Qualified Dividends and Capital Gains Worksheet 2014

What is the qualified dividends and capital gains worksheet?

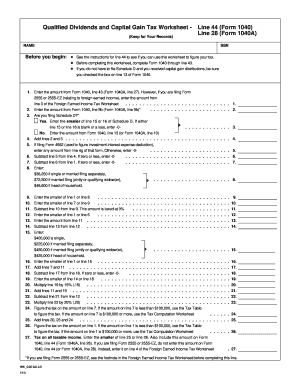

The qualified dividends and capital gains worksheet is a crucial tax document used by U.S. taxpayers to calculate the tax owed on qualified dividends and long-term capital gains. This worksheet helps taxpayers determine their tax rate on these types of income, which can be lower than ordinary income tax rates. It is essential for accurate tax reporting and ensuring compliance with IRS regulations.

How to use the qualified dividends and capital gains worksheet

To effectively use the qualified dividends and capital gains worksheet, taxpayers should first gather all relevant financial information, including details of dividends received and capital gains realized during the tax year. The worksheet guides users through a series of calculations that involve entering dividend amounts, capital gains, and applicable tax rates. Following the instructions carefully ensures accurate tax reporting and helps in determining the correct tax liability.

Steps to complete the qualified dividends and capital gains worksheet

Completing the qualified dividends and capital gains worksheet involves several steps:

- Gather necessary documents, including Form 1099-DIV for dividends and Form 1099-B for capital gains.

- Enter the total qualified dividends received in the designated section of the worksheet.

- List any long-term capital gains, ensuring to differentiate between short-term and long-term gains.

- Apply the appropriate tax rates as outlined in the IRS guidelines, which may vary based on income levels.

- Calculate the total tax owed based on the figures entered, ensuring all calculations are accurate.

Legal use of the qualified dividends and capital gains worksheet

The qualified dividends and capital gains worksheet is legally recognized by the IRS as a valid method for calculating tax on specific types of income. To ensure its legal standing, taxpayers must complete the worksheet accurately and retain supporting documents. Compliance with IRS regulations is essential, as inaccuracies can lead to penalties or audits.

Filing deadlines and important dates

Taxpayers should be aware of key filing deadlines related to the qualified dividends and capital gains worksheet. For the 2024 tax year, the deadline for filing individual tax returns is typically April 15, unless it falls on a weekend or holiday. It is advisable to complete the worksheet well in advance of this date to avoid last-minute issues and ensure all tax obligations are met on time.

Examples of using the qualified dividends and capital gains worksheet

Examples of using the qualified dividends and capital gains worksheet can illustrate its practical application. For instance, if a taxpayer received $1,000 in qualified dividends and realized $5,000 in long-term capital gains, they would enter these amounts on the worksheet. The calculations would then determine the applicable tax rate based on their overall income, demonstrating the worksheet's role in tax preparation.

Quick guide on how to complete qualified dividends and capital gains worksheet

Handle Qualified Dividends And Capital Gains Worksheet effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Qualified Dividends And Capital Gains Worksheet on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to alter and eSign Qualified Dividends And Capital Gains Worksheet with ease

- Locate Qualified Dividends And Capital Gains Worksheet and click on Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools provided by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for submitting your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Qualified Dividends And Capital Gains Worksheet while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct qualified dividends and capital gains worksheet

Create this form in 5 minutes!

How to create an eSignature for the qualified dividends and capital gains worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 qualified dividends and capital gains worksheet PDF?

The 2024 qualified dividends and capital gains worksheet PDF is a crucial tax tool that helps individuals accurately report their qualified dividends and capital gains for the tax year. It is designed to simplify the process of calculating tax obligations, ensuring compliance with IRS regulations.

-

How can I obtain the 2024 qualified dividends and capital gains worksheet PDF?

You can easily download the 2024 qualified dividends and capital gains worksheet PDF from our website. Simply visit the resources section, and you will find the worksheet available for free to facilitate your tax filing process.

-

Is there a cost associated with the 2024 qualified dividends and capital gains worksheet PDF?

No, the 2024 qualified dividends and capital gains worksheet PDF is provided at no cost. Our aim is to support users in understanding their tax liabilities without any financial burden, enhancing their overall tax filing experience.

-

What features are included in the 2024 qualified dividends and capital gains worksheet PDF?

The 2024 qualified dividends and capital gains worksheet PDF includes sections for inputting various income sources, calculating taxes owed, and providing guidance on Qualified Dividends and Capital Gains. This ensures users have all the information they need to file efficiently and accurately.

-

How does using the 2024 qualified dividends and capital gains worksheet PDF benefit me?

Using the 2024 qualified dividends and capital gains worksheet PDF can save you time and reduce errors in your tax filings. It enables you to clearly organize your financial information, thus maximizing potential tax benefits and minimizing the risk of audits.

-

Can I integrate the 2024 qualified dividends and capital gains worksheet PDF with other tools?

Yes, the 2024 qualified dividends and capital gains worksheet PDF can be integrated with various tax preparation software programs. This ensures seamless data entry and accuracy, giving you a comprehensive solution for managing your tax responsibilities.

-

Who should use the 2024 qualified dividends and capital gains worksheet PDF?

The 2024 qualified dividends and capital gains worksheet PDF is ideal for individuals earning dividends and capital gains who need to accurately report their income. It is especially useful for investors and taxpayers who seek to understand their tax situation comprehensively.

Get more for Qualified Dividends And Capital Gains Worksheet

- Las vegas hotel credit card authorization form

- Serdes verilog code form

- Ic3 complaint referral form

- Application print out form

- Interaction checklist for augmentative communication form

- Slsa patrol log surf life saving nsw surflifesaving sportal com form

- Representative authority purpose of this form retu

- Nsw higher school certificate form

Find out other Qualified Dividends And Capital Gains Worksheet

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer