Form 1 Es Massachusetts 2013

What is the Form 1 ES Massachusetts

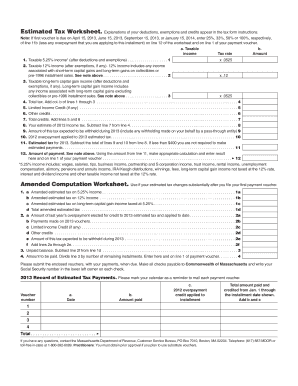

The Massachusetts Form 1 ES is an estimated tax payment form used by individuals and businesses to report and pay estimated income taxes to the state. This form is essential for taxpayers who expect to owe tax of $400 or more when they file their annual return. It allows taxpayers to make quarterly payments throughout the year, helping to avoid penalties for underpayment when filing the final tax return. The 2024 version of the form includes updates that reflect current tax rates and regulations, ensuring compliance with state tax laws.

Steps to Complete the Form 1 ES Massachusetts

Completing the Massachusetts Form 1 ES involves several straightforward steps:

- Gather necessary financial information, including your estimated income and deductions for the year.

- Calculate your estimated tax liability based on the current tax rates and your financial situation.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form along with your estimated payment by the due date to avoid penalties.

Legal Use of the Form 1 ES Massachusetts

The Massachusetts Form 1 ES is legally binding when completed correctly and submitted on time. It is crucial for taxpayers to understand that failing to file or pay the estimated taxes can result in penalties and interest charges. The form must be filled out in accordance with Massachusetts tax laws, and the estimated payments made must be based on accurate income projections to ensure compliance. Utilizing a reliable eSignature solution can further enhance the legal validity of the form, as it provides a secure method for signing and submitting the document electronically.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have multiple options for submitting the Massachusetts Form 1 ES. These methods include:

- Online Submission: Taxpayers can file the form electronically through the Massachusetts Department of Revenue’s website, which is a convenient option for many.

- Mail Submission: The completed form can be printed and mailed to the appropriate address provided in the form instructions.

- In-Person Submission: Taxpayers may also choose to submit the form in person at designated state tax offices, although this option may be less common.

Filing Deadlines / Important Dates

For the 2024 tax year, the filing deadlines for the Massachusetts Form 1 ES are critical to avoid penalties. Estimated tax payments are typically due on:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

It is important for taxpayers to mark these dates on their calendars and ensure timely submissions to maintain compliance with state tax regulations.

Key Elements of the Form 1 ES Massachusetts

The Massachusetts Form 1 ES includes several key elements that taxpayers must understand:

- Taxpayer Information: This section requires personal details such as name, address, and Social Security number.

- Estimated Income: Taxpayers must provide an estimate of their income for the year, which forms the basis for calculating tax liability.

- Payment Amount: The form specifies the amount of estimated tax owed for each quarter, based on the taxpayer's calculations.

- Signature Section: A signature is required to validate the submission, which can be done electronically for online submissions.

Quick guide on how to complete form 1 es massachusetts

Complete Form 1 Es Massachusetts effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally conscious substitute for conventional printed and signed documents, as you can find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and sign your documents promptly without hassles. Manage Form 1 Es Massachusetts on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and sign Form 1 Es Massachusetts without any hassle

- Find Form 1 Es Massachusetts and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes moments and holds the same legal significance as a traditional hand-signed signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choice. Alter and eSign Form 1 Es Massachusetts and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1 es massachusetts

Create this form in 5 minutes!

How to create an eSignature for the form 1 es massachusetts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Massachusetts form 1 ES 2024, and who needs it?

The Massachusetts form 1 ES 2024 is an estimated income tax form required for residents who expect to owe at least $400 in income tax for the year. It is essential for individuals and businesses to accurately estimate their tax obligations and pay them quarterly. Understanding this form helps taxpayers avoid penalties and interest due to underpayment.

-

How can airSlate SignNow help with the Massachusetts form 1 ES 2024?

AirSlate SignNow streamlines the signing and submission process for the Massachusetts form 1 ES 2024. With our electronic signature solution, users can easily fill, sign, and send the form securely, reducing the time spent on paperwork and ensuring compliance. This efficient process helps you stay organized and on top of your tax responsibilities.

-

Is there any cost associated with using airSlate SignNow for the Massachusetts form 1 ES 2024?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business needs for handling the Massachusetts form 1 ES 2024. Our pricing is designed to be cost-effective, providing users with access to powerful features without breaking the bank. Signing up for our service gives you the benefit of enhanced productivity at an affordable rate.

-

What features does airSlate SignNow offer for the Massachusetts form 1 ES 2024?

AirSlate SignNow provides several features to simplify the management of the Massachusetts form 1 ES 2024. These include customizable templates, real-time tracking of document status, and automated reminders for deadlines. Our user-friendly interface ensures that you can complete your forms quickly and efficiently.

-

Can I integrate airSlate SignNow with other software for handling the Massachusetts form 1 ES 2024?

Absolutely! AirSlate SignNow integrates seamlessly with many popular software applications, such as CRM systems and document management tools, to streamline your workflow regarding the Massachusetts form 1 ES 2024. These integrations enable you to manage your documents in one place, enhancing productivity and reducing errors.

-

How secure is airSlate SignNow for submitting the Massachusetts form 1 ES 2024?

AirSlate SignNow prioritizes the security of your documents, including the Massachusetts form 1 ES 2024. Our platform employs advanced encryption protocols and complies with industry standards to ensure your data is protected during transmission and storage. You can trust us to keep your sensitive information secure.

-

What are the benefits of using airSlate SignNow for tax forms like the Massachusetts form 1 ES 2024?

Using airSlate SignNow for tax forms such as the Massachusetts form 1 ES 2024 offers numerous benefits, including faster processing times and reduced administrative burdens. Our cloud-based solution allows for easy access from anywhere, making it simple to manage your tax forms. Additionally, eSigning eliminates the need for physical paperwork, which is both environmentally friendly and efficient.

Get more for Form 1 Es Massachusetts

Find out other Form 1 Es Massachusetts

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple