D 400 Fillable Form

What is the D-400 Fillable Form?

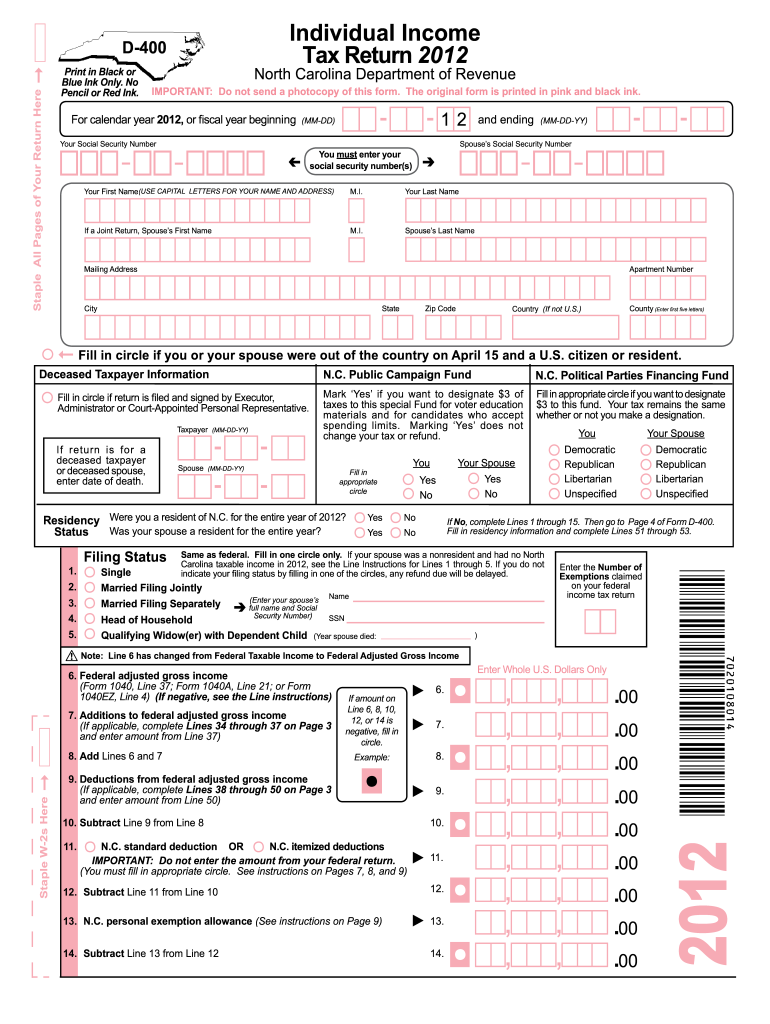

The D-400 fillable form is a tax document used by residents of North Carolina to report their income and calculate their state tax liability. This form is essential for individuals and businesses to ensure compliance with state tax regulations. It collects various types of income, deductions, and credits applicable to the taxpayer's situation. Understanding this form is crucial for accurate tax reporting and avoiding potential penalties.

How to Obtain the D-400 Fillable Form

The D-400 fillable form can be easily obtained from the official North Carolina Department of Revenue website. Users can download the form in a printable format, allowing for both digital and physical completion. Additionally, local tax offices may have copies available for those who prefer to receive the form in person. It is important to ensure that you are using the most current version of the form to comply with any recent changes in tax law.

Steps to Complete the D-400 Fillable Form

Completing the D-400 fillable form involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and records of any deductions.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income from all sources as required by the form.

- Calculate your deductions and credits to determine your tax liability.

- Review the completed form for accuracy before submission.

Legal Use of the D-400 Fillable Form

The D-400 fillable form is legally binding when completed accurately and submitted on time. It must adhere to the guidelines set forth by the North Carolina Department of Revenue. Failure to file this form can result in penalties, interest on unpaid taxes, and potential legal action. Therefore, it is essential to ensure that all information is correct and submitted by the designated deadlines.

Form Submission Methods

The D-400 fillable form can be submitted through various methods:

- Online: Taxpayers can file electronically through the North Carolina Department of Revenue's e-file system.

- Mail: Completed forms can be printed and mailed to the appropriate address provided on the form.

- In-Person: Taxpayers may also deliver their forms directly to local tax offices for processing.

Penalties for Non-Compliance

Failure to file the D-400 fillable form or submitting it late can result in significant penalties. The North Carolina Department of Revenue imposes fines based on the amount of tax owed and the duration of the delay. Additionally, interest accrues on any unpaid taxes, further increasing the total liability. It is crucial for taxpayers to be aware of these potential penalties to avoid unnecessary financial burdens.

Quick guide on how to complete d 400 fillable form 2012

Complete D 400 Fillable Form effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents swiftly without interruptions. Handle D 400 Fillable Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused task today.

How to modify and eSign D 400 Fillable Form without any hassle

- Find D 400 Fillable Form and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device of your choice. Edit and eSign D 400 Fillable Form and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

How do I make a PDF a fillable form?

1. Open it with Foxit PhantomPDF and choose Form > Form Recognition > Run Form Field Recognition . All fillable fields in the document will be recognized and highlighted.2. Add form fields from Form > Form Fields > click a type of form field button and the cursor changes to crosshair . And the Designer Assistant is selected automatically.3. All the corresponding type of form fields will be automatically named with the text near the form fields (Take the text fields for an example as below).4. Click the place you want to add the form field. To edit the form field further, please refer to the properties of different buttons from “Buttons”.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

How do I transfer data from Google Sheets cells to a PDF fillable form?

I refer you a amazing pdf editor, her name is Puspita, She work in fiverr, She is just amazing, Several time I am use her services. You can contact with her.puspitasaha : I will create fillable pdf form or edit pdf file for $5 on www.fiverr.com

-

How do I fill out a fillable PDF on an iPad?

there is an app for that !signNow Fill & Sign on the App Store

-

What tax form do I have to fill out for the money I made on Quora?

For 2018, there is only form 1040. Your income is too low to file. Quora will issue you a 1099 Misc only if you made over $600

-

How do I create a fillable HTML form online that can be downloaded as a PDF? I have made a framework for problem solving and would like to give people access to an online unfilled form that can be filled out and downloaded filled out.

Create PDF Form that will be used for download and convert it to HTML Form for viewing on your website.However there’s a lot of PDF to HTML converters not many can properly convert PDF Form including form fields. If you plan to use some calculations or validations it’s even harder to find one. Try PDFix Form Converter which works fine to me.

Create this form in 5 minutes!

How to create an eSignature for the d 400 fillable form 2012

How to make an eSignature for the D 400 Fillable Form 2012 online

How to generate an electronic signature for the D 400 Fillable Form 2012 in Chrome

How to generate an eSignature for signing the D 400 Fillable Form 2012 in Gmail

How to create an electronic signature for the D 400 Fillable Form 2012 from your smartphone

How to generate an electronic signature for the D 400 Fillable Form 2012 on iOS devices

How to generate an eSignature for the D 400 Fillable Form 2012 on Android

People also ask

-

What is the form 2012 printable and how can I access it?

The form 2012 printable is a downloadable document that allows users to easily fill and submit important information. You can access the form 2012 printable directly from the airSlate SignNow website, where it is available for quick download and printing.

-

Are there any costs associated with downloading the form 2012 printable?

No, downloading the form 2012 printable from airSlate SignNow is completely free. Users can download, print, and fill out the form without incurring any charges, making it a cost-effective solution for businesses.

-

Can I use the airSlate SignNow platform to fill out the form 2012 printable electronically?

Absolutely! airSlate SignNow offers features that allow you to fill out the form 2012 printable electronically. This functionality makes it easy to complete the form accurately and efficiently, saving you time and hassle.

-

What are the key features of the form 2012 printable on airSlate SignNow?

The form 2012 printable on airSlate SignNow includes interactive fields, making it easy to fill out specific information. Additionally, it provides options for eSigning, which enhances the document management process and ensures secure submissions.

-

How does using the form 2012 printable benefit my business?

Using the form 2012 printable can streamline your document handling process, reduce errors, and improve efficiency. It enables businesses to manage forms digitally, which helps in maintaining compliance and organizing documentation seamlessly.

-

Does airSlate SignNow integrate with other applications for managing the form 2012 printable?

Yes, airSlate SignNow integrates with various applications, allowing you to manage the form 2012 printable alongside your other business tools. This integration ensures a smooth workflow and enhances productivity through seamless communication between platforms.

-

Is there customer support available for questions regarding the form 2012 printable?

Yes, airSlate SignNow offers excellent customer support for any queries related to the form 2012 printable. Our dedicated support team is available to assist you with any challenges you may face in accessing or using the form.

Get more for D 400 Fillable Form

Find out other D 400 Fillable Form

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple