Tn Dept of Revenue Form 416

What is the Tn Dept Of Revenue Form 416

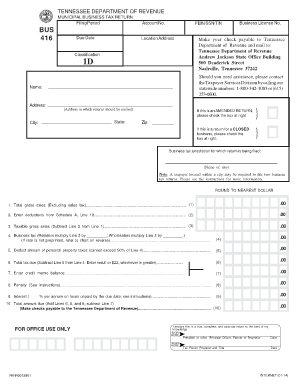

The Tn Dept of Revenue Form 416 is a crucial document used for specific tax-related purposes within the state of Tennessee. This form is primarily utilized by individuals and businesses to report and manage various tax obligations. Understanding the purpose of Form 416 is essential for ensuring compliance with state tax regulations and for facilitating accurate tax reporting.

How to use the Tn Dept Of Revenue Form 416

Using the Tn Dept of Revenue Form 416 involves several key steps. First, ensure that you have the correct version of the form, which can be obtained from the Tennessee Department of Revenue's official website or other authorized sources. Next, gather all necessary information and documentation required to complete the form accurately. Once filled out, the form can be submitted electronically or through traditional mail, depending on the instructions provided.

Steps to complete the Tn Dept Of Revenue Form 416

Completing the Tn Dept of Revenue Form 416 requires careful attention to detail. Follow these steps for a smooth process:

- Obtain the latest version of the form from the Tennessee Department of Revenue.

- Read the instructions thoroughly to understand the requirements.

- Gather all necessary financial documents and information relevant to your tax situation.

- Fill out the form accurately, ensuring all fields are completed as required.

- Review your entries for any errors or omissions.

- Submit the form according to the specified submission methods.

Legal use of the Tn Dept Of Revenue Form 416

The legal use of the Tn Dept of Revenue Form 416 is governed by state tax laws and regulations. It is important to ensure that the form is filled out accurately and submitted on time to avoid penalties. The form serves as a formal declaration of your tax obligations and must be treated with the same seriousness as any other legal document. Compliance with all legal requirements ensures that your submissions are valid and recognized by the state.

Key elements of the Tn Dept Of Revenue Form 416

Key elements of the Tn Dept of Revenue Form 416 include personal identification information, tax identification numbers, and specific financial details relevant to the taxpayer's situation. Additionally, the form may require signatures and dates to validate the submission. Understanding these elements is essential for accurate completion and compliance with state tax laws.

Form Submission Methods (Online / Mail / In-Person)

The Tn Dept of Revenue Form 416 can be submitted through various methods, offering flexibility for taxpayers. The available submission methods include:

- Online submission: Many taxpayers prefer to submit the form electronically through the Tennessee Department of Revenue's online portal.

- Mail: The completed form can be printed and sent via traditional mail to the designated address provided in the instructions.

- In-person: Taxpayers may also have the option to deliver the form in person at designated state offices, depending on local regulations.

Quick guide on how to complete tn dept of revenue form 416

Prepare Tn Dept Of Revenue Form 416 easily on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle Tn Dept Of Revenue Form 416 on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Tn Dept Of Revenue Form 416 effortlessly

- Locate Tn Dept Of Revenue Form 416 and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Tn Dept Of Revenue Form 416 and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tn dept of revenue form 416

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the TN Dept of Revenue Form 416?

The TN Dept of Revenue Form 416 is a specific form used for tax purposes within the state of Tennessee. It allows businesses to report and document their tax obligations easily. Utilizing airSlate SignNow can streamline the completion and submission process for this form.

-

How can airSlate SignNow help me with the TN Dept of Revenue Form 416?

airSlate SignNow simplifies the process of filling out the TN Dept of Revenue Form 416 by providing an intuitive platform for eSigning and document management. You can easily input your information, sign the document electronically, and send it securely to the relevant department. This saves time and reduces the chances of errors.

-

Is there a cost associated with using airSlate SignNow for the TN Dept of Revenue Form 416?

Yes, there is a subscription cost for using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. Pricing plans vary based on features and the number of users, making it accessible for companies needing to process the TN Dept of Revenue Form 416 efficiently.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers numerous features, including customizable templates, secure eSigning, and seamless document storage. These features ensure that your TN Dept of Revenue Form 416 is completed accurately and stored safely for future reference. Additionally, users can track document status and receive notifications.

-

Can airSlate SignNow integrate with other software I use?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow efficiency. You can connect it with CRM systems and cloud storage services, facilitating the process of handling the TN Dept of Revenue Form 416 and keeping all your documents organized.

-

How secure is airSlate SignNow when handling sensitive documents like the TN Dept of Revenue Form 416?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and security measures to protect your sensitive documents, including the TN Dept of Revenue Form 416. You can trust that your information remains confidential and secure.

-

Can I access airSlate SignNow from my mobile device to manage the TN Dept of Revenue Form 416?

Yes, airSlate SignNow is accessible on mobile devices, allowing you to manage the TN Dept of Revenue Form 416 on the go. The mobile-friendly platform ensures you can fill, sign, and send documents from anywhere, making it convenient for busy professionals.

Get more for Tn Dept Of Revenue Form 416

Find out other Tn Dept Of Revenue Form 416

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online