Qualified Dividends and Capital Gain 2016-2026

Understanding Qualified Dividends and Capital Gains

Qualified dividends are dividends paid by U.S. corporations or qualified foreign corporations on stocks that have been held for a specific period. These dividends are taxed at a lower rate than ordinary income, making them an attractive option for investors. Capital gains refer to the profit made from selling an asset, such as stocks or real estate, at a higher price than the purchase price. Both qualified dividends and capital gains are essential components of an investor's tax strategy, particularly for those looking to maximize their after-tax returns.

How to Use Qualified Dividends and Capital Gains

Utilizing qualified dividends and capital gains effectively involves understanding their tax implications and how they fit into your overall investment strategy. Investors should keep track of their holding periods for stocks to ensure dividends qualify for the lower tax rates. Additionally, realizing capital gains can be timed strategically, such as selling assets in a year with lower overall income to minimize tax liability. Proper record-keeping and planning can enhance the benefits of these income sources.

Steps to Complete Reporting for Qualified Dividends and Capital Gains

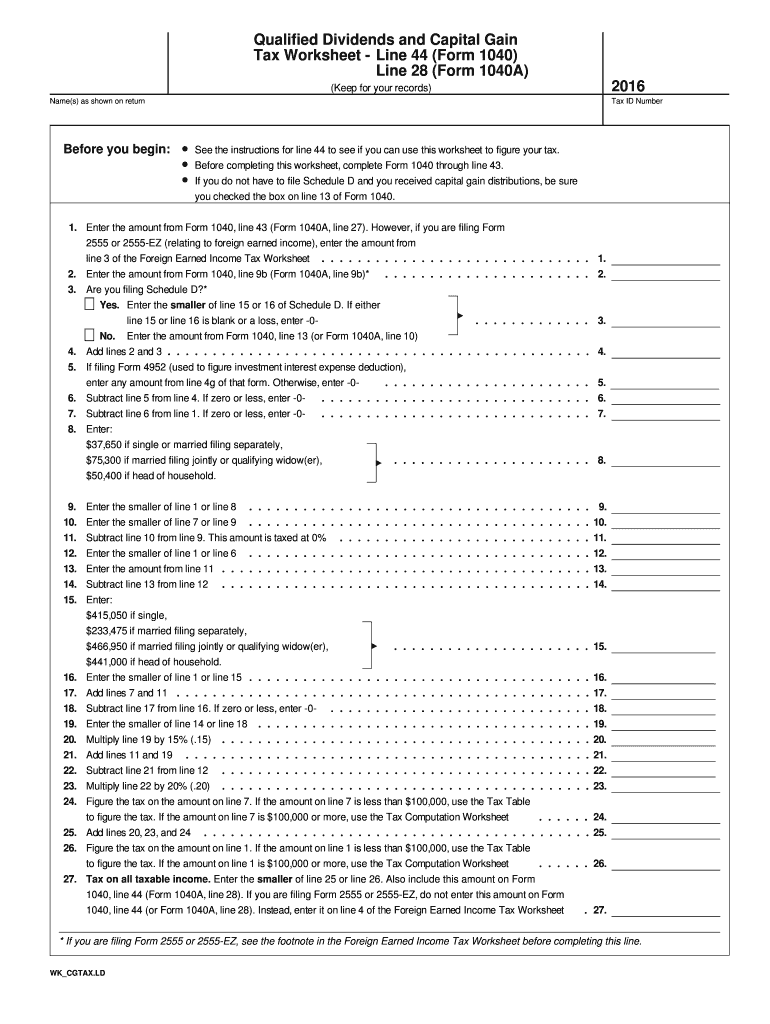

To report qualified dividends and capital gains, follow these steps:

- Gather all relevant financial documents, including brokerage statements and tax forms.

- Identify which dividends are qualified by checking the holding period and the type of corporation.

- Calculate total qualified dividends and capital gains from your investments.

- Complete the appropriate tax forms, such as Schedule D for capital gains and Form 1040 for dividends.

- File your tax return by the deadline, ensuring all information is accurate to avoid penalties.

IRS Guidelines for Qualified Dividends and Capital Gains

The Internal Revenue Service (IRS) provides specific guidelines regarding qualified dividends and capital gains. Qualified dividends must meet certain criteria, including being paid on stock held for a minimum period. The IRS also outlines the tax rates applicable to these income types, which can be significantly lower than ordinary income tax rates. Familiarizing yourself with these guidelines can help ensure compliance and optimize tax benefits.

Eligibility Criteria for Qualified Dividends and Capital Gains

To qualify for the lower tax rates on dividends, certain eligibility criteria must be met. The stock must be held for more than 60 days during the 121-day period surrounding the ex-dividend date. For capital gains, the asset must be held for more than one year to qualify for long-term capital gains rates. Understanding these criteria is crucial for investors aiming to maximize their tax efficiency.

Examples of Qualified Dividends and Capital Gains

Consider an investor who holds shares in a U.S. corporation for more than 60 days and receives a dividend payment. This dividend is classified as a qualified dividend and taxed at a lower rate. Conversely, if the investor sells a stock after holding it for more than one year, any profit realized from the sale is considered a long-term capital gain, also benefiting from reduced tax rates. These examples illustrate how strategic investment decisions can lead to favorable tax outcomes.

Create this form in 5 minutes or less

Find and fill out the correct qualified dividends and capital gain

Create this form in 5 minutes!

How to create an eSignature for the qualified dividends and capital gain

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Qualified Dividends and Capital Gain?

Qualified Dividends and Capital Gain refer to specific types of income that are taxed at a lower rate than ordinary income. Understanding these terms is crucial for investors looking to maximize their tax efficiency. By leveraging airSlate SignNow, you can easily manage documents related to your investments and ensure compliance with tax regulations.

-

How does airSlate SignNow help with managing Qualified Dividends and Capital Gain documentation?

airSlate SignNow provides a streamlined platform for sending and eSigning documents related to Qualified Dividends and Capital Gain. This ensures that all necessary paperwork is handled efficiently, allowing you to focus on your investment strategy. With our solution, you can easily track and manage your financial documents.

-

What features does airSlate SignNow offer for tracking Qualified Dividends and Capital Gain?

Our platform includes features such as document templates, automated workflows, and secure storage, which are essential for tracking Qualified Dividends and Capital Gain. These tools help you maintain organized records and simplify the process of filing taxes. Additionally, our user-friendly interface makes it easy for anyone to navigate.

-

Is airSlate SignNow cost-effective for managing Qualified Dividends and Capital Gain?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses managing Qualified Dividends and Capital Gain documentation. Our pricing plans are flexible and cater to various business sizes, ensuring you get the best value for your investment. By reducing paperwork and streamlining processes, you can save both time and money.

-

Can I integrate airSlate SignNow with other financial tools for Qualified Dividends and Capital Gain?

Absolutely! airSlate SignNow offers integrations with various financial tools that can help you manage Qualified Dividends and Capital Gain more effectively. This allows for seamless data transfer and enhances your overall workflow. By connecting your existing systems, you can create a comprehensive solution tailored to your needs.

-

What benefits does airSlate SignNow provide for businesses dealing with Qualified Dividends and Capital Gain?

Using airSlate SignNow for Qualified Dividends and Capital Gain documentation offers numerous benefits, including increased efficiency, reduced errors, and enhanced compliance. Our platform simplifies the eSigning process, making it easier to obtain necessary approvals quickly. This ultimately leads to better financial management and reporting.

-

How secure is airSlate SignNow for handling Qualified Dividends and Capital Gain documents?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive information related to Qualified Dividends and Capital Gain. Our platform employs advanced encryption and security protocols to protect your documents. You can trust that your financial data is safe while using our eSigning solution.

Get more for Qualified Dividends And Capital Gain

- 1149 sponsorship form

- Affidavit of support snhu intldocx snhu form

- Ontario automobile application form

- Mydterebates com appliances form

- Company driver pre hire form pre hire how would agility cms

- Tico form 1 76585445

- Santiago canyon college biology 109 laboratory schedule form

- Landowner prepared forest management document form

Find out other Qualified Dividends And Capital Gain

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed