YBM GST Invoice Format Ver 2 Xlsx

What is the YBM GST Invoice Format Ver 2 xlsx

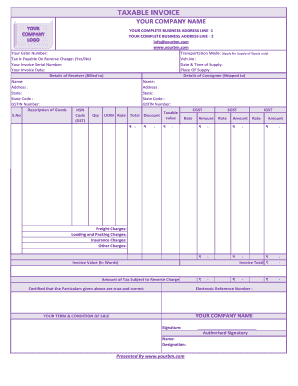

The YBM GST Invoice Format Ver 2 xlsx is a specialized template designed for businesses to create Goods and Services Tax (GST) invoices. This format is particularly useful for companies operating in regions where GST is applicable, ensuring compliance with local tax regulations. The template is structured to capture essential details such as the seller's and buyer's information, item descriptions, quantities, rates, and applicable tax amounts. By utilizing this format, businesses can streamline their invoicing processes while maintaining adherence to legal requirements.

How to use the YBM GST Invoice Format Ver 2 xlsx

Using the YBM GST Invoice Format Ver 2 xlsx is straightforward. Begin by downloading the template and opening it in a compatible spreadsheet application. Fill in the required fields, including the invoice number, date, and details of the goods or services provided. Ensure that you accurately calculate the total amounts, including GST. Once completed, you can save the document and share it electronically with your clients. This method not only simplifies record-keeping but also enhances the professionalism of your invoicing process.

Steps to complete the YBM GST Invoice Format Ver 2 xlsx

Completing the YBM GST Invoice Format Ver 2 xlsx involves several key steps:

- Download the template: Obtain the YBM GST Invoice Format Ver 2 xlsx from a reliable source.

- Open the file: Use a compatible spreadsheet application like Microsoft Excel or Google Sheets.

- Fill in seller details: Enter your business name, address, and contact information in the designated fields.

- Input buyer information: Include the client's name, address, and any other relevant details.

- List goods/services: Detail the items sold or services rendered, including quantities and unit prices.

- Calculate totals: Ensure that the GST is correctly applied and that the total amount due is accurate.

- Save and send: Save the completed invoice and send it to your client via email or other electronic means.

Legal use of the YBM GST Invoice Format Ver 2 xlsx

The YBM GST Invoice Format Ver 2 xlsx is legally valid when it meets specific requirements set by tax authorities. To ensure compliance, the invoice must include all necessary information, such as the seller's GST registration number, the buyer's details, and a clear breakdown of the goods or services provided. It is essential to retain copies of all invoices for record-keeping and tax reporting purposes. Utilizing a compliant format like this one helps businesses avoid potential legal issues and ensures that they fulfill their tax obligations accurately.

Key elements of the YBM GST Invoice Format Ver 2 xlsx

The YBM GST Invoice Format Ver 2 xlsx contains several key elements that are crucial for proper invoicing:

- Invoice Number: A unique identifier for each invoice.

- Date of Issue: The date when the invoice is generated.

- Seller Information: Business name, address, and GST registration number.

- Buyer Information: Client's name and address.

- Itemized List: Description, quantity, unit price, and total price for each item or service.

- GST Amount: The total GST charged on the invoice.

- Total Amount Due: The final amount payable by the buyer, including GST.

Examples of using the YBM GST Invoice Format Ver 2 xlsx

Businesses across various sectors can utilize the YBM GST Invoice Format Ver 2 xlsx effectively. For instance, a freelance graphic designer can issue invoices for design services rendered, detailing project descriptions and associated costs. Similarly, a retail store can use the format to invoice customers for product sales, ensuring that all relevant tax information is included. These examples highlight the versatility of the template in different business contexts, enabling efficient and compliant invoicing practices.

Quick guide on how to complete ybm gst invoice format ver 2 xlsx

Complete YBM GST Invoice Format Ver 2 xlsx effortlessly on any device

Online document management has become popular among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed papers, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents swiftly without delays. Handle YBM GST Invoice Format Ver 2 xlsx on any device with airSlate SignNow’s Android or iOS applications and enhance any document-based task today.

The easiest way to modify and eSign YBM GST Invoice Format Ver 2 xlsx without hassle

- Find YBM GST Invoice Format Ver 2 xlsx and click Get Form to initiate.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Modify and eSign YBM GST Invoice Format Ver 2 xlsx to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ybm gst invoice format ver 2 xlsx

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the YBM GST Invoice Format Ver 2 xlsx?

The YBM GST Invoice Format Ver 2 xlsx is a customizable spreadsheet template designed for creating GST-compliant invoices. It simplifies the invoicing process for businesses, ensuring that all necessary details are accurately captured according to GST regulations.

-

How can I obtain the YBM GST Invoice Format Ver 2 xlsx?

You can easily download the YBM GST Invoice Format Ver 2 xlsx directly from our airSlate SignNow landing page. This user-friendly format allows you to create professional invoices in just a few clicks, enhancing your business operations.

-

Is the YBM GST Invoice Format Ver 2 xlsx suitable for different business types?

Yes, the YBM GST Invoice Format Ver 2 xlsx is versatile and suitable for various business types, including freelancers, small businesses, and large enterprises. Its customizable features allow you to adapt it to your specific invoicing needs.

-

What are the key features of the YBM GST Invoice Format Ver 2 xlsx?

The YBM GST Invoice Format Ver 2 xlsx includes essential features such as automatic tax calculations, customizable fields for services or products, and a clear layout for easy readability. These features help ensure accuracy and professionalism in your invoicing.

-

Does the YBM GST Invoice Format Ver 2 xlsx integrate with other tools?

Yes, the YBM GST Invoice Format Ver 2 xlsx can be integrated with various accounting and financial tools. This integration helps streamline your invoicing process and ensures consistency across your business operations.

-

How does the YBM GST Invoice Format Ver 2 xlsx benefit small businesses?

The YBM GST Invoice Format Ver 2 xlsx benefits small businesses by providing a cost-effective, easy-to-use solution for managing invoices. It enhances professionalism and ensures compliance with tax regulations, allowing small business owners to focus on growth.

-

Is customer support available for issues related to the YBM GST Invoice Format Ver 2 xlsx?

Yes, airSlate SignNow offers customer support for any issues related to the YBM GST Invoice Format Ver 2 xlsx. Our dedicated team is ready to assist you with any questions, ensuring a smooth invoicing experience.

Get more for YBM GST Invoice Format Ver 2 xlsx

Find out other YBM GST Invoice Format Ver 2 xlsx

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation