Business Payroll Services Employee Information Setup

What is the Business Payroll Services Employee Information Setup

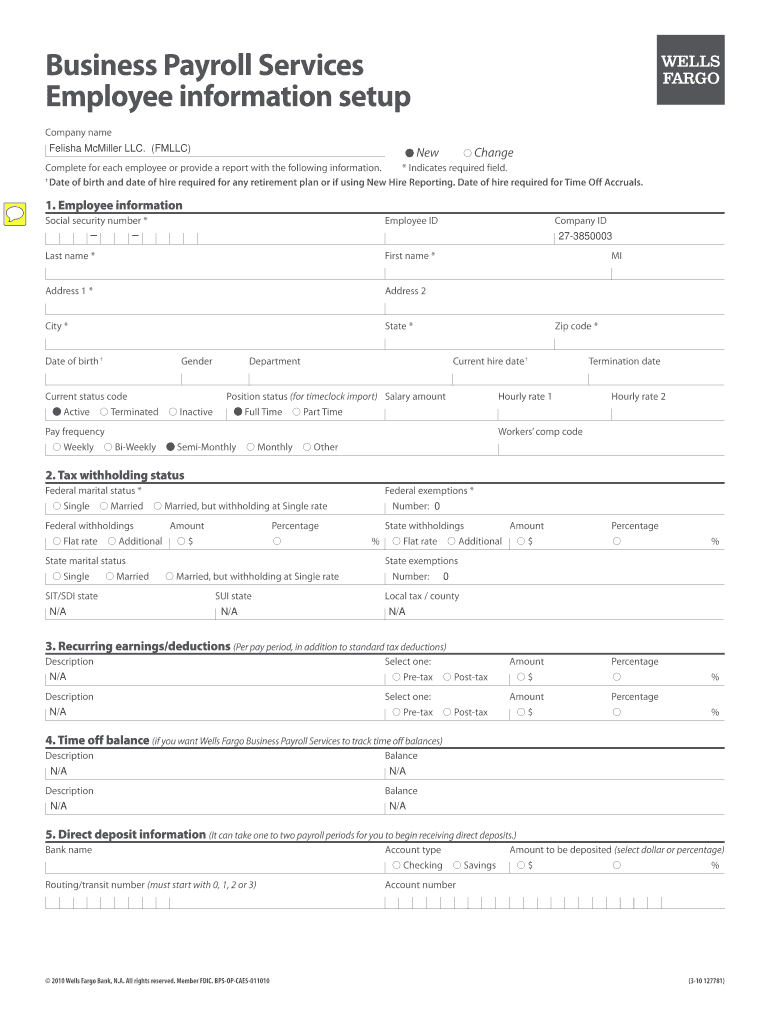

The business payroll services employee information setup is a crucial process for organizations to collect and manage essential employee data. This setup typically includes personal details such as name, address, Social Security number, and tax withholding preferences. It is vital for ensuring accurate payroll processing and compliance with federal and state tax regulations. By establishing a comprehensive employee information setup, businesses can streamline payroll operations and maintain organized records for each employee.

Steps to Complete the Business Payroll Services Employee Information Setup

Completing the business payroll services employee information setup involves several key steps:

- Gather necessary employee information, including personal identification and tax details.

- Utilize a secure platform to input and store this information, ensuring compliance with data protection regulations.

- Review the entered data for accuracy and completeness to avoid payroll discrepancies.

- Obtain necessary signatures or approvals from employees to validate the information provided.

- Regularly update the employee information as needed to reflect changes in personal or tax circumstances.

Legal Use of the Business Payroll Services Employee Information Setup

The legal use of the business payroll services employee information setup is governed by various federal and state regulations. Compliance with laws such as the Fair Labor Standards Act (FLSA) and the Internal Revenue Code is essential. Proper handling of employee information ensures that businesses meet their obligations regarding tax reporting and employee rights. Additionally, maintaining strict confidentiality and security of this information protects both the employer and employees from potential legal issues.

Key Elements of the Business Payroll Services Employee Information Setup

Several key elements are critical to an effective business payroll services employee information setup:

- Personal Information: Collecting names, addresses, and contact details.

- Tax Information: Gathering Social Security numbers and tax withholding preferences.

- Employment Details: Recording job titles, start dates, and salary information.

- Banking Information: Obtaining direct deposit details for payroll processing.

- Compliance Documentation: Ensuring all necessary forms, such as W-4s, are completed and filed correctly.

Form Submission Methods

Submitting the business payroll services employee information setup can be done through various methods, including:

- Online Submission: Using secure digital platforms to input and store employee information.

- Mail: Sending completed forms to the payroll department or relevant authorities.

- In-Person: Delivering physical documents directly to the payroll office for processing.

Examples of Using the Business Payroll Services Employee Information Setup

Examples of utilizing the business payroll services employee information setup include:

- Onboarding new employees by collecting necessary data for payroll processing.

- Updating employee records when there are changes in tax status or personal information.

- Ensuring compliance with tax regulations by accurately reporting employee earnings and deductions.

Quick guide on how to complete business payroll services employee information setup

Effortlessly prepare Business Payroll Services Employee Information Setup on any device

Managing documents online has gained popularity among businesses and individuals. It offers a superb environmentally friendly substitute for traditional printed and signed paperwork, as you can access the appropriate form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without any delays. Handle Business Payroll Services Employee Information Setup on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Business Payroll Services Employee Information Setup seamlessly

- Locate Business Payroll Services Employee Information Setup and click Get Form to initiate.

- Use the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive data using tools specifically provided by airSlate SignNow for that reason.

- Generate your electronic signature with the Sign feature, which takes merely seconds and carries the same legal significance as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Edit and eSign Business Payroll Services Employee Information Setup to guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the business payroll services employee information setup

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of business payroll services employee information setup?

Our business payroll services employee information setup includes comprehensive features such as automated payroll calculations, tax compliance management, and employee data management. These features ensure that payroll is processed accurately and efficiently, saving businesses time and reducing errors. Additionally, our user-friendly interface makes it easy for employees to access their information.

-

How does airSlate SignNow's business payroll services employee information setup benefit my company?

By utilizing airSlate SignNow's business payroll services employee information setup, your company can streamline payroll processes and improve accuracy. This leads to increased employee satisfaction as they receive timely payments and have easy access to their payroll information. Furthermore, the integration of e-signature capabilities enhances security and ensures compliance with labor laws.

-

What pricing options are available for business payroll services employee information setup?

Our pricing for business payroll services employee information setup is tailored to fit businesses of all sizes. We offer flexible plans that accommodate different needs, starting with a basic package that includes essential features and scaling up to more comprehensive solutions. This ensures you only pay for what you need while benefiting from all necessary payroll functionalities.

-

Can the business payroll services employee information setup integrate with other HR tools?

Yes, the business payroll services employee information setup can seamlessly integrate with various HR and accounting tools. This integration allows for a smooth flow of employee data and payroll information across your systems. It helps eliminate redundancy and ensures that all departments have access to the most up-to-date information.

-

Is the business payroll services employee information setup easy to use for employees?

Absolutely! The business payroll services employee information setup is designed with user experience in mind. Employees can easily access their payroll data, request adjustments, and view pay stubs through a simple interface. This promotes transparency and keeps employees informed about their payroll status.

-

How secure is the employee information stored in business payroll services setup?

Security is a top priority in our business payroll services employee information setup. We employ robust encryption methods and secure access controls to protect sensitive employee data. Regular audits and compliance checks also ensure that your payroll information remains safe and meets regulatory standards.

-

What kind of support is provided with business payroll services employee information setup?

With our business payroll services employee information setup, you receive dedicated customer support to assist with any inquiries or issues. Our support team is knowledgeable and available to help you navigate the system and resolve any challenges that may arise. We also provide resources and tutorials to help you make the most of your payroll system.

Get more for Business Payroll Services Employee Information Setup

Find out other Business Payroll Services Employee Information Setup

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online