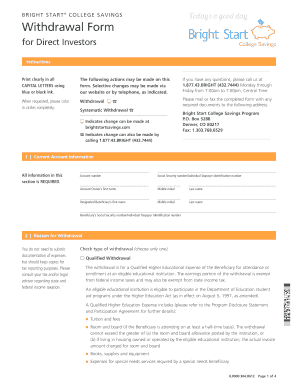

Bright Start Withdrawal Form

What is the Bright Start Withdrawal

The Bright Start Withdrawal refers to a process that allows participants in certain retirement plans to withdraw funds under specific conditions. This form is typically used by individuals who wish to access their savings for various reasons, including financial hardship or other qualifying events. Understanding the nuances of this withdrawal is essential for participants to ensure compliance with plan rules and regulations.

How to use the Bright Start Withdrawal

Using the Bright Start Withdrawal form involves several steps to ensure that the process is completed correctly. First, participants should review their plan's guidelines to determine eligibility for withdrawal. Next, they need to fill out the Bright Start Withdrawal form accurately, providing all required information. Once completed, the form must be submitted according to the instructions provided by the plan administrator, which may include online submission or mailing the form directly.

Steps to complete the Bright Start Withdrawal

Completing the Bright Start Withdrawal form requires careful attention to detail. Here are the steps to follow:

- Review the eligibility criteria for the withdrawal.

- Obtain the Bright Start Withdrawal form from your plan administrator or website.

- Fill out the form, ensuring all required fields are completed.

- Provide any necessary documentation to support your withdrawal request.

- Submit the form through the designated method, whether online or by mail.

- Keep a copy of the submitted form for your records.

Legal use of the Bright Start Withdrawal

The Bright Start Withdrawal form must be used in accordance with applicable laws and regulations. This includes adherence to the Employee Retirement Income Security Act (ERISA) and other federal guidelines that govern retirement plan withdrawals. Ensuring that the form is filled out correctly and submitted in a timely manner is crucial for maintaining compliance and avoiding potential penalties.

Key elements of the Bright Start Withdrawal

Several key elements are essential when dealing with the Bright Start Withdrawal form:

- Eligibility Criteria: Participants must meet specific conditions to qualify for a withdrawal.

- Required Documentation: Supporting documents may be necessary to validate the reason for withdrawal.

- Submission Method: Understanding how to submit the form correctly is vital for processing.

- Processing Time: Participants should be aware of how long it may take for their withdrawal request to be processed.

Who Issues the Form

The Bright Start Withdrawal form is typically issued by the plan administrator of the retirement plan in which the participant is enrolled. This could be a financial institution, a third-party administrator, or the employer offering the retirement plan. It is important for participants to obtain the correct version of the form to ensure compliance with their specific plan requirements.

Quick guide on how to complete bright start withdrawal

Complete Bright Start Withdrawal effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Bright Start Withdrawal on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The optimal way to modify and eSign Bright Start Withdrawal without hassle

- Locate Bright Start Withdrawal and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you'd like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Bright Start Withdrawal and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bright start withdrawal

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the bright start withdrawal feature in airSlate SignNow?

The bright start withdrawal feature in airSlate SignNow allows users to efficiently manage document signing processes. This feature streamlines the withdrawal of documents when needed, ensuring all parties are updated in real-time. With this efficient approach, businesses minimize delays and enhance productivity.

-

How does the bright start withdrawal impact document management?

Utilizing the bright start withdrawal function signNowly improves your document management workflow. It enables you to retract a document from the signing process swiftly and notify all participants immediately. This capability helps prevent unnecessary signature collection on outdated or incorrect documents.

-

Is there a cost associated with using bright start withdrawal in airSlate SignNow?

There are no additional fees for utilizing the bright start withdrawal feature within airSlate SignNow plans. Users benefit from this essential function as part of an affordable subscription package. This value-added feature enhances overall usability without increasing costs.

-

What are the benefits of using the bright start withdrawal feature?

The bright start withdrawal feature provides businesses with flexibility and control over their document workflows. By allowing users to retract documents easily, it prevents unwanted approvals and ensures accuracy. This benefit leads to a smoother signing experience and reduced turnaround time.

-

Can the bright start withdrawal function be integrated with other tools?

Yes, the bright start withdrawal feature in airSlate SignNow can be easily integrated with various productivity tools. This enhances the overall efficiency of business operations and allows for seamless collaboration. Integration ensures that your document management is cohesive across multiple platforms.

-

How secure is the bright start withdrawal feature?

The bright start withdrawal feature is supported by robust security protocols within airSlate SignNow. All withdrawal actions are logged, ensuring accountability and traceability. Security measures keep your documents safe, even during the withdrawal process.

-

Can I customize notifications for bright start withdrawal actions?

Yes, you can customize notifications for the bright start withdrawal actions in airSlate SignNow. This allows you to inform recipients promptly when a document is withdrawn, keeping everyone informed. Personalized notifications enhance communication and maintain clarity throughout the process.

Get more for Bright Start Withdrawal

- Flood insurance coverage form

- Logo license agreement attachment a socialworkers form

- Ps form 1261 29877225

- Medication administration checklist pdf form

- Rumke table form

- Destructive roofing in progress inspection application coj net form

- Building log book example form

- Petition for order of protection adult aa40 form

Find out other Bright Start Withdrawal

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast