a declaration for certain tax-related information and is essential for individuals and businesses to ensure compliance with federal regulations. Understanding the Rc66sch is crucial for accurate tax reporting and maintaining good standing with the Internal Revenue Service (IRS).

How to use the Rc66sch

Using the Rc66sch involves several key steps to ensure that the information provided is accurate and complete. First, gather all necessary documentation, such as income statements and previous tax returns. Next, fill out the form carefully, ensuring that all fields are completed according to IRS guidelines. Once completed, review the form for accuracy before submission. Utilizing electronic tools can enhance the process, allowing for easier corrections and secure submission.

Steps to complete the Rc66sch

Completing the Rc66sch requires a systematic approach:

- Gather required documents, including income records and identification.

- Access the Rc66sch form through the appropriate channels.

- Fill out the form, ensuring all information is accurate and complete.

- Review the form for any errors or omissions.

- Submit the completed form electronically or via mail, depending on your preference.

Legal use of the Rc66sch

The Rc66sch must be completed in compliance with federal regulations to be considered legally valid. This includes adhering to guidelines set forth by the IRS regarding the information reported. Electronic submissions of the Rc66sch are legally recognized as long as they meet the requirements of the ESIGN Act, ensuring that eSignatures and electronic records are treated equally to their paper counterparts.

Required Documents

To complete the Rc66sch accurately, several documents are typically required:

- Income statements, such as W-2s or 1099s.

- Identification documents, like a Social Security card.

- Previous tax returns for reference.

- Any relevant financial documents that support the information provided.

Form Submission Methods

The Rc66sch can be submitted through various methods, catering to different preferences:

- Online: Submitting electronically through approved platforms ensures a quicker processing time.

- Mail: Physical submission is also an option, though it may take longer to process.

- In-Person: Some individuals may choose to submit the form in person at designated IRS offices.

Eligibility Criteria

Eligibility to use the Rc66sch depends on specific criteria set by the IRS. Generally, individuals or businesses who need to report certain tax information or claim deductions are eligible. It is important to review IRS guidelines to determine if the Rc66sch is the appropriate form for your situation.

Quick guide on how to complete rc66sch 41915587

Effortlessly Prepare Rc66sch on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle Rc66sch on any platform using airSlate SignNow’s Android or iOS applications and simplify any document-centric task today.

How to Edit and Electronically Sign Rc66sch with Ease

- Find Rc66sch and click Get Form to initiate the process.

- Use the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools provided by airSlate SignNow designed for that specific use.

- Create your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether via email, SMS, or a shareable link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Rc66sch while ensuring excellent communication throughout the entire document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rc66sch 41915587

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is rc66sch and how does it relate to airSlate SignNow?

rc66sch is a unique identifier for features and documents within airSlate SignNow. This intuitive platform is designed for businesses looking to streamline their document signing processes efficiently, making it easier to manage contracts and agreements electronically.

-

How much does airSlate SignNow with rc66sch cost?

The pricing for airSlate SignNow varies depending on the selected plan, with options that cater to different business needs. Start by exploring basic and premium packages, both of which offer valuable features under the unique rc66sch framework for enhancing document workflows.

-

What features are included in airSlate SignNow's rc66sch offerings?

airSlate SignNow provides a comprehensive suite of features, including customizable templates, secure eSigning, document tracking, and real-time collaboration. The rc66sch approach makes document handling more efficient, ensuring an organized and user-friendly experience.

-

How does rc66sch improve document security in airSlate SignNow?

With the rc66sch system, airSlate SignNow enhances document security through encrypted communications and compliance with various regulations. This ensures that sensitive information remains protected while allowing users to access and manage their documents securely.

-

Can I integrate airSlate SignNow with other applications using rc66sch?

Yes, airSlate SignNow supports several integrations that enhance the rc66sch experience. Users can easily connect with popular applications such as Salesforce, Google Drive, and Zapier, allowing for a seamless document management process across platforms.

-

What are the benefits of using airSlate SignNow's rc66sch platform for my business?

Using airSlate SignNow with rc66sch can signNowly reduce the time and costs associated with traditional document signing. The user-friendly interface and robust features improve both productivity and customer satisfaction, giving your business a competitive edge.

-

Is there a free trial available for airSlate SignNow's rc66sch features?

Yes, airSlate SignNow offers a free trial that allows potential users to explore its rc66sch capabilities without commitment. This trial period enables businesses to assess the platform's features and determine how it meets their document management needs.

Get more for Rc66sch

- Agency disclosure information for buyers and sellers

- New york advanced informed consent to dual agency

- New york city housing authority employer form

- Nyc electrical code pdf form

- Mississippi lease to own option to purchase agreement form

- Sample new york exclusive right to sell listing agreement form

- Louisiana agency disclosure pamphlet form

- Louisiana agency disclosure form

Find out other Rc66sch

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney