IRS Audit Letter CP2000 Sample PDF 3 Form

What is the IRS Audit Letter CP2000?

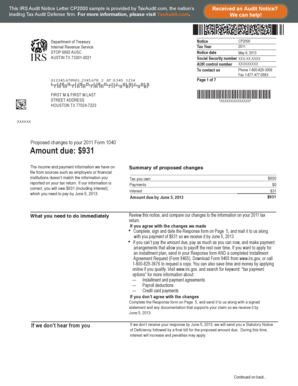

The IRS Audit Letter CP2000 is a notification sent by the Internal Revenue Service (IRS) to taxpayers when there is a discrepancy between the income reported on their tax return and the income reported by third parties, such as employers or financial institutions. This letter outlines the proposed changes to the taxpayer's return and requests a response within a specified timeframe. Understanding this letter is crucial for taxpayers to ensure compliance and avoid potential penalties.

Key Elements of the IRS Audit Letter CP2000

The CP2000 letter typically includes several important components:

- Taxpayer Information: This section contains the taxpayer's name, address, and Social Security number.

- Proposed Changes: A detailed explanation of the discrepancies found, including the amounts in question.

- Response Instructions: Clear guidelines on how to respond, including deadlines and acceptable methods of communication.

- Contact Information: Details on how to reach the IRS for further clarification or assistance.

Steps to Complete the IRS Audit Letter CP2000

Responding to the CP2000 letter requires careful attention to detail. Here are the steps to follow:

- Review the Letter: Carefully read the entire letter to understand the discrepancies and proposed changes.

- Gather Documentation: Collect any relevant documents, such as W-2s, 1099s, or other income statements, to support your case.

- Prepare Your Response: Draft a response letter addressing the discrepancies. Use a cp2000 response letter sample as a guide to ensure your letter is clear and professional.

- Submit Your Response: Send your response to the address provided in the CP2000 letter, ensuring it is postmarked by the deadline.

Legal Use of the IRS Audit Letter CP2000

The CP2000 letter serves as an official communication from the IRS. It is essential to treat this letter with the seriousness it deserves. Failure to respond appropriately can lead to adjustments in tax liability, penalties, or further audits. Legal use involves adhering to the instructions provided, maintaining documentation of all correspondence, and ensuring compliance with IRS regulations.

How to Obtain the IRS Audit Letter CP2000 Sample PDF

To obtain a sample PDF of the IRS Audit Letter CP2000, you can visit the official IRS website or consult tax preparation resources. Many tax professionals also provide templates and examples to assist taxpayers in crafting their responses. Ensure that any sample you use is up-to-date and reflects the current IRS guidelines.

Filing Deadlines and Important Dates

Timeliness is critical when responding to a CP2000 letter. The IRS typically allows a specific period, usually thirty days, for taxpayers to respond. Missing this deadline can result in automatic adjustments to your tax return and potential penalties. It is advisable to mark your calendar with the response deadline as soon as you receive the letter.

Quick guide on how to complete irs audit letter cp2000 sample pdf 3

Effortlessly Prepare IRS Audit Letter CP2000 Sample PDF 3 on Any Device

Digital document management has become increasingly popular among companies and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed paperwork, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly and efficiently. Manage IRS Audit Letter CP2000 Sample PDF 3 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and eSign IRS Audit Letter CP2000 Sample PDF 3 with Ease

- Locate IRS Audit Letter CP2000 Sample PDF 3 and then click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then select the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require new document prints. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign IRS Audit Letter CP2000 Sample PDF 3 to ensure effective communication at every stage of the form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs audit letter cp2000 sample pdf 3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CP2000 response letter sample?

A CP2000 response letter sample is a template that can be used to respond to the IRS CP2000 notice about discrepancies in reported income. This sample outlines how to address the discrepancies and provides supporting documentation. Utilizing a well-structured response can help clarify your tax situation and prevent further complications.

-

How can airSlate SignNow assist with creating a CP2000 response letter sample?

airSlate SignNow simplifies the process by allowing you to draft, customize, and sign your CP2000 response letter sample online. The platform offers easy-to-use templates and tools for adding electronic signatures, ensuring your response is both professional and compliant with IRS guidelines. This streamlines your workflow and saves you time.

-

Is there a cost associated with using airSlate SignNow for a CP2000 response letter sample?

Yes, there are pricing plans available for airSlate SignNow that cater to different business needs. Starting with a free trial, you can explore the features and decide which plan suits you best for managing documents like a CP2000 response letter sample. Competitive pricing makes it a cost-effective solution for all businesses.

-

What features does airSlate SignNow offer for creating documents like a CP2000 response letter sample?

airSlate SignNow offers a range of features including customizable templates, electronic signatures, and document sharing. These tools ensure that you can efficiently create a CP2000 response letter sample while maintaining a professional appearance. Additionally, you can track your document status with ease.

-

Can I integrate airSlate SignNow with other applications for my CP2000 response letter sample?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing your workflow when working on a CP2000 response letter sample. Whether you use CRM systems, cloud storage, or other productivity tools, these integrations ensure smooth document management and collaboration.

-

What are the benefits of using airSlate SignNow for my CP2000 response letter sample?

Using airSlate SignNow for your CP2000 response letter sample offers convenience, speed, and security. The platform allows you to create, sign, and send documents from anywhere, reducing time spent on paperwork. This efficiency can lead to a quicker resolution of your tax matters.

-

How secure is airSlate SignNow when handling my CP2000 response letter sample?

airSlate SignNow prioritizes security by using advanced encryption and secure cloud storage for your CP2000 response letter sample and other documents. Compliance with industry standards ensures that your sensitive information remains protected. You can focus on your business while feeling confident about your data security.

Get more for IRS Audit Letter CP2000 Sample PDF 3

Find out other IRS Audit Letter CP2000 Sample PDF 3

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple