Sommaire T5 Form

What is the Sommaire T5

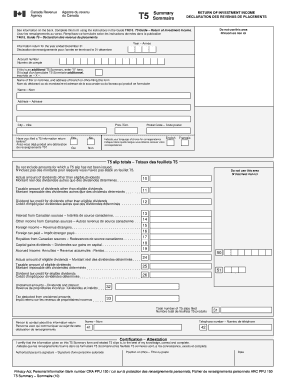

The Sommaire T5 is a tax form used in Canada to report various types of income, such as interest and dividends, to the Canada Revenue Agency (CRA). This document is essential for individuals and businesses that earn investment income, as it summarizes the amounts paid to recipients during the tax year. The T5 document helps ensure accurate reporting of income on tax returns, facilitating compliance with tax laws.

How to use the Sommaire T5

Using the Sommaire T5 involves several steps to ensure proper reporting of income. Recipients of the T5 must include the income reported on the form in their tax returns. It's important to keep the T5 slip for personal records and to verify the accuracy of the information provided. If discrepancies arise, contacting the issuer for clarification is advisable. Additionally, taxpayers should consult tax professionals if they have questions regarding the implications of the T5 on their tax obligations.

Steps to complete the Sommaire T5

Completing the Sommaire T5 requires careful attention to detail. Here are the steps involved:

- Gather all relevant income information, including interest and dividends received.

- Fill out the recipient's information, including name, address, and social security number.

- Report the total amounts of income in the designated fields.

- Ensure all figures are accurate and double-check for any errors.

- Submit the completed form to the appropriate tax authority by the specified deadline.

Legal use of the Sommaire T5

The Sommaire T5 is legally binding when used in accordance with tax regulations. It must be issued by financial institutions or businesses that have paid interest or dividends to individuals. Recipients are required to report the income on their tax returns, making it crucial for compliance with tax laws. Failure to report income from the T5 may result in penalties or audits by tax authorities.

Key elements of the Sommaire T5

Understanding the key elements of the Sommaire T5 is essential for accurate reporting. The main components include:

- Recipient Information: Name, address, and social security number of the individual or entity receiving the income.

- Income Types: Categories of income reported, such as interest, dividends, and other investment earnings.

- Total Amounts: The total income amounts for each category, clearly outlined for reporting purposes.

- Issuer Information: Details about the institution or business issuing the T5, including their identification number.

Examples of using the Sommaire T5

Examples of using the Sommaire T5 can help clarify its application. For instance, an individual receiving $1,000 in interest from a savings account will receive a T5 slip reflecting this amount. When filing their tax return, they must report this income, ensuring compliance with tax regulations. Similarly, a corporation that pays dividends to shareholders will issue T5 slips summarizing the total dividends paid, which shareholders must also report on their tax returns.

Quick guide on how to complete sommaire t5

Complete Sommaire T5 effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage Sommaire T5 on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Sommaire T5 seamlessly

- Locate Sommaire T5 and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Produce your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Sommaire T5 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sommaire t5

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a t5 dokument?

A t5 dokument is a specific type of tax document used in Canada to report income from investments. It provides details on various types of earnings, which are crucial for accurate tax reporting. Understanding how to manage your t5 dokument is essential for businesses and individuals to ensure compliance with tax regulations.

-

How does airSlate SignNow support t5 dokument eSigning?

airSlate SignNow offers a seamless platform for eSigning t5 dokument, ensuring that you can sign and send these important tax documents quickly and securely. With an intuitive interface, users can easily upload their t5 dokument and get it signed by multiple parties in just a few clicks.

-

What features does airSlate SignNow provide for managing a t5 dokument?

airSlate SignNow includes features specifically designed to manage your t5 dokument efficiently. You can track document status, set up reminders for signing, and store all your t5 dokument securely in the cloud, facilitating better organization and easy access.

-

Is airSlate SignNow suitable for businesses that frequently handle t5 dokument?

Yes, airSlate SignNow is an excellent solution for businesses that regularly handle t5 dokument. Its cost-effective pricing and user-friendly features make it easy to streamline the eSigning process for tax documents, ensuring prompt handling and compliance.

-

What are the benefits of using airSlate SignNow for t5 dokument?

Using airSlate SignNow for your t5 dokument offers several benefits, including reduced turnaround time, enhanced security, and improved workflow management. Businesses can minimize the hassle of physical signatures and keep everything organized digitally.

-

Can I integrate airSlate SignNow with other tools for t5 dokument management?

Absolutely! airSlate SignNow offers integration capabilities with various tools that can assist you in managing your t5 dokument effectively. This includes accounting software and document management systems, streamlining your workflow even further.

-

What is the pricing structure for airSlate SignNow related to t5 dokument transactions?

AirSlate SignNow has a flexible pricing structure that scales according to your needs, making it a cost-effective choice for handling t5 dokument. Various plans are available, catering to different volumes of document transactions, ensuring you only pay for what you use.

Get more for Sommaire T5

Find out other Sommaire T5

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe